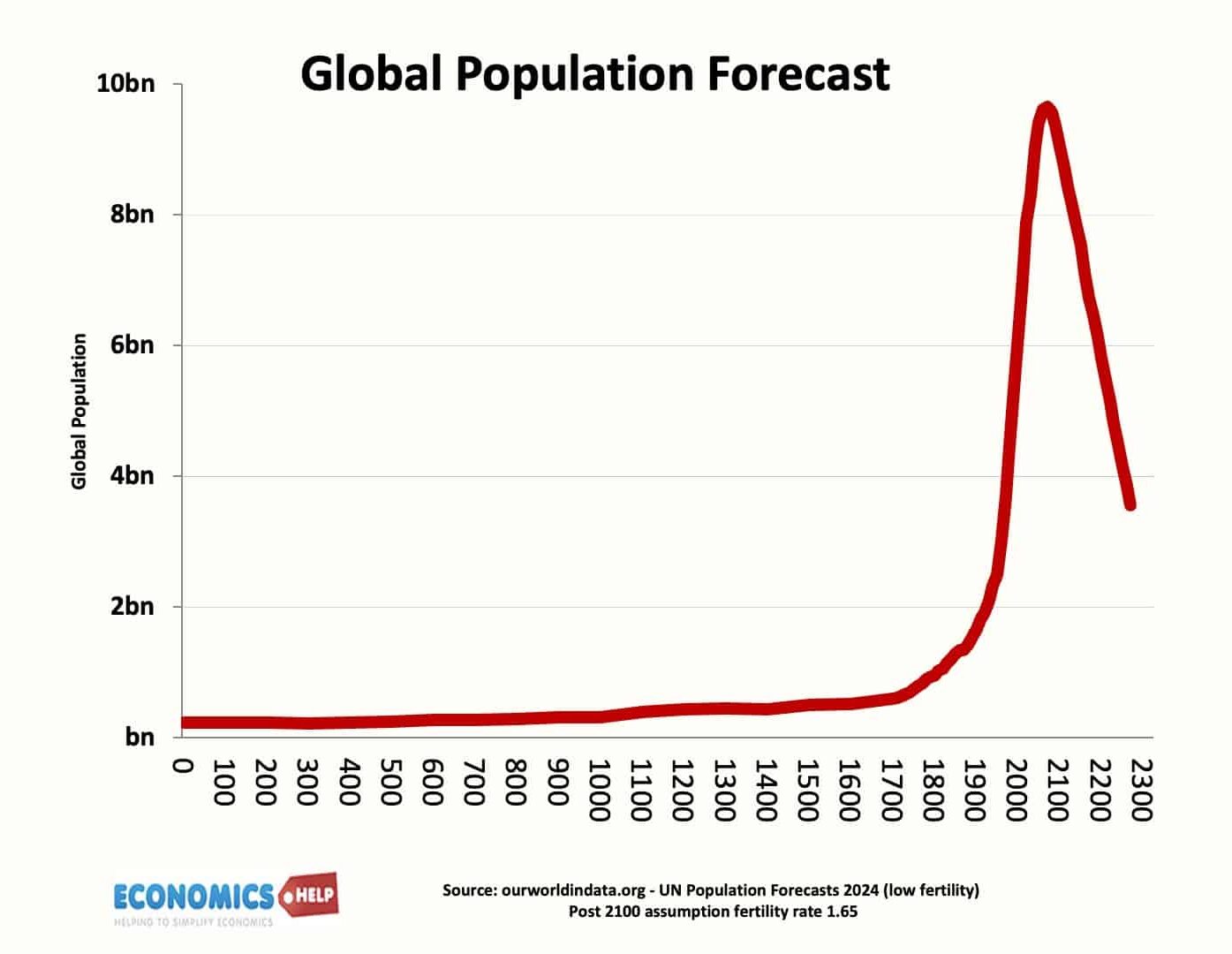

The story of the past 2000 years, is the inexorable rise of the human population. Yet as fertility rates drop faster than forecast, this remarkable story is set to go into an unchartered reverse. Population Collapse – What Happens when the Population Shrinks?Watch this video on YouTube In the twentieth century, Italy’s population roughly doubled …

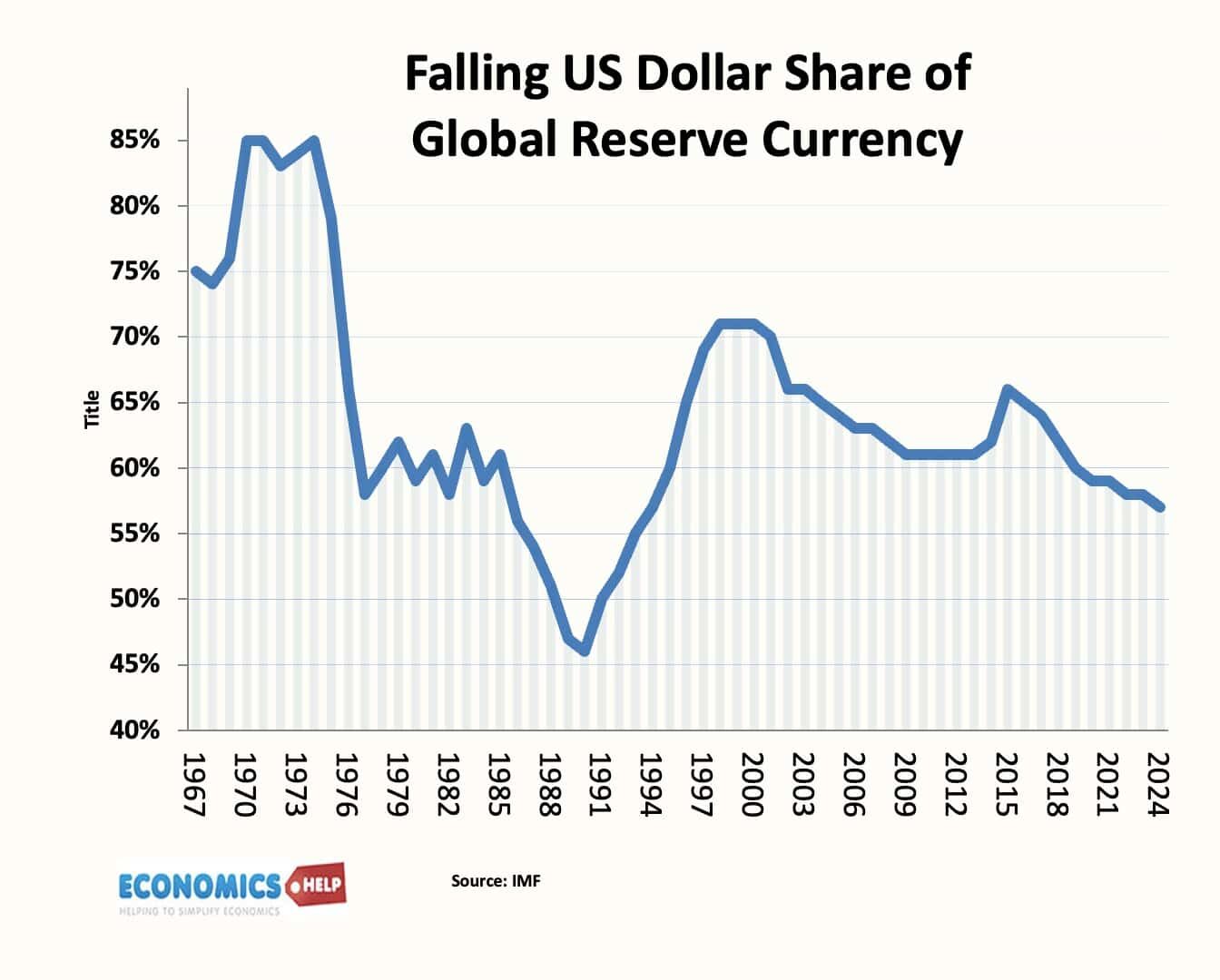

Why the Dollar is on the Way Down

Since the start of the year, the dollar has fallen 11%. And this fall in the dollar has occurred despite the US having significantly higher short-term rates which should in theory, be boosting the dollar value. Investors are worried about US instability, higher tariffs, the threat of inflation, lower growth and now a rapid rise …

What is Britain Good at – Growth areas in the Economy

Winter in Britain can be pretty bleak and grey; no wonder many want to leave. But British ingenuity has designed this all-year round strawberry growing facility. Artificial light powered by renewable energy and this impressive mechanism ensures the plants get optimal access to light. No more expensive imports, no need for pesticides or even backbreaking …

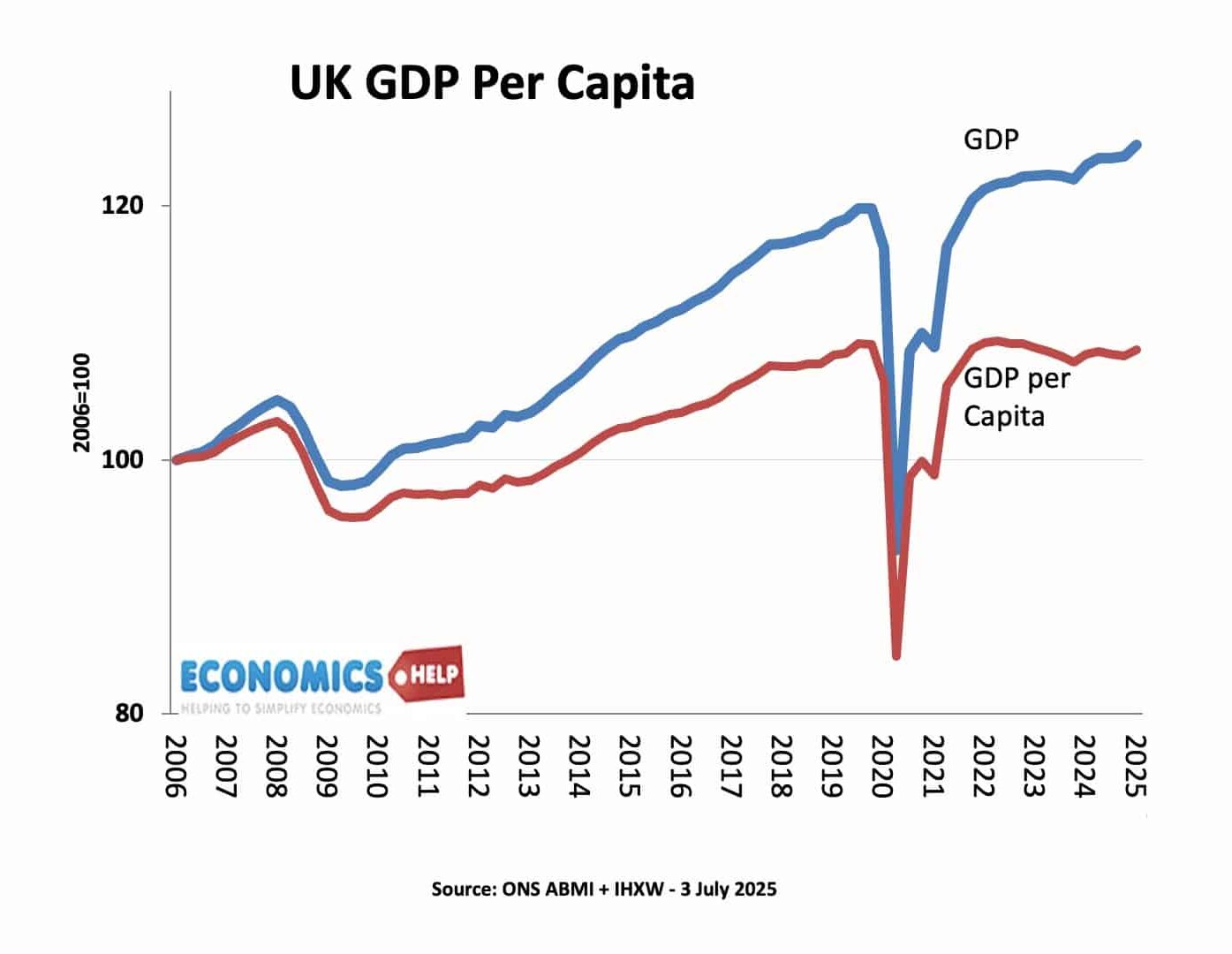

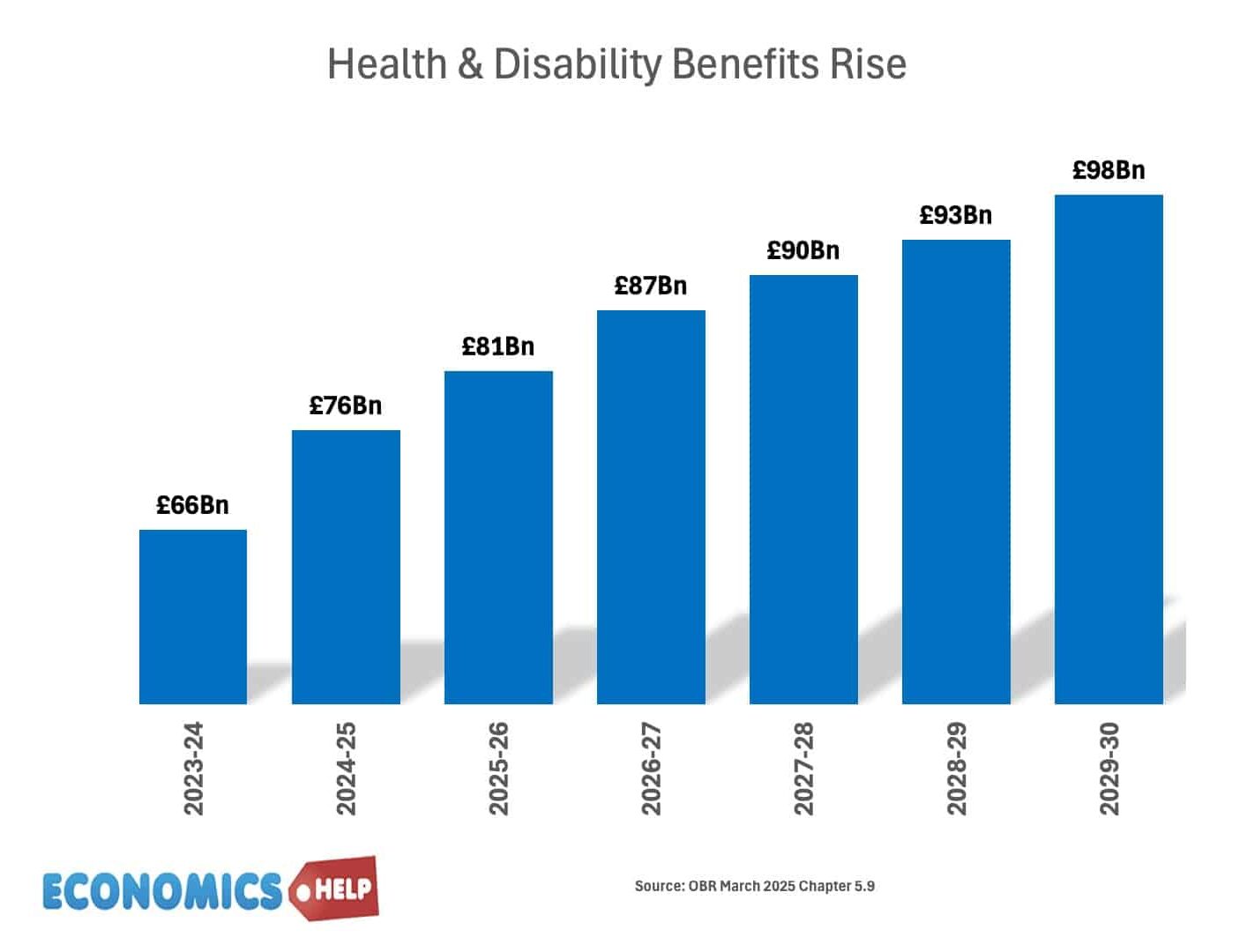

How is the Economy Doing in 2025? – Labour’s First Year

After a bankbench rebellion, the chancellor Rachel Reeves was visibly upset in parliament this week, perhaps she had just been given the latest UK economic forecasts. When the OBR published this forecast for UK debt, one commentator said it was misleading and alarmist, because it assumes policy never changes. But, the evidence from recent years …

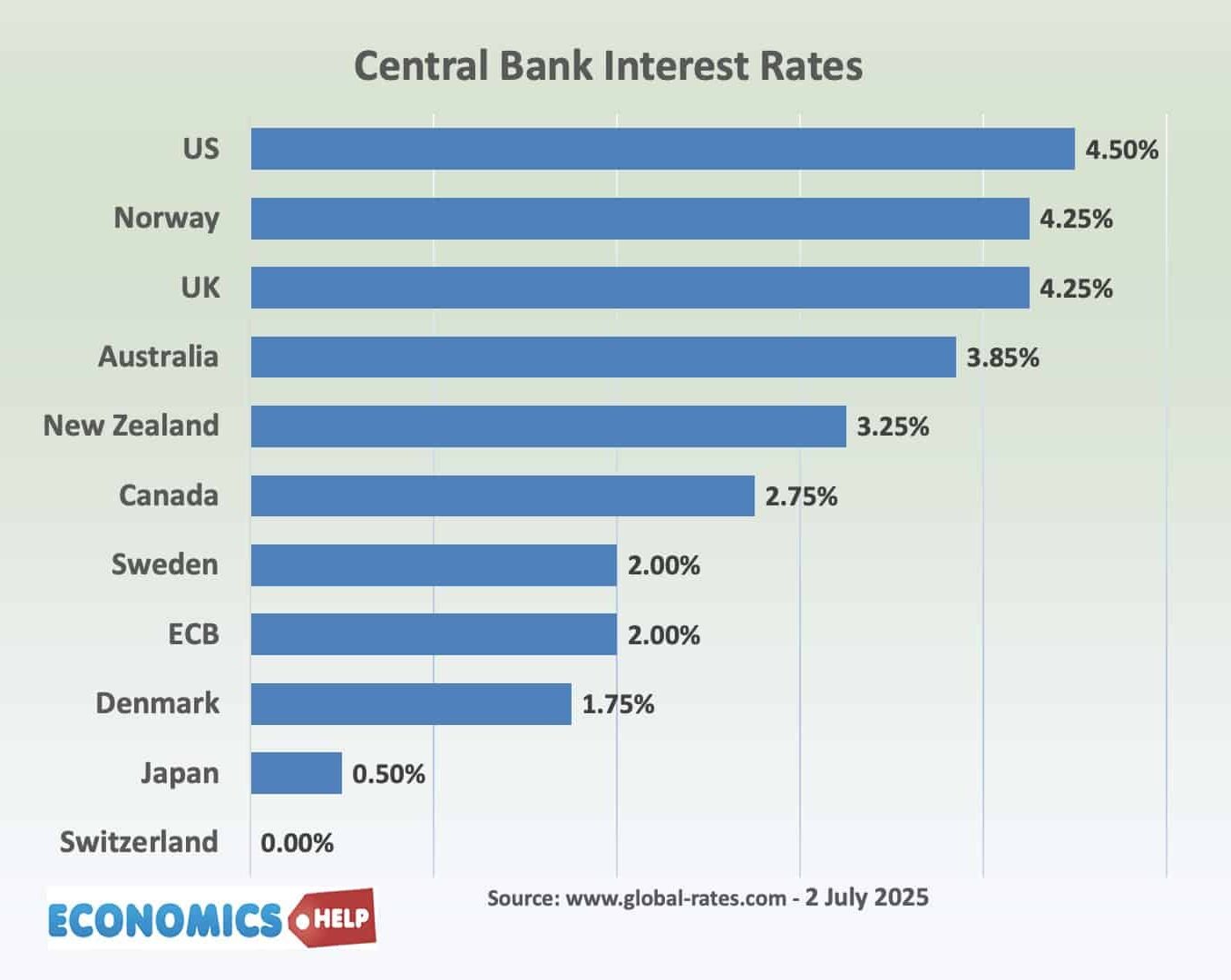

Interest Rate Forecasts 2025

Recently, Donald Trump told the chair of the Federal Reserve that the US should be cutting interest rates like other countries. And it is true the UK and US have been slow to cut interest rates. They are now double the level in Europe and Canada. Although Rachel Reeves is unlikely to be sending notes …

The Madness of Spending Money to Deal with Cuts

The Madness of Spending Money to Deal with CutsWatch this video on YouTube In the past two years, I’ve spent £450 fixing broken suspension on my car. I’m not the only one, Kwik Fit estimated the costs to motorists from pothole damage to be £1.7bn. Yet fixing roads has suffered from government cut backs, especially …

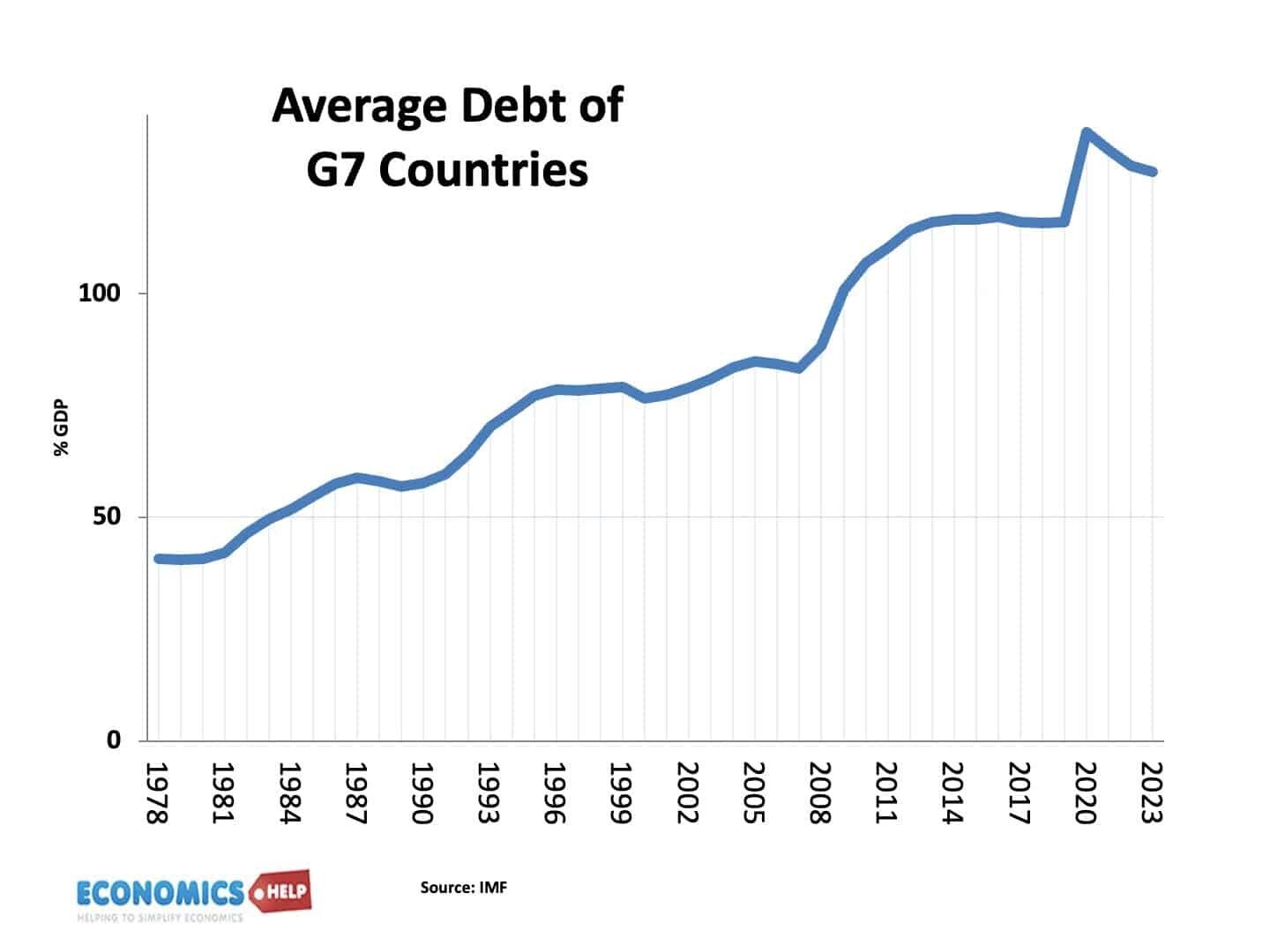

Government Debt Explained – Who Benefits from Debt?

This is UK National debt since 1780. It tells part of the national story. Napoleon’s defeat at Waterloo didn’t just change European history, it saved Britain from bankruptcy. The two world wars once again saw debt surge as the debt provided an emergency lifeline. How Does Government Debt Work?Watch this video on YouTube However, despite …

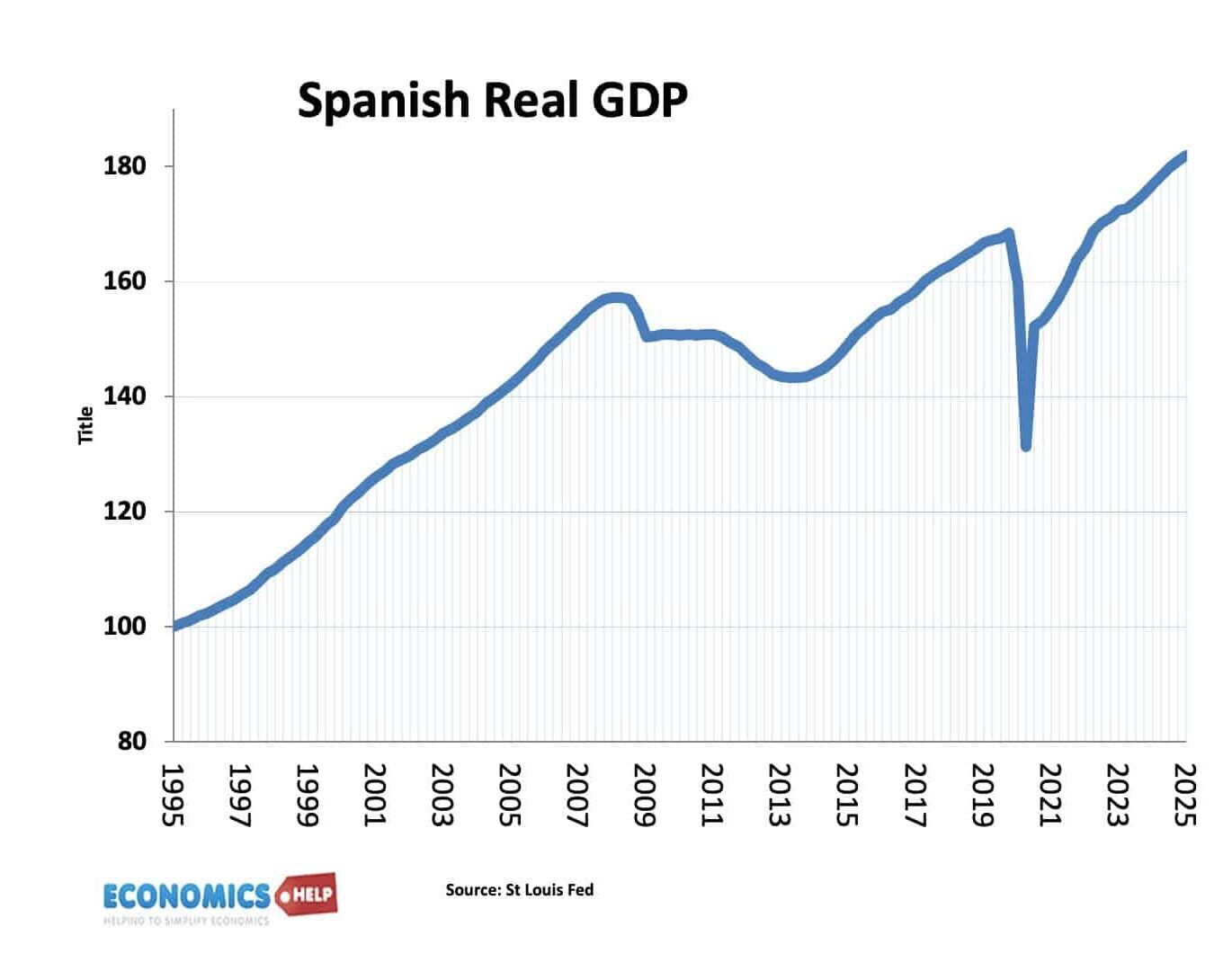

How the Spanish Economy became the Envy of Europe

Since 2020, Spain has been one of Europe’s best-performing economies. Despite Covid, it has grown by 8%, outperforming the likes of the UK, Germany and France. In 2024, Spanish growth was an impressive 3.1%, (and according to the boast of a Spanish minister), accounting for 50% of all the EU’s economic growth. How the Spanish …