In 2012, the EU introduced a new form of its growth and stability pact. The main rules for EU fiscal policy are:

- Total Government debt must not be more than 60% of gross domestic product;

- The Government deficit must not be more than 3% of GDP except in particular circumstances.

- (Source: EU, Current EU rules)

Excessive Deficit Procedure EDP

If a country breaches these rules, it becomes subject to the Excessive Deficit Procedure EDP. This means that the country in question is subject to EU surveillance and must comply with EU decisions on how to deal with the high debt. The country then has to meet medium term budget requirements to reduce deficits. If countries fail to make satisfactory progress, they can be given financial penalties, (‘e.g. an interest-bearing deposit of 0.2% of GDP will be imposed on non-compliant euro-area countries’.)

Countries undergoing EDP

Currently 23 out of 27 EU countries are considered to have excessive debt and are subject to EDP.

For example, Ireland has been given until 2015 to meet the deficit requirement of 3% of GDP. Ireland has until 2018 to meet the debt requirement of 60% of GDP. (Current EU rules)

Reasons for Fiscal Rules

- Overcoming political resistance to spending cuts. Politicians often have an incentive to allow higher short term budget deficits and ignore the long-term consequences. Fiscal rules put pressure on governments to stick to fiscal responsibility. The EU would say the constitutional fiscal rules reduce the political cost of unpopular decisions.

- Lower bond yields. In 2010-12, the Eurozone was hurt by rising bond yields, as markets feared the liquidity of Eurozone nations. If countries stick to fiscal rules, markets will have more confidence that borrowing will be sustainable and the Eurozone will not see the expensive rise in bond yields, which increase the cost of interest payments.

- Single currency makes fiscal rules more important. Countries in the Eurozone cannot rely on an independent Central Bank to print money and buy bonds, therefore fiscal responsibility becomes more important. Some argue these fiscal rules are the first step towards fiscal union.

Problems with Implementing fiscal rules

- Most countries are exceeding these fiscal rules, and to comply with the rules, European governments have had to adopt strict austerity measures to try and achieve the target. This involves cutting government spending and increasing taxes. The consequence of this deflationary policy aiming at deficit reduction has been to cause lower economic growth and rising unemployment.

- Lack of alternative policies. Countries pursuing fiscal austerity, in the Euro, have not been able to adopt other macro-economic policies to stimulate demand. Eurozone countries have not been able to devalue or promote expansionary monetary policy. Therefore, there are several factors reducing demand all at once. A country like the UK, at least as its own monetary policy to offer some stimulus.

- Lack of flexibility. The EU rules state borrowing limits should be reduced to 3% of GDP within certain time frames, but this time frame may be unsuitable for the state of the economy. In the aftermath of the credit crunch, the EU economy faced a balance sheet recession with low bank lending, falling house prices, and high private sector debt. As the private sector cut back on spending and investment this caused a stronger than usual fall in aggregate demand. With governments also trying to reduce debt, this has caused a dual deleveraging and fall in demand. The rules on deficit reduction can become inflexible and require fiscal tightening that damages the prospect of recovery.

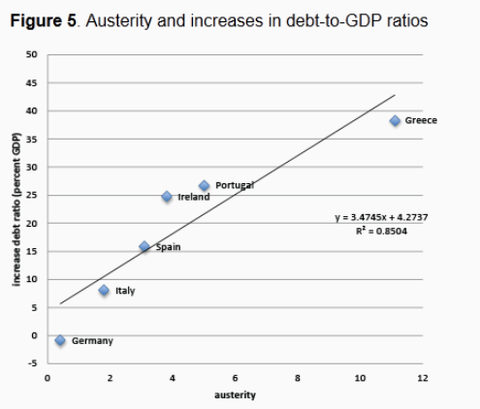

- Austerity has been self-defeating. Many countries which have pursued austerity measures to meet debt targets have been very dissappointed that their debt reduction targets have not been met. The actual attempt to reduce budget deficits has caused lower growth, lower tax receipts and falling GDP. Some studies have shown that attempts to reduce budget deficits are actually increasing the debt to GDP ratio. This is the problem with meeting rules on fiscal responsibility it can have large unintended consequences, and there is a danger of causing a debt spiral. The below graph shows the possibility austerity is associated with rising debt to GDP ratios.

Source: Vox See also: ‘Panic driven austerity‘.

- Why should fiscal rules be more important than unemployment targets and economic growth targets?

- Eurozone economies are struggling because of divergences in competitiveness. Reducing budget deficits doesn’t tackle this underlying divergence in wage costs and competitiveness.

- EU fiscal rules don’t solve the political problems. There is a danger of increased political tension has domestic citizens ‘blame the EU’ for forcing harsh austerity measures on the country.

- It is not clear how much markets are reassured by fiscal rules given that countries have a very poor track record in meeting targets. Also markets are as concerned about economic growth and recovery as meeting fiscal targets.

- There is no evidence that debt above 60% of real GDP becomes damaging. In the past countries have exceeded such debt levels and enabled a period of economic expansion and gradual debt reduction. See: UK national debt history.

Evaluation

- It depends on the economy situation. If the global economy was strong and there is room for growth in exports, it becomes easier to reduce government spending without causing a recession.

- It depends on the type of government spending cuts. For example, some types of current government spending, welfare benefits, public investment would have a large negative impact on aggregate demand. However, if the government pushed spending cuts towards the future, e.g. raising retirement age, changing entitlement to health care and pension, it is possible to make a big dent in public sector spending, without having a negative impact on economic growth. However, governments often find it easier to cut public sector investment, rather than make politically unpopular decisions to boost spending.

- You could argue adherence to fiscal rules during the normal economic cycle will give countries more room for manoeuvre during a recession. If Greece had stuck to fiscal rules in the run up to 2007, the crisis may have been less severe. However, many countries like Spain, Ireland had low levels of debt pre-crisis.

- A reason give for fiscal rules is that it will lead to lower bond yields, however, the rising bond yields in the Eurozone are due to lack of effective Central Bank intervention, rather than debt levels. Countries outside the Euro – Japan, US and UK all had rising debt levels breaching the fiscal limits, but falling bond yields because they have their own currency.

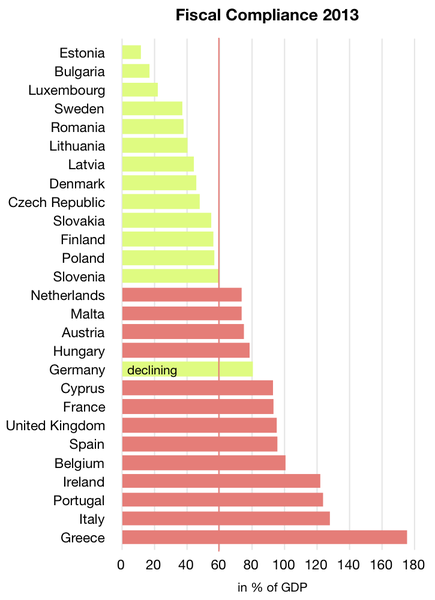

Countries complying with Debt to GDP rules

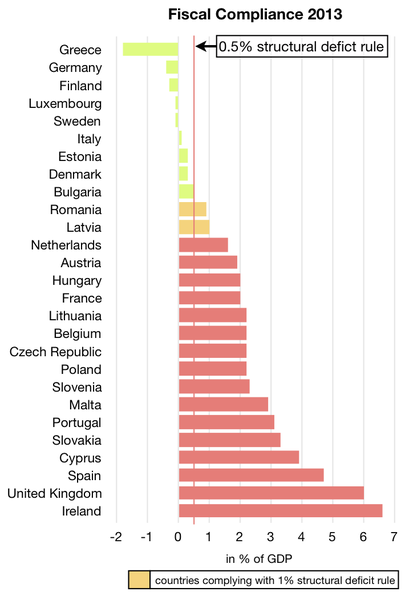

Compliance with structural deficit

Countries complying with structural deficit (deficit excluding cyclical effects of economic cycle)

1 thought on “EU Fiscal rules – economic issues and problems”

Comments are closed.