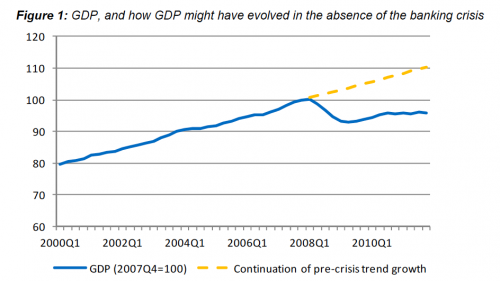

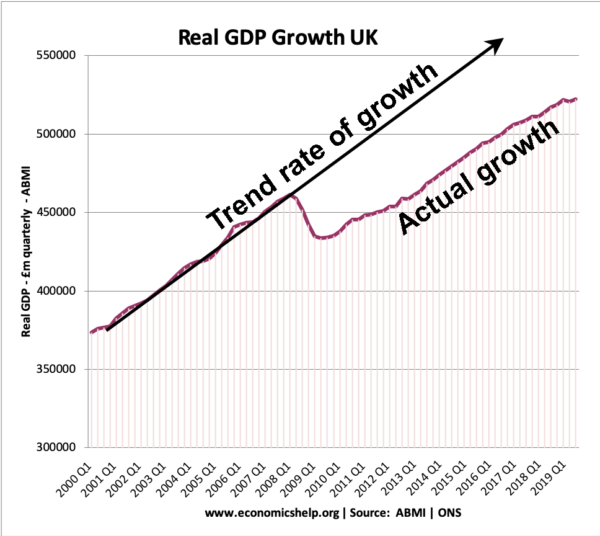

Typically, a recession will lead to a negative output gap and lower inflation. However, after the recession is over, the economy can usually bounce back and recover this temporary loss of output. However, this ‘great recession’ is different in that there has been no bounce – only a prolonged recession – suggesting the usual expectations for trend growth have been clearly missed.

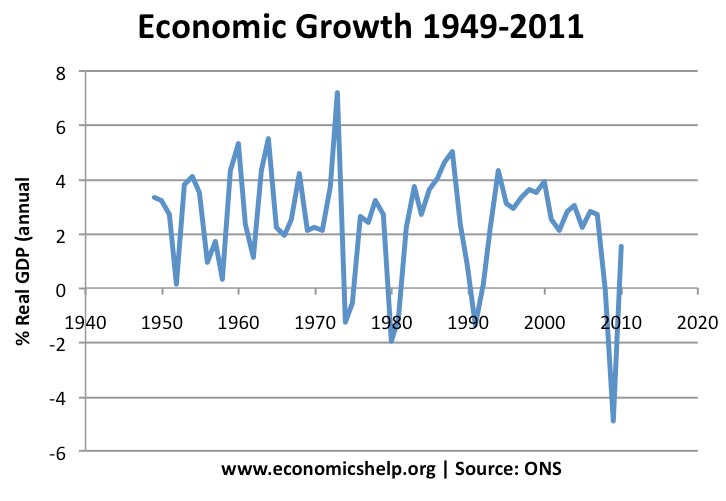

For example, after the 1991-92 recession, the economy bounced back and we experienced strong growth of 4% in 1994; the UK was able to maintain its long-run trend rate of 2.5%

In short-lived recessions, we can maintain the average long-run trend rate of economic growth. But, this recession and financial crisis appear to have created a permanent loss in output.

The current recession is one of the longest-lasting on record. The above graph gives an indication of how much potential output has been lost.

The depth and scope of this recession has also made it difficult to predict how much spare capacity there is in the economy. Some economists feel that despite the depth of the recession, there is little spare capacity in the UK economy. This is because

- Inflation has remained stubbornly above target. If the UK had a large negative output gap, we would expect inflation to fall quicker and further.

- In surveys, many firms indicate they have little spare capacity.

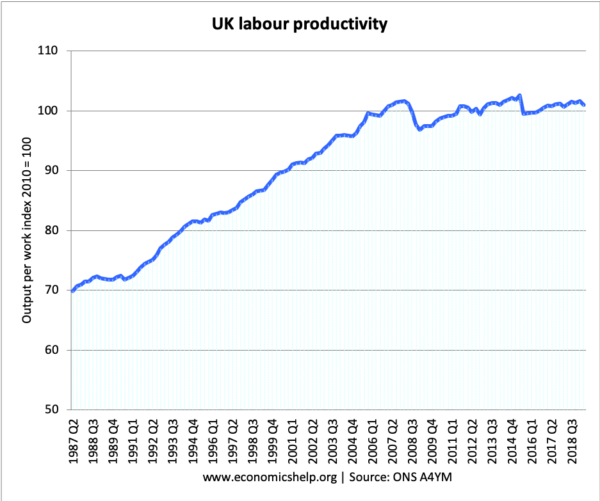

- Since the recession, labour Productivity Growth has been very low.

Policy Implications of Low Spare Capacity

- Economic growth is likely to remain low.

- There is less room for loosening monetary policy (because of inflation threat)

- There has been a fall in the medium term long run trend rate of economic growth.

However, it is possible that the UK actually has more spare capacity than survey suggests. Also, there is scope for the UK economy catching up lost output in the future.

- Surveys are fairly unreliable as a guide to spare capacity. Firms may misinterpret what is meant by operating at full capacity. The survey doesn’t include firms who have closed down.

- Unemployment at 8.2% suggest substantial unemployed resources in the economy. Also important is the increase in the long-term unemployment rate from 1.5% in 2008 to over 3% in 2012

- Labour productivity often falls in a recession. (For example, a firm which sees a fall in demand, may try to keep some workers on – even though there is less work to do. Therefore, when the economy recovers, these workers will be producing more.)

- We can have a negative output gap and stubborn inflation at the same time. UK inflation has primarily been caused by cost-push factors (higher taxes, impact of devaluation, and rising commodity prices). Underlying core inflation has been much lower.

- Recent evidence suggests that when an economy goes into recession, there is still a price stickiness and inflation doesn’t fall. For example, wages are sticky downward – it is hard to cut nominal wages. Therefore, it means that a fall in output has less impact on reducing demand than you might expect. The trade off between output and inflation is weak.

Depth of the Recession

Recently, Mervyn King warned about how the UK economy could remain stagnant for another 5 years. In these unusual times, the UK economy is likely to be held back by

- Ongoing Eurozone crisis and Euro recession

- Dealing with hangover of financial crisis

- Falling UK house prices and negative wealth effect

The experience of Japan shows that no country is guaranteed a certain long run trend rate. Factors can combine to permanently reduce long run trend rate. In the UK’s case, there is still no reason to believe, the economy won’t be able to return to trend growth in the future. But, it is very unlikely we will be able to catch up with the lost years of 2008-12.

Conclusion

There are clearly some supply side issues, but the ongoing recession indicates that lack of aggregate demand is a major factor in the persistence of negative growth. Because official inflation figures are misleading as a guide to the amount of spare capacity, there is a strong argument that monetary and / or fiscal loosening would have limited impact on inflation.

Sources: Monetary Policy and Damaged Economy at Bank of England

Update 2020

The recession did lead to a loss of real GDP

Related

1 thought on “Impact of Recession on Trend Growth Rate”

Comments are closed.