OK, I have a question for you. This was the example which popped to mind as I was reading your entry. (price elastic products)

Here in my Middle Eastern country, sheep are sold for meat. Each year, prior to the Festival of the Sacrifice (Muslim holiday where every family buys a sheep to butcher at home in the house), families go shopping for their sheep. In the weeks prior to the Festival, the price of sheep goes UP, UP, UP. Sometimes the prices seem to reach scandalous levels. Of course, after the Festival, the price falls back to normal.

It appears that according to your explanation, this would be a PRICE INELASTIC good. However, this is NOT a monopoly, as there are MANY, MANY sellers of sheep in the market-place. It looks more like a collusion of price-fixing among the many sellers, to me. What do you think about this?

Thanks for question, it is interesting. I feel that the increase in price is due to an exceptional increase in demand, but a relatively inelastic supply of sheep at this particular time.

What seems to happen at this particular point in time, is that demand for sheep may increase by, say 1000%. However, in this festival week, the supply cannot increase by 1000%? I assume that farmers will try and predict the increase in demand. However, it may be that they can only increase the supply of sheep on the market by say 500%. Therefore, despite an increase in the supply of sheep, the increase in demand for sheep is far greater and therefore prices rise.

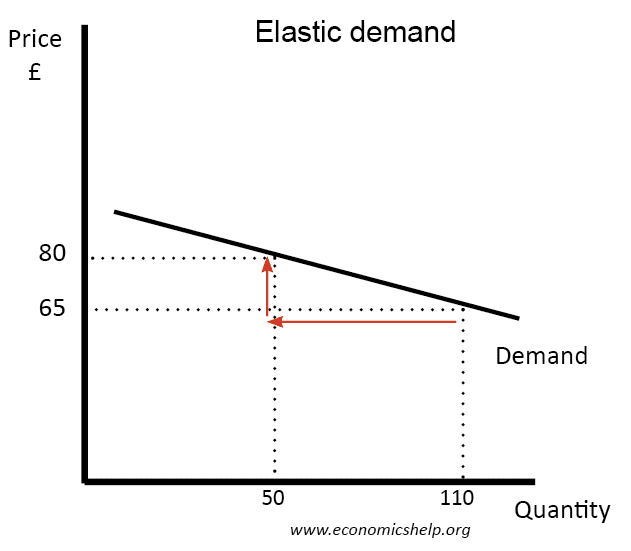

Since buying a sheep, at this time, is seen as an essential purchase, demand is very inelastic for sheep during this week. Therefore, consumers are willing to pay the higher price (a price they wouldn’t pay at other times of the year when other types of meat would be seen as a substitute.)

Inelastic demand and monopoly

A good can still have an inelastic demand even if markets are competitive. Demand for sheep is inelastic because consumers don’t see any alternative to buying sheep. In the UK, demand for tobacco is inelastic because smokers don’t see any alternative to smoking

However, because there are many sellers, demand for individual farmers may be elastic. E.g. if one farmer sold cheaper sheep he would see an increase in demand. Similarly a particular brand of cigarettes may be elastic despite overall demand for cigarettes being inelastic.

Collusion and High Prices?

Perhaps the farmers could try harder to increase supply at this time, but, you can see the temptation to avoid doing this. This week offers a chance to make a very high profit. My feeling is that farmers are not actively colluding to set high prices. But, they don’t have much incentive to try and increase supply and avoid prices rising. In other words, it is easy for farmers to tacitly collude and allow prices to rise each year. Farmers have little to be gain from working out how to avoid the shortages which benefit them so much.

Read more