Readers Question: What do you think about Argentina’s economical future, with the current presidents politics and ~v22% inflation, taken in mind?

Argentina performed relatively well since crisis of 2002 (see: Argentina Recovery and Crisis). Leaving their exchange rate peg enabled some re balancing in the economy and helped to boost exports. Importantly, it left the Argentina economy with greater autonomy. However, although devaluation and expansionary policies can provide a temporary boost to the economy, this is not a panacea and there is a danger the Argentinian economy could experience increasing difficulties.

1. Misleading Economic Statistics.

According to the economist, the government statistic body is under-estimating inflation.

PriceStats, a specialist provider of inflation rates which produces figures for 19 countries that are published by State Street, a financial services firm, puts the annual rate at 24.4% and cumulative inflation since the beginning of 2007 at 137%. INDEC says that the current rate is only 9.7%, and that prices have gone up a mere 44% over that period.

Misleading economic statistics will be a factor that discourages foreign investment because there will be a lack of trust. The fact economists can be censored for publishing inflation figures only cements this damaging reputation.

2. Inflationary Growth Unsustainable.

I have written a lot about the need for Europe to promote expansionary policies in the middle of a recession. But, the situation in Argentina is different. Nominal GDP is growing quickly, (if we believe GDP statistics) and inflation is a persistent problem. People increasingly fear a higher rate of inflation in Argentina. This is because:

- Government willing to print money

- Expansionary Fiscal policy. The government have increased spending with no obvious plan to meet deficit shortfall. Recently, government funded higher spending through using pension fund in social security.

Roberto Lavagna — the former economy minister under Nestor Kirchner who is credited with resurrecting Argentina’s economy after the country’s 2001 default on its foreign debts — estimates that government subsidies for transportation and energy soared from U.S. $1.2 billion at the end of 2005 to U.S. $19 billion last year. (link)

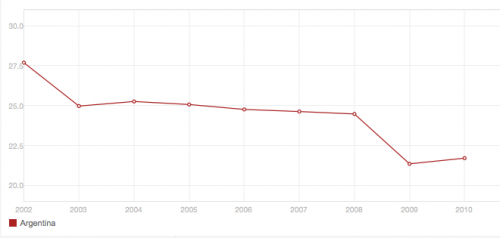

Argentina National Debt

Argentina have a history of debt default. The 2001 default was largest sovereign debt default on record £80bn Official statistics show national debt of only 48% of GDP. However, S&P give Argentina a credit rating of B. There is danger of higher borrowing reducing credit rating and leading to future debt defaults. There are still disputes over the default from 2001 (Economist link)

Commodity Growth Limited

The Argentinian economy benefit from the growth in commodity prices during the 2000s. This helped boost export revenue and provided the backdrop to improving economic fortunes. However, with the global slowdown occurring, commodity prices have stopped rising. China is still buying commodities, but Argentina has been perhaps too reliant on rising commodity prices.

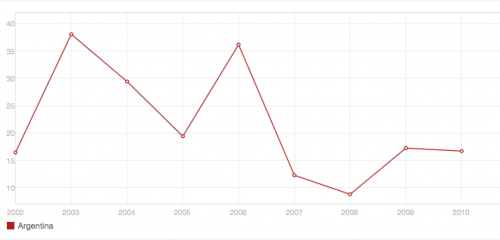

Graph Showing Argentina Exports as % of GDP

Nationalisation Policies discouraging foreign investors. Repsol a major Spanish oil firm was nationalised by the government for its failure to re-invest in oil production. However, the nationalisation process may discourage future inward investment.

Fall in Oil Production. Argentina oil production fell by 22% between 2000 and 2010, meaning Argentina now has to spend money on energy imports.

After recovering from crisis of 2002, it is unfortunate that Argentina has become reckless in pursuit of nominal GDP growth and dismissive of need to create greater stability through low inflation and encouraging foreign investment.

Rather than pursuing more expansionary fiscal and monetary policies, at this point in time, it would be better to give monetary policy to an independent Central Bank to pursue a dual target of low inflation and sustainable economic growth. There is a real danger and likelihood Argentina could end up with unsustainable inflation in the near future.

HI! Either this article is written by a native, in which case I have nothing to comment; or you shoul hire a proffessional translator, as there are too many grammar mistakes in it! By the way… I teach ESL and translate profesionally.

shoulD, sorry

also proffessional has one f ‘professional’

Just saying, if you’re going to comment about someone’s grammar mistakes you really shouldn’t make multiple spelling mistakes in you’re comment.