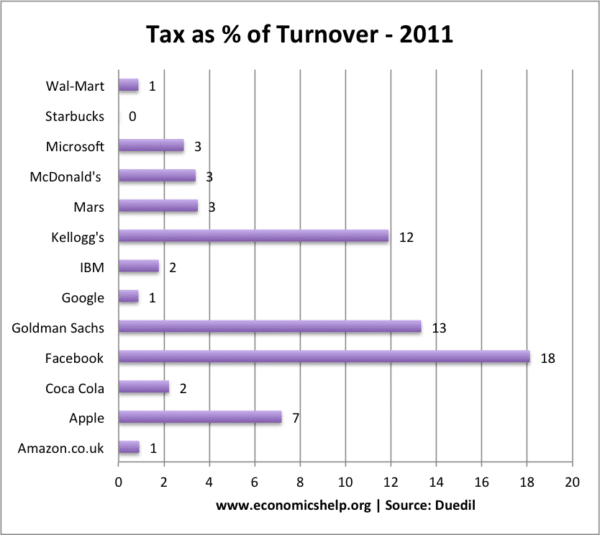

Some interesting data about large multinationals and the amount of tax they have paid in the UK, compared to their turnover.

If we look at tax as a % of 2011 turnover, we see many paying a small percent.

Source: Guardian data via Duedil

The share of turnover paid in tax by Facebook might look impressive, but Facebook has been accused of under-reporting their true turnover in the UK.

Facebook paid its 90 UK-based staff an average of £275,000 each in 2011 while contributing just £195,890 to the Treasury’s coffers. Facebook reported UK revenues of £20.4m, but media analysts estimate that the true UK turnover was closer to £175m in 2011. (Facebook under-report)

Total Tax Paid by Selected Companies

| UK turnover, 2011 £ | Profit before tax, 2011 £ | Tax paid, 2011 | |

| Amazon.co.uk | 207,696,000 | 3,092,000 | 1,880,000 |

| Apple | 69,743,000 | 43,485,000 | 5,007,000 |

| Coca Cola | 1,765,135,000 | 256,277,000 | 39,144,000 |

| 20,413,542 | -13,928,926 | 3,699,057 | |

| Goldman Sachs | 3,160,008,621 | 1,914,749,061 | 421,182,339 |

| 395,757,534 | -20,717,565 | 3,448,446 | |

| IBM | 3,974,300,000 | 327,500,000 | 70,500,000 |

| Kellogg’s | 107,151,000 | 31,292,000 | 12,737,000 |

| Mars | 788,697,000 | 99,844,000 | 27,534,000 |

| McDonald’s | 1,248,549,000 | 176,563,000 | 42,344,000 |

| Microsoft | 663,198,000 | 66,538,000 | 19,024,000 |

| Starbucks | 397,716,437 | -32,853,958 | 0 |

| Wal-Mart | 21,847,700,000 | 443,400,000 | 190,500,000 |

The investment bank, Goldman Sachs paid by far the largest amount of corporation tax.

Microsoft Tax Avoidance

Microsoft pays just 3% of their turnover. Some estimate Microsoft’s worldwide tax avoidance amounts to $4.6 billion, with approx £105m in the UK. (Microsoft tax avoidance)

Google Tax Avoidance

Google is estimated to put 90% of its turnover through its Irish subsidiary to benefit from lower corporation tax in Ireland. It also routes some money through Bermuda

Google had £2.5bn of UK sales in 2011. But only paid £3.4 million UK tax. A tax rate of 00.1% despite having a global-wide profit margin of 33%.

Amazon

Amazon had a turnover of £3.9 bn but the company paid just £1.9m in tax – the equivalent of just 2.5 % of its estimated profits

Related

To pay tax is the highest level of wisdom to a particular country

Nice profit

And we pay to clean up after sales

Every inch of motorway verge is covered

In coke cans bottles years and years old

They make the money and have no responsibility

For there packaging designed to make them money

That’s filling the Earth in waste every second of every day another thousand empty container s

Dumped