The French are not too happy. The rating agency Moody have stripped France of their triple AAA rating – downgrading French debt to AA. [link] It probably wouldn’t be so bad, but their English neighbours still retain a AAA rating, despite having a much higher budget deficit. As the English would say, that’s just not cricket. To rub salt into the wounds, the Economist recently ran a cover with several baguettes wrapped around with a lit fuse ready to explode – The French economy on slow road to Crisis at Economist.com.

Is the French economy really at risk? or is the Economist just indulging in the traditional game of baiting the French?

Positive Signs for the French Economy

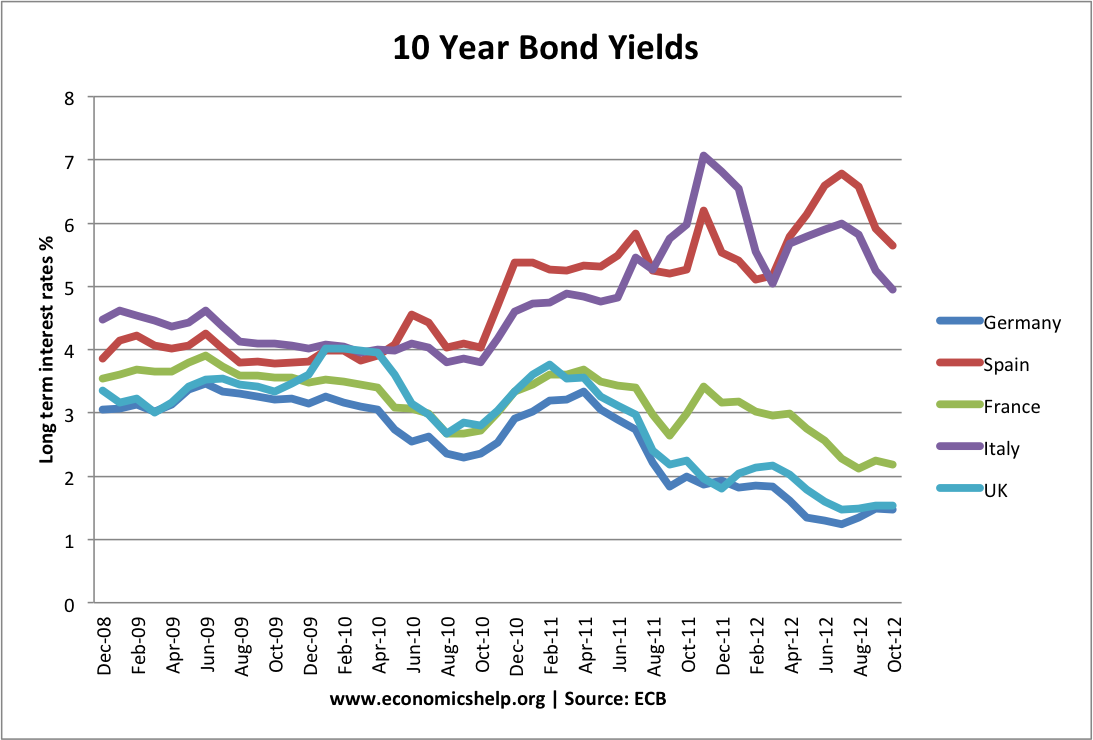

1. Bond yields.

So far, the French have been able to weather the Euro crisis. Markets have been reassured that the French economy is strong enough to deal with the twin problems of debt levels and sluggish growth. Furthermore, if you take the optimistic point of view, there are some signs that Eurozone bond yields have fallen from their previous peaks. The Spanish premier has recently claimed the worst of the Euro crisis is now over.

- However, as the crisis drags on, the debt to GDP ratio show little sign of immediate improvement, The Eurozone economy is getting dragged into a recession, and the French look more vulnerable at their exposure to other countries debt, and the growing possibility of years of economic stagnation. Optimism is a good thing, but in the context of the Eurzone, optimistic forecasts for recovery have shown a depressingly regular habit of proving to be wrong. You are hardly reassured when the Spanish Premier claims the worst of the crisis is over.

- For France, low bond yields are good and they have enabled them to borrow at low rates, but should the economy deteriorate, the markets could quickly turn.