UK House Prices are Rising: How Long Will it Last?

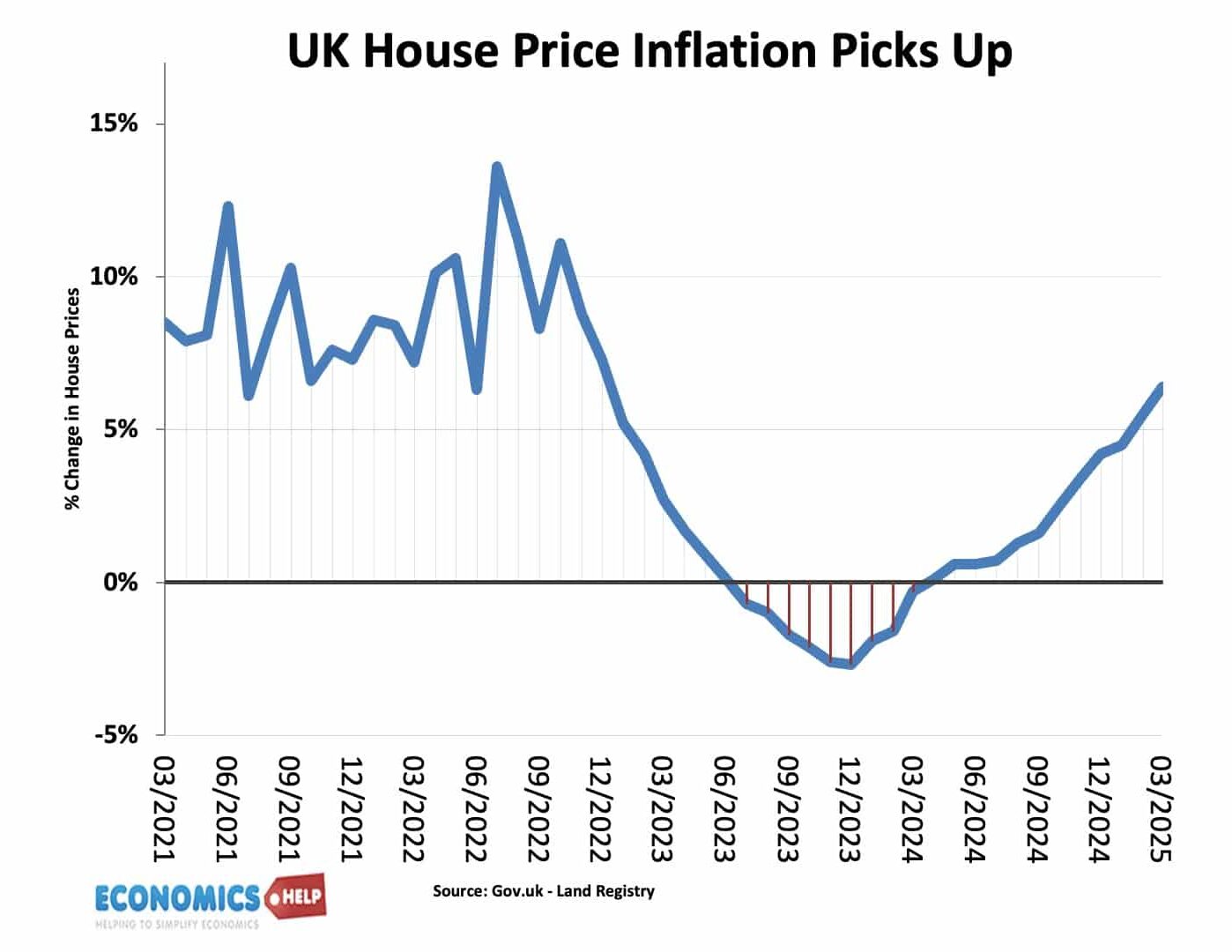

In the past 12 months, UK house prices have once again started to rise, with house price inflation reaching 6%. Even the end of stamp duty in April, did not prevent prices rising by £3,000 in May, according to the Nationwide. It means prices have regained their previous peak of 2022. However, the rise …