Readers Question: How are we tied up with the European Union in respect to the national debt?

In short, the EU has little direct impact on UK national debt. If we were in the Eurozone, our bond yields and debt situation would be very different. But, being outside the Eurozone means the UK debt is primarily in our hands. However, a serious default in the Eurozone could change that.

Firstly, membership of the EU costs around €12.15bn (0.7% of GDP). The UK also receives a rebate of – €3.56bn.Leaving a net contribution of around €8.7bn (rebate was negotiated by Mrs Thatcher due to Common Agricultural Policy not benefitting UK). source: EU spending at Guardian

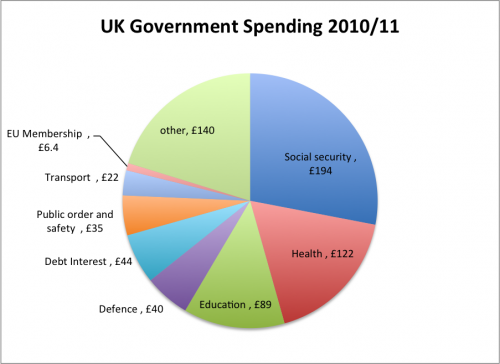

€12.15bn a year may seem a lot, but as a % of total UK spending it is a small, and dwarfed by other departments, as seen above.

The cost of EU membership has a limited impact on UK national debt.

UK and Trade with the EU

60% of UK trade is with the EU. (Who does UK trade with)

Impact of EU Recession on UK

Exports to EU are a significant part of the UK economy. Exports vary between £10-£15 bn a month – roughly £120 bn a year. A deep recession in the EU would cause a fall in UK export demand, leading to lower growth and could cause a prolonged double dip recession. If the UK was kept in recession from low growth in Europe, it would worsen the UK’s national debt due to the cyclical effect on tax revenues.

However, the UK’s double dip recession is only partly caused by lower EU growth. It is also related to the drop in UK public sector investment, low bank lending, fall in real incomes and falling house prices.

An EU recession would have some negative impact on UK’s debt situation, but again it would be relatively minor.

Eurozone and UK bond Rates

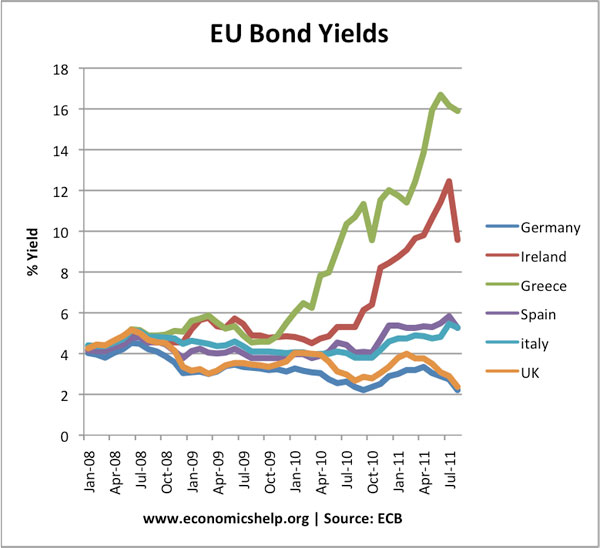

An irony of the Euro debt crisis is that it has contributed to record low UK bond yields. Investors are concerned about the security of lending to peripheral members of the Eurozone (Italy, Spain, Portugal e.t.c) Therefore, they have been buying more UK bonds which are seen as relatively safe. Therefore UK 10 year bond yields have fallen to less than 2%.

Note: UK bond yields are also currently low because:

- Quantitative easing – UK Central bank creating money and buying UK bonds

- Low prospects for growth mean investors willing to buy bonds at low interest rates (rather than finance riskier private sector investment)

These low bond yields has made it easier for the UK to finance its current deficit. If the UK was in the Eurozone, we could expect to have much higher bond yields, which would increase cost of debt interest payments (currently around £44bn) and put pressure on pursuing increased austerity measures.

Could the EU Debt Crisis spill over into UK?

The EU debt crisis has made investors more circumspect about lending. UK public finances will be scrutinised more carefully than before the crisis. There is no guarantee, the UK will continue to benefit from ultra low bond yields.

EU Banking crisis

The real concern is that the EU crisis could escalate leading to a banking crisis in countries like Spain. If Spanish banks fail and the Spanish government / EU is unable / unwilling to bail out the banks, then British banks will lose money. If British banks lose money invested in European banks, then again that could place great pressure on the UK government to have to bailout British banks more.

The problem is that the EU situation is very delicate. There is a reluctance / inability to really tackle problem. EU default could definitely harm the UK’s debt position.

Related