A recession (fall in national income) will typically be characterised by high unemployment, falling average incomes, increased inequality and higher government borrowing. The impact of a recession depends on how long it lasts and the depth of the fall in output.

The main costs of a recession will be:

- Unemployment

- Fall in income – shorter working week.

- Rise in poverty

- Fall in asset prices (e.g. fall in house prices/stock market)

- Increased inequality and an increase in relative poverty

- Higher government borrowing (less tax revenue)

- Permanently lost output.

- Firms go out of business.

Who is most affected by a recession?

The worst affected will be those who lose their job or see their hours/self-employed income dramatically fall.

It also depends on the type of recession. The 2009 recession hit the financial sector the hardest. Many highly-paid ‘white-collar’ workers lost their jobs. Banks saw large-scale losses and falls in profit. It hit the housing sector very hard. The 2020 recession will be different. It will particularly affect low-income workers in the leisure and tourism sector – which will be devastated by the Coronavirus. It will also depend on whether the worker can work from home (writer) or has a job in the physical economy which will suffer more. (e.g. selling coffee). The effect will also depend on the extent of government support and whether people are entitled to benefits/rent relief.

Unemployment

A fall in economic output will cause a rise in unemployment. This is because:

- Some firms will go bankrupt meaning workers will lose their jobs.

- Firms will lay off workers to try and reduce costs.

- Firms will cut back on hiring new workers.

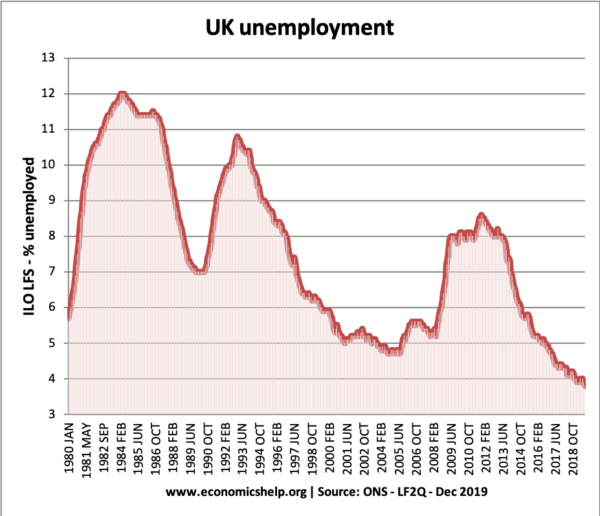

In the 2009 recession, unemployment in the UK rose to over 2.6 million, though given the depth of the recession, you might have expected it to be even more (e.g. in the 1980s, unemployment rose to over 3 million). However, in Europe, many countries saw a catastrophic rise in unemployment. With rates of over 20% in countries such as Greece, Spain and Portugal.

The unemployment figures may under-estimate the true level of unemployment. For example, in a recession the self-employed may see a dramatic fall in income, but still not be classed as unemployed.

UK unemployment showing very clearly the recession of 1981, 1992 and 2009.

UK unemployment showing very clearly the recession of 1981, 1992 and 2009.

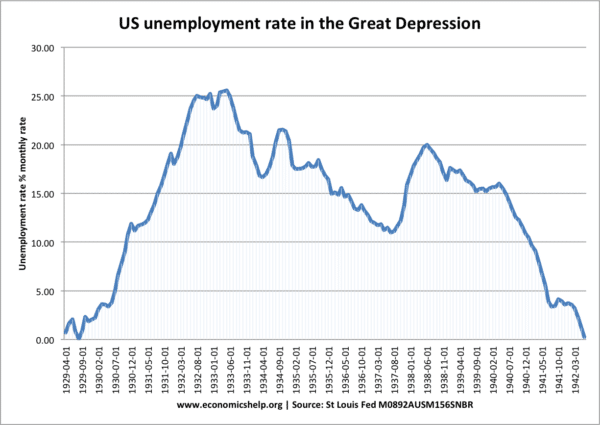

In the great depression, where there was a rapid fall in GDP, unemployment rose from 0% to 25% within three years.

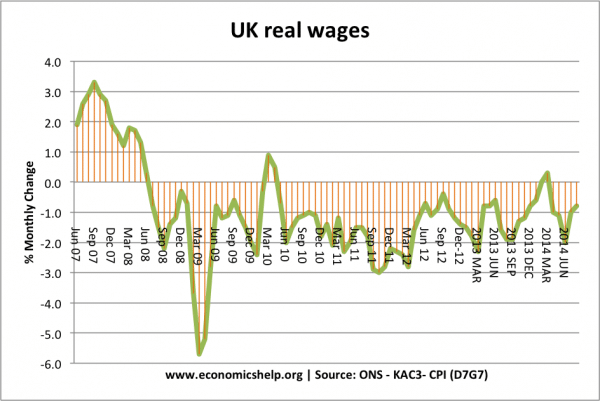

Lower wages

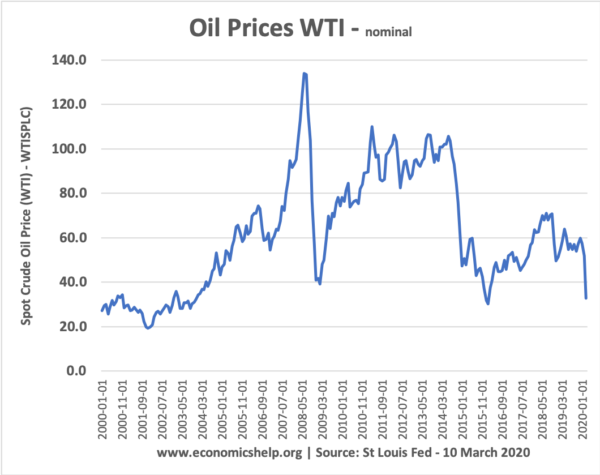

In a recession, firms will also try to reduce costs by keeping wages low. Some workers (especially temporary workers without contracts may see wage cuts) This was a key feature of the 2008-12 recession, also aggravated by rising costs of living (e.g. higher taxes/oil prices) In 2020, at least cost-push inflation will be low – helped by falling oil prices and commodities.

Negative real wage growth 2008-14

Another cause of lower wages is under-employment. Some workers may keep their job, but see their hours cut. Rather than working full time, they become part-time workers (e.g. 20 hours a week). This means that the rise in unemployment may be muted, but many workers see substantial falls in effective income.

The self-employed are particularly vulnerable to recession. In an economic downturn, the self-employed may see a cash-flow shortage very quickly and struggle to make ends meet.

Higher government borrowing

Governments will see a fall in tax revenue as a result of a recession.

- Firms make less profit, therefore the government receive lower corporation tax

- Workers receive lower-income, therefore government receive lower income tax

- Lower house prices and fewer housing transaction lead to lower stamp duty revenue.

- Lower expenditure, leading to lower VAT payments.

Government spending

- Rising government spending on welfare payments, such as unemployment benefits, housing benefit and income support.

Because of falling tax revenues and rising welfare payments (automatic fiscal stabilisers), a recession tends to cause an increase in the budget deficit and total government debt.

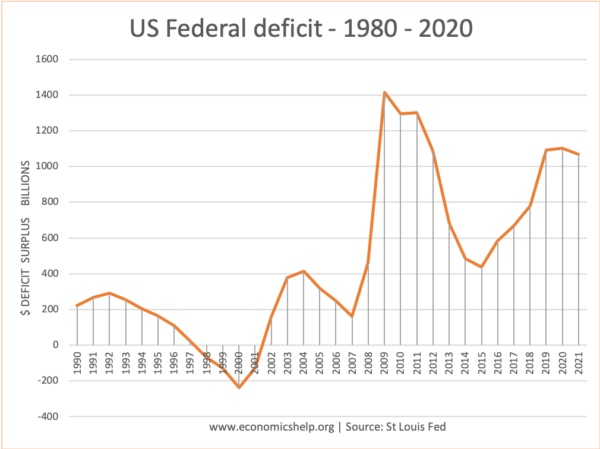

US budget deficit rose sharply after the recession of 2008/09. Note, the forecast for 2021 is wrong. Borrowing in 2021 in the US will surge because of the impact of Coronavirus and impending recession.

Many countries saw a sharp rise in the budget deficit post-2008 credit crunch because they relied on tax revenues from property and the finance sector. The fall in the property market hit tax revenues harder. VAT receipts tend to be less cyclical.

A budget deficit may also increase because the government decide to pursue expansionary fiscal policy and attempt to stimulate economic activity. FOr example, in 2010, the UK government cut VAT.

Falling asset prices

In a global recession, we tend to get a fall in oil prices because demand falls. The 2020 Coronavirus caused a sharp drop in oil prices and also a dramatic fall in share prices. It is an indication of the extent to which analysts expect the recession to hurt. Falling asset prices contribute to the downward spiral in the economy. Falling house prices create a negative wealth effect, reducing confidence and causing further falls in spending. We are likely to see a drop in house prices in 2020.

Bond Yields

Usually, in a recession, government bond yields fall. This is because in a recession, saving tends to rise and people demand the security of bonds rather than stock market. In 2020, US bond yields have fallen to near-record levels. US 2 year bond yield is at 0.46%.

It is possible bond yields may rise if markets fear the recession will cause very serious problems for the government and liquidity shortage. For example, Italian bond yields have started to rise in 2020 because of real concerns about the collapse in the Italian economy. A lot will depend on the reaction of the ECB and whether they will create money to provide liquidity.

Lost Output

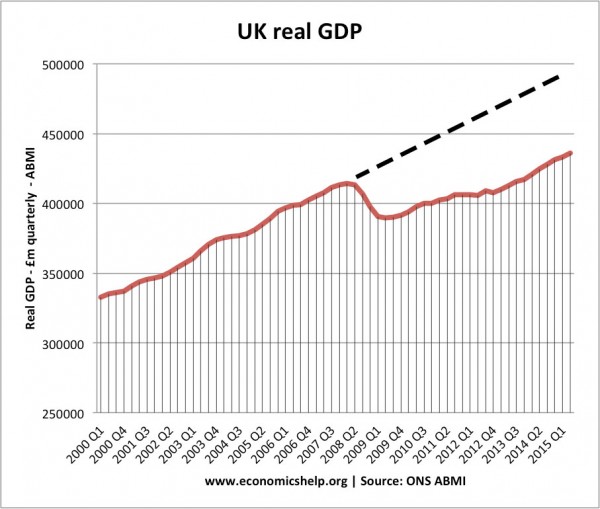

A recession leads to lower investment and therefore can damage the long-term productive capacity of the economy. If the recession is short, this lost output may be quite limited – economies can bounce back. But, in a prolonged recession, this lost output becomes greater. The 2009 recession caused a permanent loss of output because the recession was very deep and fundamental weaknesses.

See Impact of recession on trend rate of economic growth

Impact on Workers

Unemployment can leave lasting negative impacts. Firstly, unemployment is very stressful and can damage the person’s morale, and even health. Areas of high unemployment tend to experience more social problems. High unemployment can be a factor in creating social instability, leading to problems such as riots and vandalism. Mass unemployment can threaten the social fabric of the countries.

The unemployed lose the opportunity to gain skills and on-the-job training. Long-term unemployment can make it harder for the worker to gain a job in the future; it can even cause people to give up and drop out of the labour market completely.

Unemployment and recession can also cause a rise in social/health problems such as depression and suicide.

Impact on firms

Firms will see a fall in demand and lower profits. Some firms may start to make a loss and go bankrupt. This may be due to fundamental inefficiency but also firms may go out of business purely because of the cyclical factors and an inability to borrow sufficient firms to see the end of the recession. A recession will hit some firms more than others. In a recession, there is a large fall in demand for luxury goods (foreign holidays) top-end sports cars and so these firms will be more vulnerable.

If a company has large reserves then it will be able to ride out the recession even if it makes a temporary loss. A recession may cause a firm to pursue price wars and cost-cutting.

- Price Wars – Firms often seek to hang onto market share. This leads to aggressive price cuts, which further reduce the profitability of business.

- Cost Cutting – The impact of declining profitability means companies will be forced to look closely at reducing costs and maybe closing unprofitable areas of the business. Companies may be forced to lay off staff in an effort to reduce costs

Inequality

In a recession, inequality and relative poverty tend to worsen. This is because unemployment is a big cause of relative poverty (unemployed see fall in incomes)

Are there any potential positive effects of a recession?

- The collapse in Chinese manufacturing in early 2020 led to a sharp fall in air pollution and will have some effect in reducing deaths related to air pollution.

- Rather ironically, some recessions have shown to increase life expectancy. During the Great Depression, mortality rates in the US fell amongst areas of high unemployment. The reasoning was people spent less on alcohol and cigarettes which damage health. Also, there is a fall in traffic accidents. (NPR – Great Recession, led to lower mortality rates)

Related

Great article; thank you very much!!

Very nice article , thank you

How much will a deep recession effect food prices?

How will the U.K. provide food security?