There is mixed evidence about the success of the Funding for Lending scheme

Firstly, there is evidence that credit is still tight and firms are struggling to gain finance. Since last August, £1.8bn of credit has been drained out of the system At the same time, up to 40 lenders have accessed the £16.5bn in funding from the FLS. However, the pace of credit contraction has slowed when last quarter of 2012, when £2.4bn was sucked out of the economy. (Drop in business loans for lending)

However, funding for lending does appear to be reducing borrowing rates, leading to lower mortgage rates. Combined with the governments Help to Buy scheme, this has led to the highest house price rise for 3 years (house prices 1.4% higher than a year ago Q1 2013). However, given the valuation of house prices, it is arguably damaging to be fuelling another supply constrained house price rise.

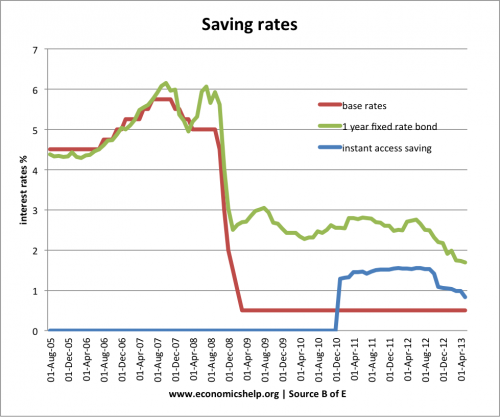

Savers have also seen a fall in deposit rates.

The problem with Funding for Lending so far, is that it has failed to increase bank loans to business, but is fuelling higher demand for mortgages and leading to fall in the savings ratio. Arguably, this is not helping the economy to ‘rebalance’ away from consumer spending and the housing market. The Bank of England argue it will take time for the effects of Funding for Lending to filter through into higher lending, and it is better than doing nothing.

http://www.nypost.com/seven/09242008/pos…

There’s one villain that has slipped notice: how illegal immigration, crime-enabling banks and open-borders Bush policies fueled the mortgage crisis. It’s no coincidence that the areas hardest hit by the foreclosure wave – Loudoun County, Va., California’s Inland Empire, Stockton and San Joaquin Valley, and Las Vegas and Phoenix – also happen to be some of the nation’s largest illegal alien sanctuaries. Half of the mortgages to Hispanics are subprime. A quarter of all those subprime loans are in default and foreclosure.

Regional reports across the country have decried the subprime meltdown’s impact on illegal-immigrant “victims.” A July report showed that in seven of the 10 metro areas with the highest foreclosure rates, Hispanics were at least one-third of the population; in two of those areas – Merced and Salinas-Monterey, Calif. – Hispanics comprised half the population. The National Council of La Raza and its Development Fund have received millions in federal funds to “counsel” their constituents on obtaining mortgages with little to no money down; the group almost succeeded in attaching a $10 million earmark for itself in one of the housing bills passed this spring.

The Washington Post noted in 2005: “Hispanics, the nation’s fastest-growing major ethnic or racial group, have been courted aggressively by real-estate agents, mortgage brokers and programs for first-time buyers that offer help with closing costs. Ads proclaim: “Sin verificacion de ingresos! Sin verificacion de documento!” – which loosely translates as, ‘Income tax forms are not required, nor are immigration papers.’ ”

Fraudsters also have engaged in house-flipping rings using illegal aliens as straw buyers. Among many examples the FBI cites: a conspiracy in Las Vegas involving a former Nevada First Residential Mortgage Company branch manager who directed loan officers and processors in the origination of 233 fraudulent Federal Housing Authority loans valued at over $25 million. The defrauders made and submitted false employment and income documentation for borrowers; most were illegal immigrants from Mexico. To date, the FBI reported, “Fifty-eight loans with a total value of $6.2 million have gone into default, with a loss to the Housing and Urban Development Department of over $1.9 million.”

Thanks to lax Bush administration policies allowing illegal aliens to use “matricula consular cards” and taxpayer-identification numbers to open bank accounts, mortgage fraud has grown. Money-lenders still have no access to a verification system to check Social Security numbers before approving loans.

In an interview about rampant illegal-alien home-loan fraud, a spokeswoman for the US General Accounting Office told me five years ago: “Considering the size of Los Angeles, New York, Chicago, Houston and other large cities throughout the United States known to be inundated with illegal aliens, I don’t think the federal government is willing to expose this problem for financial reasons as well as for fear of political repercussions.”

http://www.americandaily.com/article/232…

While offering credit cards to people who are here illegally and lack Social Security numbers, Bank of America has been offering checking accounts and even mortgages to illegal aliens for years. Lending giants Wells Fargo and Citibank are among those who have also extended home loans to illegal aliens.

In 2005, President of Immigration Matters Marti Dinerstein, angry over this practice, told CNN: “It’s institutionalizing illegality. Now there’s no distinction being made between the people that follow all the rules and those who break our laws by entering the country or overstaying their visas.”

An American cannot obtain a mortgage loan for a home unless he or she has government issued identification, established credit, and verifiable income. However, for several years, the banks have been giving mortgages to illegal aliens who lack all of these things.

Now they have a bailout so will illegal aliens ultimately benefit? Off our tax dollars?