Definition: Current Prices measures GDP/ inflation/asset prices using the actual prices we notice in the economy. Current prices make no adjustment for inflation.

Constant prices adjust for the effects of inflation. Using constant prices enables us to measure the actual change in output (and not just an increase due to the effects of inflation.

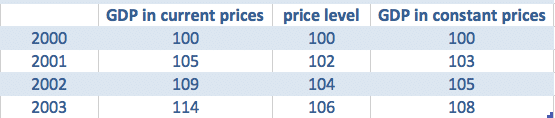

Example

This shows that between 2000 and 2003, GDP (at current market prices) rose 14%.

However, in this period, inflation was 6%.

Therefore, adjusting for effects of inflation, GDP has increased in real terms by 8%.

- At current market prices, GDP rose 14%

- At constant prices (ignoring inflation) GDP rose 8%

The importance of current and constant prices

If your wage went from $40,000 a year to $70,000 – that would seem a very substantial improvement in living standards.

However, if inflation was running at 50% a year, the purchasing power of that extra 75% income would be reduced by the effects of inflation. Using constant prices would give a better guide to your real wage.

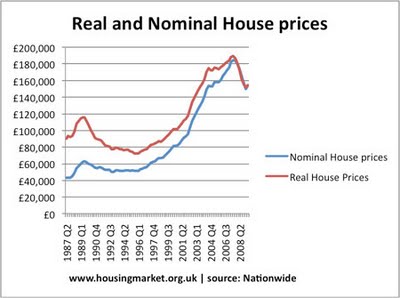

Real and nominal house prices

Using current market prices (nominal), house prices rose from £41.000 to £158,000 in 2008

However, a large part of this rise is due to effects of inflation. Using constant prices, the house price increase is £92,000

Related

Thank you ! It was very helpful.

It was helpful

Very helpful thanks.

Thank you very much! It was really helpful.

just what i needed to know, thanks