Economic growth means an increase in real output (real GDP). Therefore, with increased output and consumption we are likely to see costs imposed on the environment. The environmental impact of economic growth includes the increased consumption of non-renewable resources, higher levels of pollution, global warming and the potential loss of environmental habitats.

However, not all forms of economic growth cause damage to the environment. With rising real incomes, individuals have a greater ability to devote resources to protecting the environment and mitigate the harmful effects of pollution. Also, economic growth caused by improved technology can enable higher output with less pollution.

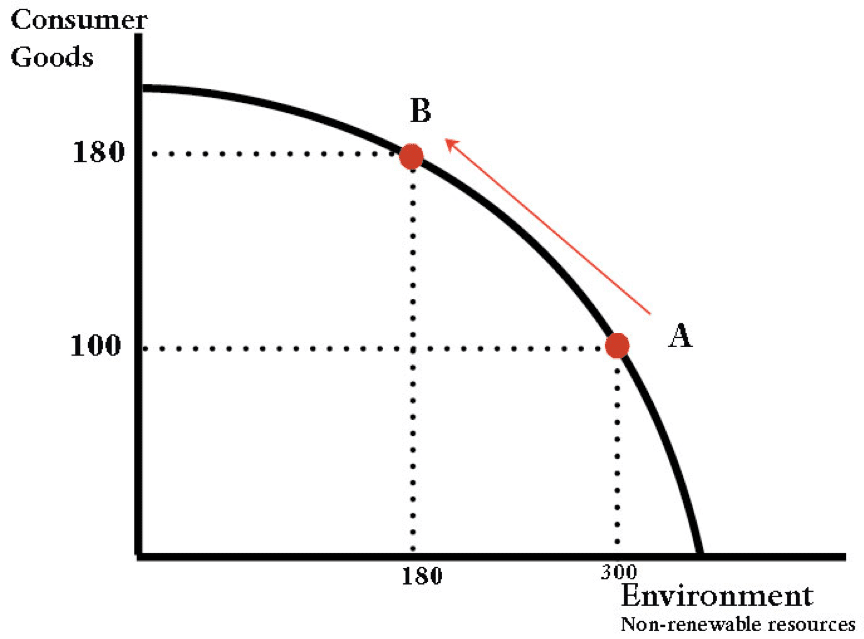

Classic trade-off between economic growth and environmental resources

This PPF curve shows a trade-off between non-renewable resources and consumption. As we increase consumption, the opportunity cost implies a lower stock of non-renewable resources.

For example, the pace of global economic growth in the past century has led to a decline in the availability of natural resources such as forests (cut down for agriculture/demand for wood)

- A decline in sources of oil/coal/gas

- Loss of fishing stocks – due to overfishing

- Loss of species diversity – damage to natural resources has led to species extinction.

External costs of economic growth

- Pollution. Increased consumption of fossil fuels can lead to immediate problems such as poor air quality and soot, (London smogs of the 1950s). Some of the worst problems of burning fossil fuels have been mitigated by Clean Air Acts – which limit the burning of coal in city centres. Showing that economic growth can be consistent with reducing a certain type of pollution.

- Less visible more diffuse pollution. While smogs were a very clear and obvious danger, the effects of increased CO2 emissions are less immediately obvious and therefore there is less incentive for policymakers to tackle. Scientists state the accumulation of CO2 emissions have contributed to global warming and more volatile weather. All this suggests economic growth is increasing long-term environmental costs – not just for the present moment, but future generations.

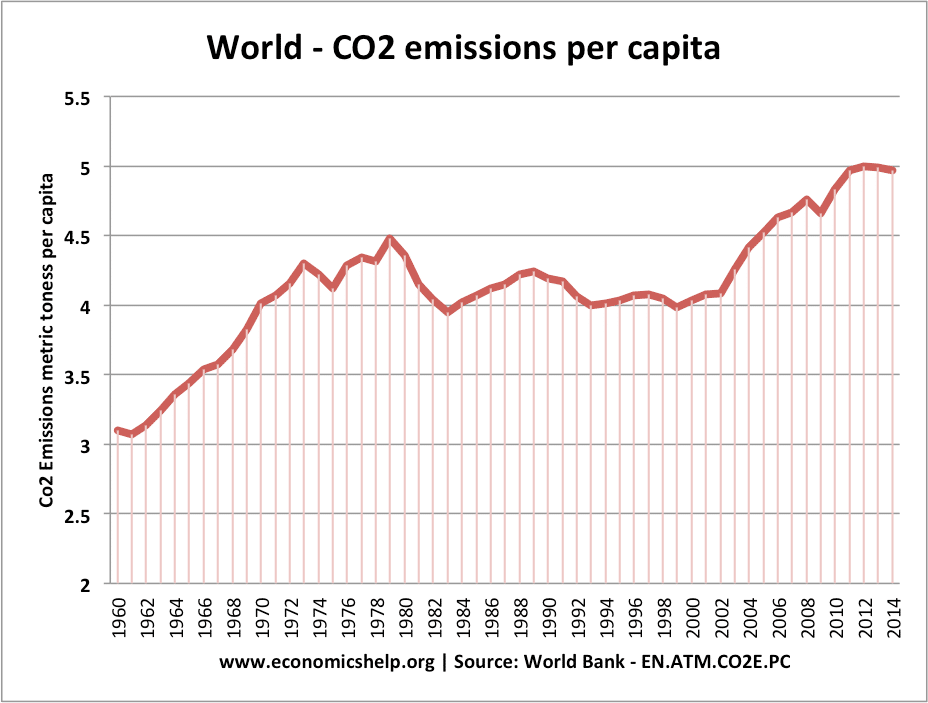

- This graph shows CO2 emissions per capita. It shows a 66% rise in per capita pollution between 1960 and 2014. The total emissions are also higher because of population growth. 1960 to 2014 was a period of strong economic growth and despite the development of new technologies, has failed to halt the rise. The last few years 2011 to 2014 show a levelling – this is only a short time range, but could be due to improved global efforts to reduce pollution. (it was also a period of low economic growth in Western economies)

- Damage to nature. Air/land/water pollution causes health problems and can damage the productivity of land and seas.

- Global warming and volatile weather. Global warming leads to rising sea levels, volatile weather patterns and could cause significant economic costs

- Soil erosion. Deforestation resulting from economic development damages soil and makes areas more prone to drought.

- Loss of biodiversity. Economic growth leads to resource depletion and loss of biodiversity. This could harm future ‘carrying capacity of ecological systems’ for the economy. Though there is uncertainty about the extent of this cost as the benefit of lost genetic maps may never be known.

- Long-term toxins. Economic growth creates long-term waste and toxins, which may have unknown consequences. For example, economic growth has led to increased use of plastic, which when disposed of do not degrade. So there is an ever-increasing stock of plastic in the seas and environment – which is both unsightly but also damaging to wildlife.

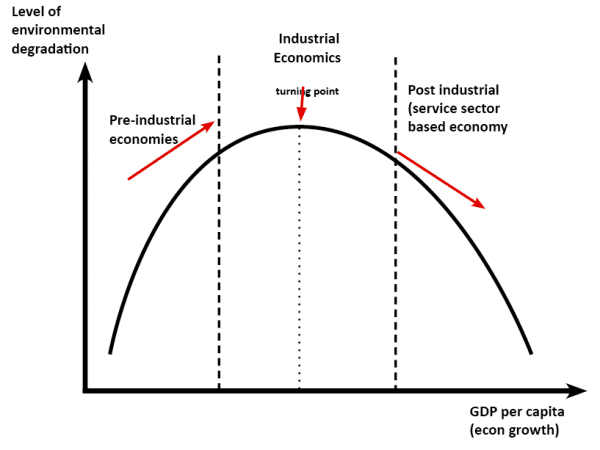

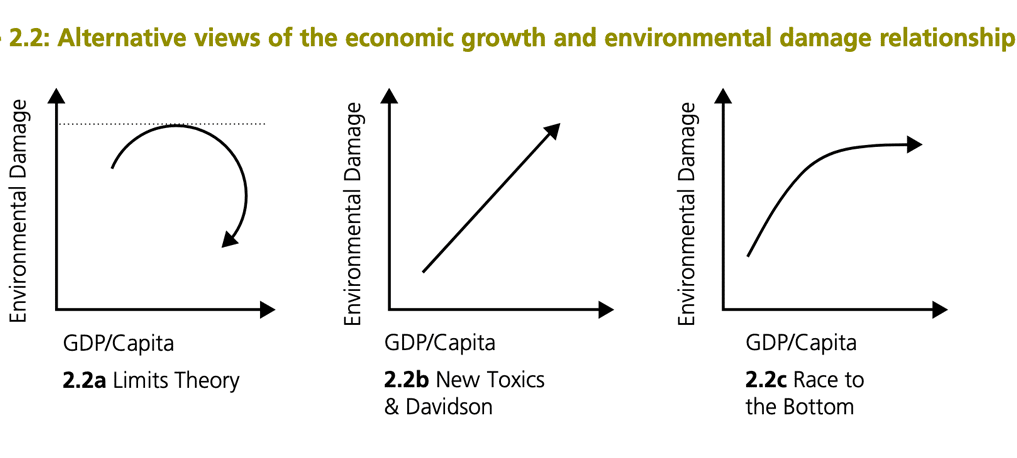

U-Shaped curve for economic growth and the environment

One theory of economic growth and the environment is that up to a certain point economic growth worsens the environment, but after that the move to a post-industrial economy – it leads to a better environment.

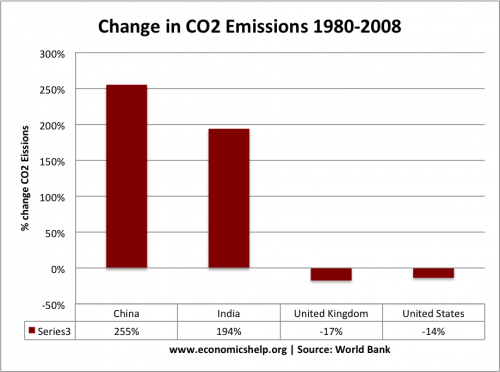

For example – since 1980, the UK and the US have reduced CO2 emission. The global growth in emissions is coming from developing economies.

Another example – In early days of growth, economies tend to burn coal/wood – which cause obvious pollution. But, with higher incomes, an economy can promote cleaner technology which limits this air pollution. However, in a paper “Economic growth and carrying capacity” by Kenneth Arrow et al. they caution about this simplistic u-shape. As the authors state:

“Where the environmental costs of economic activity are home by the poor, by future generation, or by other countries, the incentives to correct the problem are likely to be weak”

- It may be true there is a Kuznets curve for some types of visible pollutants, but it is less true of more diffuse and less visible pollutants. (like CO2)

- The U-shaped maybe true of pollutants, but not the stock of natural resources; economic growth does not reverse the trend to consume and reduce the quantity of non-renewable resources.

- Reducing pollution in one country may lead to the outsourcing of pollution to another, e.g. we import coal from developing economies, effectively exporting our rubbish for recycling and disposal elsewhere.

- Environmental policies tend to deal with pressing issues at hand but ignore future intergenerational problems.

Other models of a link between economic growth and environment

Limits Theory

This suggests that economic growth will damage the environment, and damage will itself start to act as a brake on growth and will force economies to deal with economic damage. In other words, the environment will force us to look after it. For example, if we run down natural resources, their price will rise and this will create an incentive to find alternatives.

New toxics

This is more pessimistic suggesting that economic growth leads to an ever-increasing range of toxic output and problems, some issues may get solved, but they are outweighed by newer and more pressing problems which are difficult if impossible to overturn.

This model has no faith that the free-market will solve the problem because there is no ownership of air quality and many of the effects are piling up on future generations; these future effects cannot be dealt with by the current price mechanism.

Race to the bottom

This suggests that in the early stages of economic growth, there is little concern about the environment and often countries undermined environmental standards to gain a competitive advantage – the incentive to free-ride on others’ efforts. However, as the environment increasingly worsens, it will reluctantly force economies to reduce the worst effects of environmental damage. This will slow down environmental degradation but not reverse past trends.

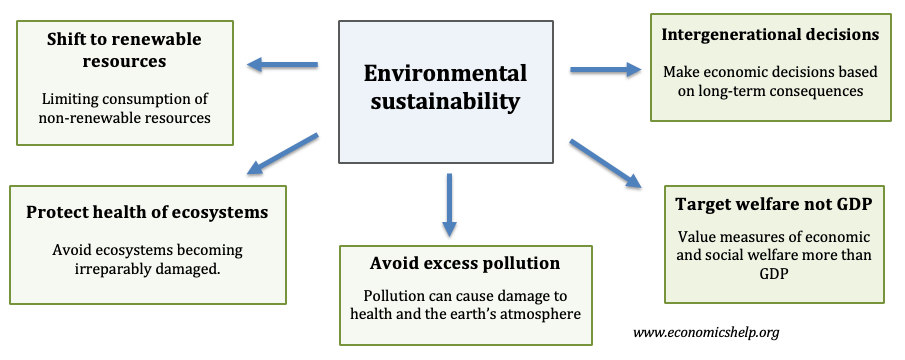

Economic growth without environmental damage

Some ecologists argue economic growth invariably leads to environmental damage. However, there are economists who argue that economic growth can be consistent with a stable environment and even improvement in the environmental impact. This will involve

- A shift from non-renewables to renewables A recent report suggests that renewable energy is becoming cheaper than more damaging forms of energy production such as burning coal and in 2018 – this has led to a 39% drop in new construction starts from 2017, and an 84% drop since 2015.

- Social cost pricing. If economic growth causes external costs, economists state it is socially efficient to include the external cost in the price (e.g. carbon tax). If the tax equals the full external cost, it will lead to a socially efficient outcome and create a strong incentive to promote growth that minimises external costs.

- Treat the environment as a public good. Environmental policy which protects the environment, through regulations, government ownership and limits on external costs can, in theory, enable economic growth to be based on protection of the environmental resource.

- Technological development. It is possible to replace cars running on petrol with cars running on electricity from renewable sources. This enables an increase in output, but also a reduction in the environmental impact. There are numerous possible technological developments which can enable greater efficiency, lower costs and less environmental damage.

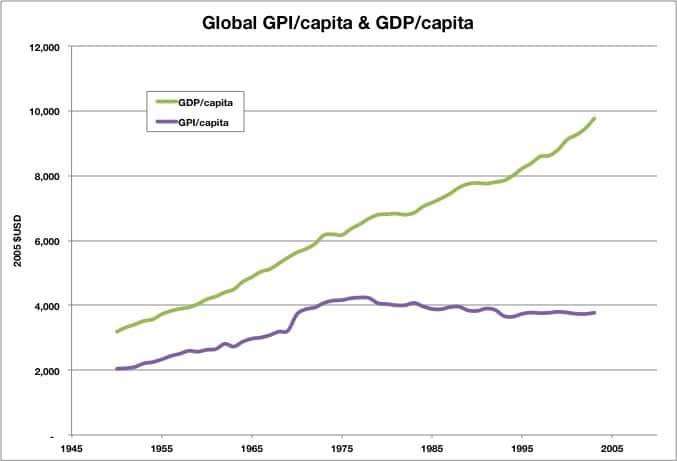

- Include quality of life and environmental indicators in economic statistics. Rather than targetting GDP, environmental economists argue we should target a wider range of living standards + living standards + environmental indicators. (e.g. Genuine Progress Indicators GPI)

Source: Ida Kubiszewski et al, “Beyond GDP: Measuring and Achieving Global Genuine Progress,” Ecological Economics, 93, (2013).

Related

It’s really interesting and useful to me, but I need to know more about the relationship between economic growth, energy consumption and environmental degradation

Verry understandable

GDP is direct related with Energy generation, Carbon dioxide Emission (due to fossil fuel use in electric & motive power generation },Resource Depletion/Degradation, Global Warming and Climate Change. Reports by various agencies including DOE, IPCC, World Bank etc are sources for these information.

I have covered this subject in my latest book entitled ”Green Tribology, Green Surface Engineering and Global Warming,ASM International, OH, USA, 2014” with hundreds of references for further studies.Ram, Austin, Texas,

The imminent collapse of ecosystems can only be stopped by economic diminution, dispensing with all unnecessary products and reducing the total production to the most essential. The concept of degrowth should be implemented as fast as possible on a larger scale. Eco-sufficiency and life quality are more important than profit maximization. https://degrowth.org/ https://www.degrowth.info/en/ https://en.wikipedia.org/wiki/Degrowth

Life quality as mentioned above, in my sense, is a little bit vague term. Life quality now is better than the ice-age we had. Environmental protection versus at the cost of economic supportive growth will bring to some good extent non-collapsible ecosystem home.

this essay give me some importance information and it really helpful to me. also, l wanna know how economic growth impact natural environment?

Very useful.

True it has really helped me in my studies. Thank you.

This just helped me with my exam. Thank God!

The size of our planet is finite. Continued growth will eventually result in saturation, starvation etc. 2bn people to the current 8bn in 100 years, and governments all still say growth is a good thing? It might end humans quicker (good for the planet, which has plenty if time to recover) but not so good for us.

Very informative stuff, especially on the environment, quite an eye opener for me and truly intrigued.

I FIND YOUR MATERIALS TO BE VERY EDUCATIVE, KINDLY INCLUDE ME ON YOUR MAILING LIST.

REGARDS

RICHARD

i found its very educative & knowledgeable. especially the curve system for environment affect to the gdp. its an eye opener information to the respective researches. informative aspects clear.

I have been suffering with course work but thank you very much

Is the graph at 2.2a (Limits Theory) possible or meaningful? It suggests that beyond a certain level of GDP per capita there are two possible amounts of environmental damage.

Take your pick?

Where next (arrow)?

I suggest this ‘graph’ has not been thought through, and is meaningless.