Readers Question: To what extent does the kinked demand curve model explain price rigidity in oligopoly?

Often prices appear to be relatively stable in oligopolistic markets. There are different models to explain periods of price stability. The most predominant one being the kinked demand curve model, though this has received substantial criticism and economists have put forward other explanations.

Kinked Demand Curve

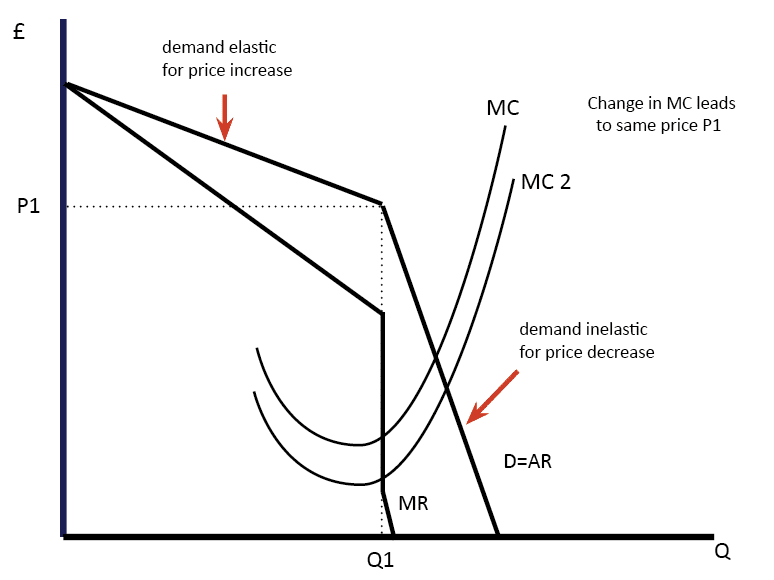

The Kinked demand curve suggests firms have little incentive to increase or decrease prices.

- If a firm increases the price, they become uncompetitive and see a big fall in demand; therefore demand is price elastic for a higher price. This means increasing price would lead to a fall in revenue.

- However, if firm decreases price, they would gain market share. It is assumed in this situation other firms don’t want to lose market share and so, therefore, they cut prices too. Therefore, for a price cut, demand is price inelastic. Because every firm is cutting prices so they receive no increase in market share.

Kinked demand curve model

The model of the kinked demand curve suggests prices will be stable.

- Firms don’t want to increase prices because they will see a sharp fall in demand.

- Firms don’t want to cut prices because they will start a price war, where they don’t gain market share, but do get lower prices and lower revenue.

- Therefore, in theory, the kinked demand curve suggests an explanation for why prices are stable.

Problems with Kinked demand Curve Model

- Empirical evidence to support this model is very weak. Prices do change in Oligopolistic markets much more often than this model suggests.

- The kinked demand curve doesn’t say why prices were reached in the first place.

- Oligopoly makes assumptions about the behaviour of firms in response to price changes that firms, in reality, may not make.

Other Models Explaining Price Stability in Oligopoly

Marginal Cost Plus Pricing. Hall and Hitch in “Price Theory and Business Behavior,” argue that many firms set price on a basis of looking at – marginal cost, plus a percentage of fixed costs, plus a certain profit margin. In other words, firms often look at costs and the industry average to gauge a ‘fair price’. If costs change only slowly, then prices will remain fairly stable. In an oligopoly market like petrol retail. A change in the price of oil will often lead to all firms changing prices by a similar amount.

Game Theory. Game Theory looks at the behaviour of firms when there is interdependence. A kinked demand curve is a limited form of game theory, in that it assumes firms won’t cut prices because of how other firms will react. But, in the real world, there may be situations which explain why firms wait to see how other firms react. Firms don’t want to be the first to change prices.

Psychological Pricing. Psychological pricing suggests in the real world firms seek to set prices which are psychologically attractive to customers. Firms may choose easy to remember numbers like £9.99. In circumstances of low inflation, they may be reluctant to change or they may wait and move to another significant price like £10.99.

Firms are not Short-Term Profit maximisers. In the kinked demand curve model, it is assumed firms wish to maximise profits. However, firms may wish to maximise other objectives such as creating goodwill amongst stakeholders. This may encourage them to absorb cost increases rather than pass it straight on to customers.

Price Leadership. In some oligopolies, there may be an element of price leadership. Firms look up to one dominant firm to set prices. If the dominant firm keeps prices stable, other firms are reluctant to change.

Related

In my experience cost-plus pricing most accurately reflects the internal debate that goes on in industrial oligopoly type firms. At least those where you assume all firms have essentially the same cost of inputs. When input prices are not similar, generally one or more firms is in “not profit maximizing” for whatever reason, and the guy with the best cost structure sets prices via cost+.

This is reinforced in situations where the customers understand the cost model. Then, even a firm benefits from a situation allows them to raise prices (say, a temporary drop in industry-wide production due to a natural disaster that didn’t affect you) they might choose not to do so because of the long standing bad will it would produce.