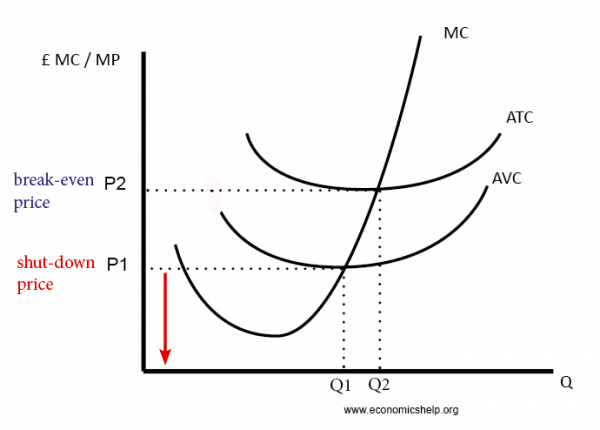

The break-even price is the price necessary to make normal profit. It is a price which includes all costs, including variable and fixed costs.

- At the break-even price, the firm neither makes a loss or profit.

- The break-even price occurs where AR = ATC

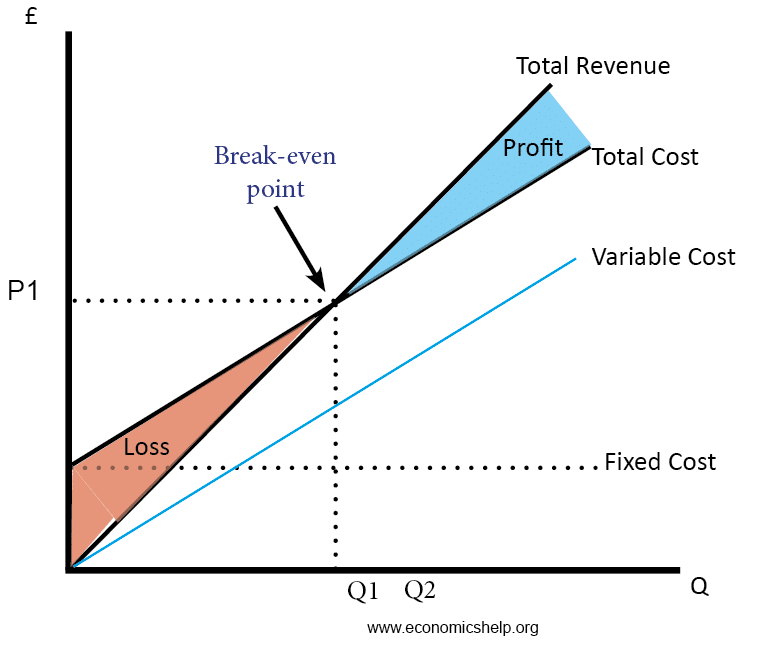

- The break-even price occurs where Total Revenue = Total Cost (TC)

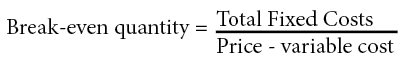

Formula for break-even price

(Total fixed cost / production unit volume) + variable cost per unit

Example of break-even price calculation

- Fixed costs = £12,000

- Average variable cost = £12

- Output = 3,000

- Break-even price = (12,000/3,000) + £12 = £16

Example 2

- If the output increases to 24,000, the break-even price would be lower.

- The average fixed cost would now be 12,000/24,000) = £0.50

- Therefore, the break-even price would be £12.50

Diagram of break-even price

At P2 – average revenue (AR) = ATC.

Break-even output

Suppose:

- Fixed costs = £40,000

- Average variable cost = £8

- Market Price = £13

How much does the firm need to sell in order to break even, with a market price of £13?

Q = 40,000/ (13-8)

Q = 8,000

Uses of break-even price

- A firm will be interested to know the break-even price. For example, if it is entering a market, it may be interested in the lowest price it can set without making a loss.

- This is important for a firm with the objective of sales maximisation. One definition of sales maximisation is setting the price as low as possible, whilst still making normal profit (and breaking even).

- A firm may find out its break-even price and then add a certain profit margin, to help set prices.

Evaluation of break-even price

- A firm may not be able to easily calculate all its average total costs, and so in the real world, it could get the price wrong.

- Similarly, it may calculate break-even price on a certain output, but if demand is less than expected, the price will be too low.

Related