Readers Question Can you tell me: Is speculation on a hot real estate market a counterexample to the law of demand or indirect evidence of it?

The Law of Demand

One of the first things you learn in economics is the basic law of demand – When prices rise, people buy less. When prices fall, people buy more. This seems intuitive. If HMV cut the price of CDs, they would probably see an increase in sales.

However, sometimes, markets appear not to follow this basic principle.

One example is the market for real estate (housing in UK). When prices are rising it attracts buyers into the market. Rising prices encourage people to buy because

- It makes real estate look a good investment

- A small deposit can soon be increased into a big deposit.

- It is easier to get mortgage finance.

When house prices start falling, the number of buyers sharply falls. This has occurred in both the US and now the UK where the number of potential buyers has sharply fallen.

It appears that higher prices encourage people to demand more. Lower prices encourage people to demand less.

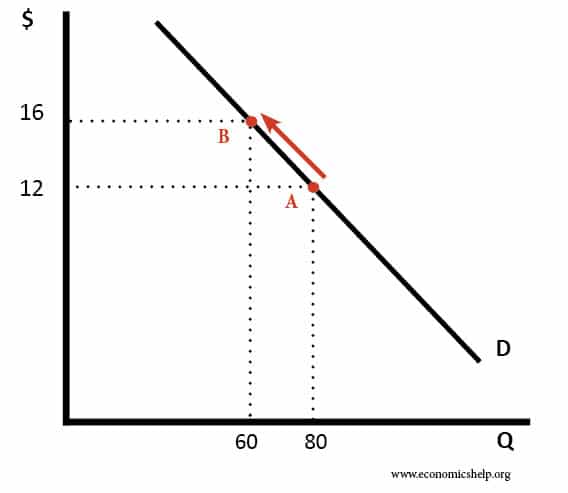

However, for any point in time, the law of demand is still true. What happens is that in a housing boom the demand curve is shifting to the right. People want to buy more houses at any given price. The demand curve has shifted to the right because:

- People think buying a house has become attractive

- It is much easier to buy because lenders are offering various attractive mortgages (therefore effective demand is shifting to the right)

- Higher confidence

When house prices are falling, lenders don’t want to lend mortgages without a big deposit. Therefore, it is hard to buy a house – even if you wanted to. This causes the demand curve to shift to the left.

Also, consumers are less willing to demand a house when prices are falling because they think it will be cheaper in the future.

But, suppose you are having difficulty selling your house at the moment (because the demand curve for housing is shifting to the left) then if you cut the asking price, the number of prospective buyers would increase and you are more likely to sell your house. Therefore, this shows that the law of demand does apply in the short term.

Even in a boom, if you increased the house price above the market average, you would have more difficulty selling it.

It is also worth bearing in mind that the Supply for housing is usually very inelastic in the short term. Therefore, if the demand curve shifts to the right, it will cause a big rise in price.

Related

4 thoughts on “Speculative Demand for Housing”

Comments are closed.