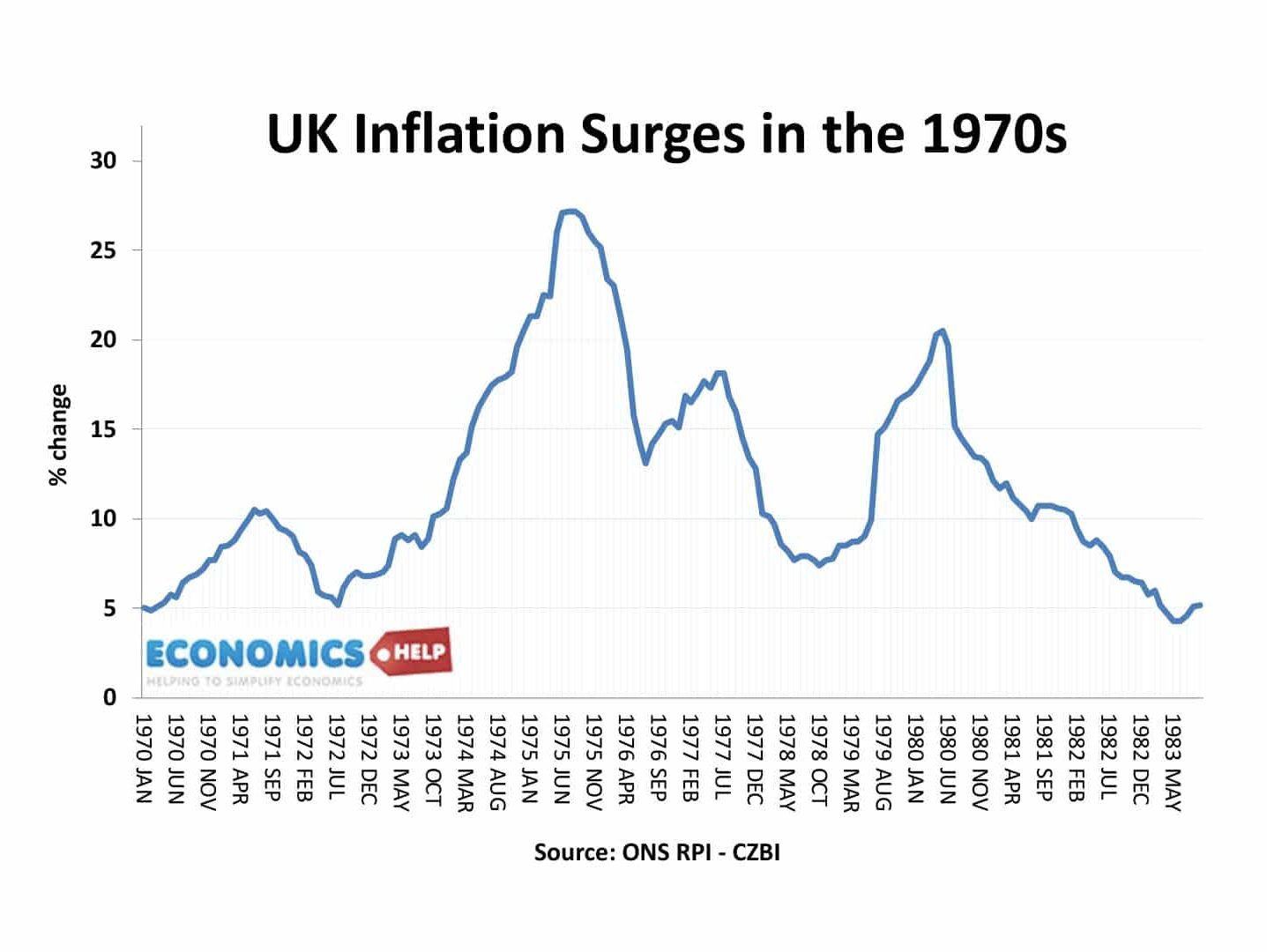

The Economic Crisis of the 1970s

1970s – The Decade That Nearly BROKE BritainWatch this video on YouTube Rubbish piled on the streets, record levels of strikes, an IMF bailout and runaway inflation. The 1970s has gone down in the popular imagination as a dark time, literally in the case of the 3-day week, when lights were turned off, but …