There is no absolutely agreed definition to a depression. But I would define a depression as

- A deep and long-lasting period of negative economic growth, with output falling for at least 12 months and GDP falling by over 10%.

A depression means the economy experiences a significant fall in output, higher unemployment and disruption to normal economic activity. It is a deep and prolonged form of a recession (negative economic growth)

A mild recession, with a small fall in GDP (of say 1-3%) would not be considered a depression by economists. Though in everyday use, people may refer to the economic downturn as a depression.

Harry Truman gave a famous quip about the practical meaning of depression.

It’s a recession when your neighbor loses his job; it’s a depression when you lose your own.”

― Harry S. Truman

Features of a depression

A depression would involve:

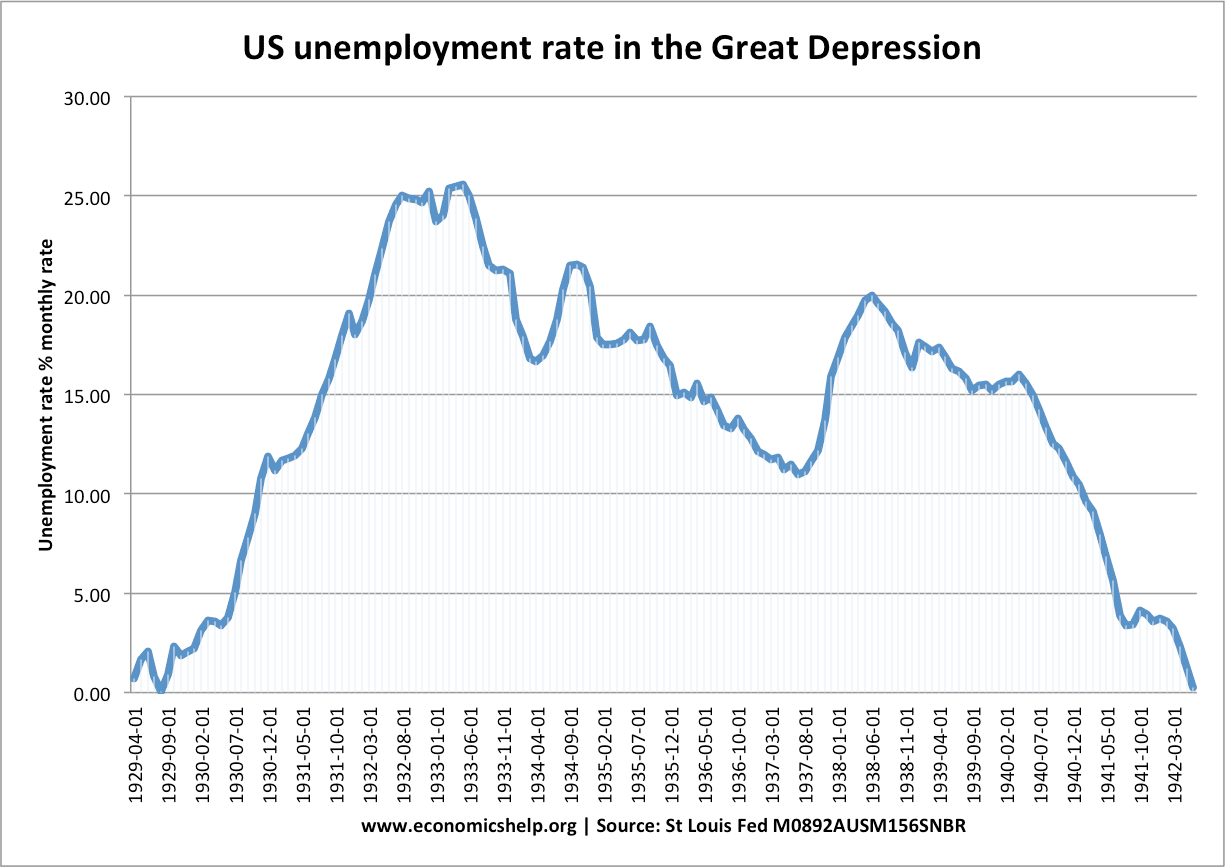

- Very high levels of unemployment (In the great depression, unemployment often rose to 20% or more)

- Fall in real wages

- Very low inflation and possibly deflation

- Falls in asset prices, such as the stock market and house prices.

- Significant fall in business and consumer confidence.

- Liquidity trap – interest rates cut, but have little impact in boosting demand.

Examples of Depressions

US economy 1929-32

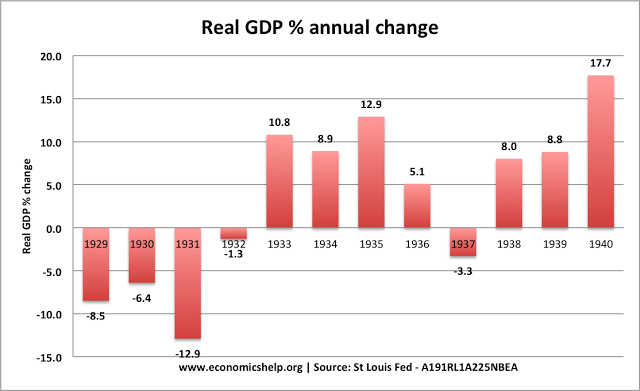

In the three years of 1929-32, the US economy fell by nearly 30%.

The economy rebounded in 193-36, but to many people, the economy still felt like it was in a depression because unemployment was so high.

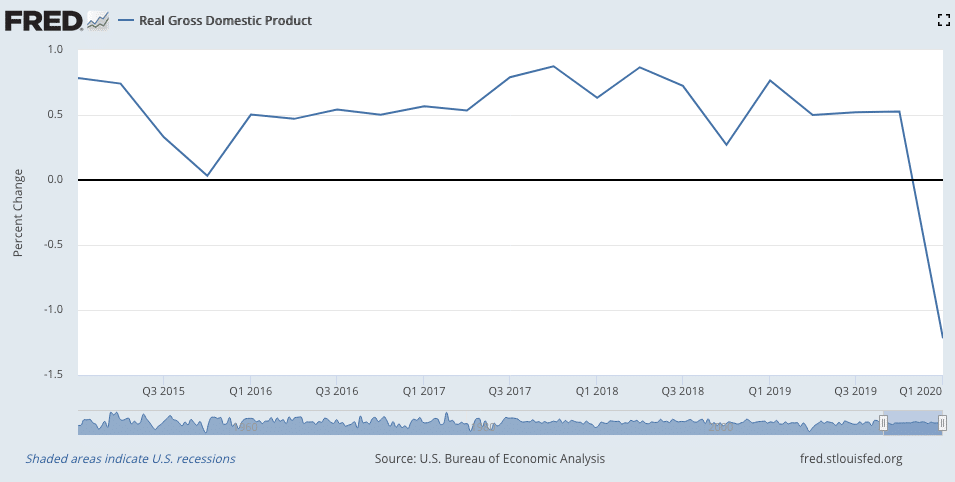

2020 Covid Depression

This graph just shows Q1 of 2020, with a quarterly fall of 1.2% (which is equivalent to an annual fall of 4.8%).

Technically, this is not a depression yet. But, by the end of 2020, I am sure we will have seen a fall in GDP of at least 10% – if not 25%.

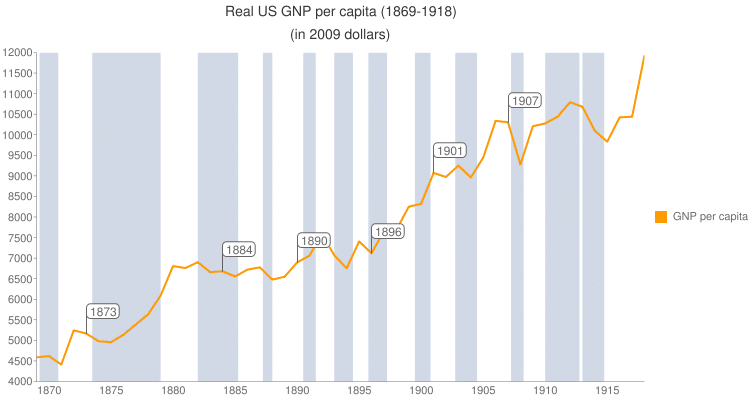

Was the Long Depression of 1873-1879 really a depression?

The long depression of 1873-79 saw falling prices and substantially reduced rate of economic growth. In the US GDP continued to rise, but this was mainly due to a substantial rise in population.

By the metric of GDP, it was not a depression.

However, by the metric of GDP per capita – it was a depression – with the NBER stating the US experienced 65 consecutive months of falling real GDP per capita. Unemployment rose to an estimated 1 million and up to 25% unemployment around New York.

Related concept

- Deflation. This involves a fall in the general price level and is very rare. But, when prices do fall it usually causes a big fall in spending.

Further reading on depressions

Tejvan Pettinger, Oxford, UK. www.economicshelp.org 5 May 2020