Why have countries in the Eurozone faced greater difficulties in promoting economic recovery?

How does a country with its own currency find greater flexibility in overcoming a recession?

1. Impact of Currency and Bond Yields

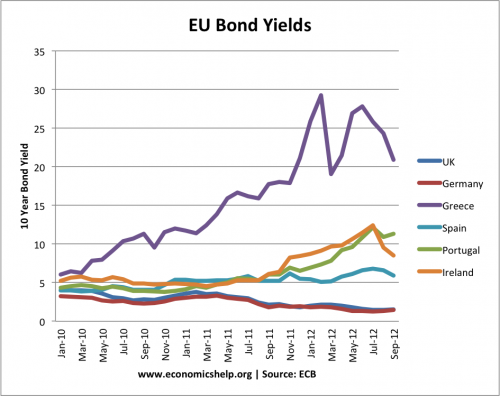

A striking feature of recent years is that countries in the Eurozone have been significantly more susceptible to rising bond yields. By comparison, the UK and US who have their own currency, have seen falling bond yields, despite high budget deficits.

Firstly, if you have your own currency, your Central Bank has the ability to print money and buy government bonds if necessary. Therefore bond markets know that a country like the UK is unlikely to have a liquidity crisis. I.e. if not enough people buy bonds on one occasion, the Central Bank can step in and buy the necessary bonds. This creates certainty and removes fears over a temporary liquidity crisis. (it doesn’t solve a solvency issue but, apart from Greece, most Eurozone economies are not insolvent)

However, countries in the Eurozone don’t have this luxury. There is no Central Bank willing to step in and buy bonds (at least not without very protected wrangles and uncertainty)