I started www.economicshelp.org in Nov 2006. Within a year, I was writing about the US housing crash, the credit crunch and the recession of 2008/09. It was a turbulent period and there was a surge of interest in economics, which helped the economics blog to take off (which left me with mixed feelings!) But, the thing about the 2008/09 recession is that life still seemed fairly normal. We kept travelling everywhere, signs of the recession were not particularly visible to me and my circle of friends. It was a recession that really hit the banking sector hard. Business was tough, but for many people, life continued – though with lower pay growth and the threat of unemployment. But despite falls of GDP of 6%, the recession seemed to be affecting other people.

The contrast with 2020 is quite stark. When I see economies closing down, I can’t help but be aware of how many people I know are going to be hit very hard. I know a lot of people working in hospitality – owning cafes, restaurants, running shops. I know good friends who teach English – relying on foreign visitors. It is like the rug has been pulled from under the carpet and we are left feeling very vulnerable. It reminds me of the famous saying by Harry Truman

“It’s a recession when your neighbor loses his job; it’s a depression when you lose yours.”

The problem with this shutdown and inevitable deep recession is that so many people in the economy are living ‘hand to mouth’ – This means a very minimal level of savings and people consuming all of their disposable income. This makes them reliant on maintaining a stream of income to pay outgoing bills. According to this study, 40% of Americans are living ‘hand to mouth’ – and is not just the poor who have no savings.

When cafes, schools and shops are shut, the income collapses, but the bills are still there to be paid.

The shutdown and recession will particularly hurt

- Self-employed, who have no sick pay.

- Those working in the hospitality industry – hotels, cafes, airlines, restaurants who are liable to face shorter hours or job losses.

- Those reliant on international travel, for teaching EFL teachers, B&B owners, tourist industry.

- Parents who have to pay for childcare or take time off for work when schools are closed.

- People who are sick and have to self-isolate without any pay or minimal statutory sick pay.

- Those who have to work in the ‘people’ economy rather than the ‘virtual’ economy. What I mean by that is for some workers, it is relatively painless to make the transition to working from home (like people writing about economics). But, if you work as a tourist guide, the job cannot be replicated online.

- Manufacturers affected by a break-down in global trade. Factory shutdowns can cause production lines to come to a halt. Supply constraints combined with a demand-side shock will fall.

- Oil companies who borrowed to fund expansion could see large losses now the oil price has fallen below $30. It will also negatively affect firms selling renewable energy, which is less competitive.

How deep will the recession be?

The impact of even a temporary partial shut-down of the economy will be very significant in reducing economic activity and GDP. However, there will also be knock-on effects.

- Dramatic fall in investment as firms do not want to take any risks in this difficult environment.

- Paradox of thrift. Even for households who have a stable income, their consumption will fall significantly. There will be less opportunities to spend, but the environment of pessimism will lead to consumers cutting back on purchases – especially

- Knock-on effect for supply chains. A partial stop in some sectors like hotels and tourism will affect everyone. If people don’t travel, it won’t just be airlines who suffer but business who rely on selling goods to tourists. Then the firms who supply materials to the travel industry will be affected. For every job lost on an airline will give repercussions across the economy.

- Monetary and fiscal policy are limited. Central Banks have cut interest rates in response to recent events, but this will have a very limited effect. Mortgage payments will fall marginally, but it will not make any real difference to someone who loses their job – nor does it help renters or people living on savings.

How long will the recession last?

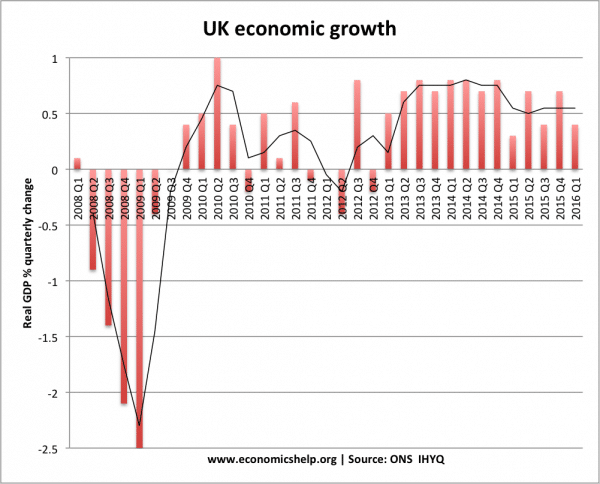

A big question is how long will the virus affect economic activity. One potential problem of prolonged shut-down is that the virus is still there when you re-open. (this is reasons behind government’s ‘herd immunity theory’) Like the common cold, the virus is here to stay. I think many people are assuming (or hoping) that after two months, everything will return to normal. But, after three months, we may continue to get a steady stream of infections, which continues to block a return to normal activity. Combined with the dismal economic performance of the past 10 years, this may lead to prolonged economic stagnation and a deep recession.

On the other hand, if the economy partially closes for a few months, when it reopens, you could see the release of a lot of pent up economic activity and there will be a ‘bounce back.’

Related