Oil price futures are financial contracts which involve obligations to buy or sell an instrument in the future at a fixed price. Oil price futures are a derivative, which means their value derives from the price of oil.

Typically, people may buy oil futures with a 3 month date from the present time.

Oil futures may be used by airline companies to hedge against volatile movements in prices. E.g. by buying a future it enables an airline to plan for the next 3 month costs knowing the oil price. If oil prices rise more than expected they can insulate themselves from this price rise.

Oil futures may also be bought by speculators seeking to predict future oil prices. When buying a future contract you only have to pay part of the cost. This enables speculators to buy on the margin and enable bigger gains (and of course bigger potential losses).

The market for oil price futures indicates what the market think will happen to oil prices in the future.

For example, looking at the futures market for NYMEX oil you can see that the price is expected to rise

- June 09 – $57

- DEC 09 $60

- FEB 09 – $62

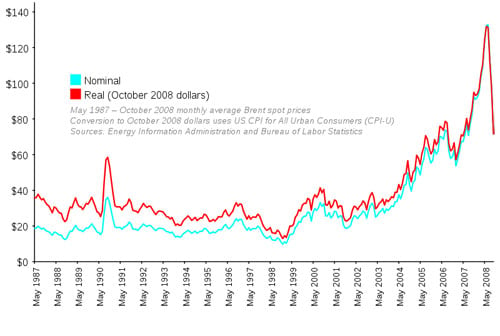

Looking at the price rise of oil in 2008, there is scope for oil prices to rise much more than $62. If the global economy recovers and demand for oil starts to rise again, oil prices could again rise to over $100. This could give a large profit to those who take an option to buy at a fixed price of $60.

However, the price of oil has proved very volatile and hard to predict in recent years

graph from: wikipedia (creative commons)