In 2012, the Pound has strengthened against the Euro – reaching a level not seen since 2008. However, the value of the Euro to Pound is still less than the peak of late 2007, when £1 reached €1.4.

In June 14th, 2012 £1 = €1.24 Euros. An increase since the start of the year when £1 = 1.18 Euros.

This appreciation in the Pound makes it cheaper to buy goods from Europe, but makes UK exporters less competitive.

Why Has the Pound Appreciated against the Euro?

The Pound’s appreciation against the Euro reflects the growing concern over the future of the Euro.

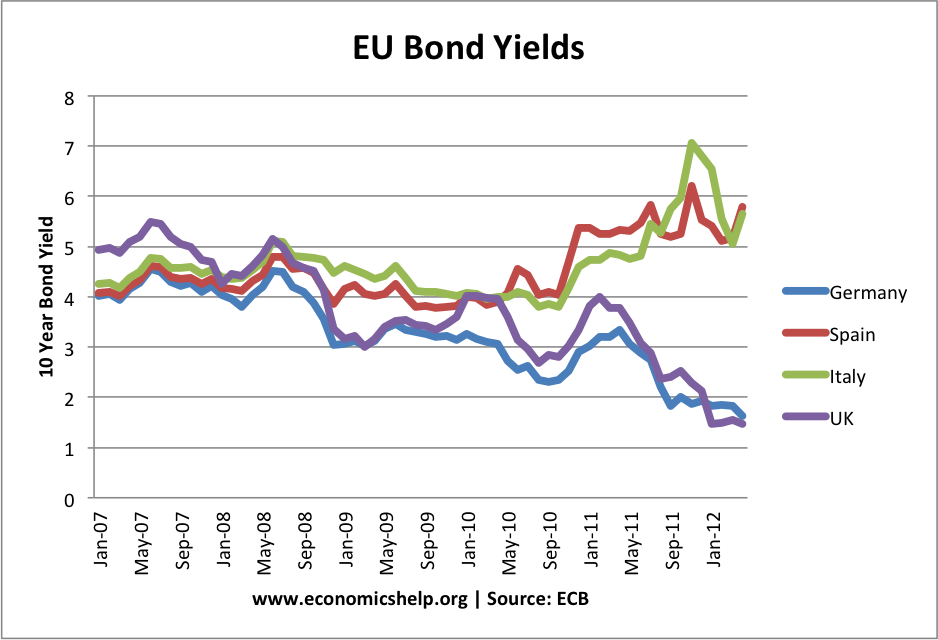

- Rising Euro bond yields. Bond yields on major economies, Spain and Italy have continued to rise. There is fear over prospect of possible default in not just Greece, but also bigger economies like Spain and Italy.

- Lack of Effective Political Will to Deal with Eurozone’s problems. There appears to be a reluctance to embrace a form of fiscal union. The main approach is to rely on fiscal austerity to deal with budget deficits in the peripheral countries. But, these austerity measures have failed to stop bond yields rising.

- Uncertainty over role of ECB. Despite rising bond yields, the ECB is so far reluctant to get involved in the purchase of government bond yields. The ECB argue this is outside its remit, but this means countries like Spain have no lender of last resort.

- Prospects for Recession. Growth in some parts of the Eurozone is positive. However, countries in the periphery are at risk of recession. There are fears that if the crisis continues, the whole of the Eurozone could be dragged into recession. This would create an unwelcome combination of falling GDP, and rising debt burdens.

- Prospect of Lower interest rates in the ECB. The ECB have been very reluctant to pursue expansionary monetary policy. ECB interest rates are currently 1%, UK rates have been 0.5% since 2009. The UK has performed significant quantitative easing. This Q.E. was a key factor in the weakness of the Pound post 2008. However, if the Eurozone goes into recession, even the inflation hawks in the ECB may be persuaded to cut interest rates; this would reduce the value of the Euro even more.

What Will Happen Next?

The Eurozone crisis shows no signs of abating. It is hard to see effective action which would deal with debt crisis and provide the kind of economic recovery which will reassure markets. At the moment, there is so much uncertainty over the Eurozone that investors are looking for alternatives.

The flight from the Euro would be much greater, but there is evidence that much of the currency flight is from the Eurzone periphery to stronger Eurozone countries like Germany.

If Italy and Spain get into real difficulties, the shock to the Euro will be much greater than likely default in Greece. This could increase demand for the Pound even more.

If the Eurozone enters a deeper crisis, this will adversely affect the UK economy. European bank losses would also weaken the UK financial situation even more. However, if the UK could show signs of economic recovery and an improving fiscal position, then the Pound could look increasingly attractive as an alternative to the Euro.

This would be good news for UK tourists traveling to Europe – £1 will buy more Euros making the cost of living cheaper.

However, a further appreciation in the Pound, would be bad news for UK exporters struggling to remain competitive in the Eurozone.

Related