A merger involves two firms combining to form one larger company; it can occur due to a takeover or mutual agreement.

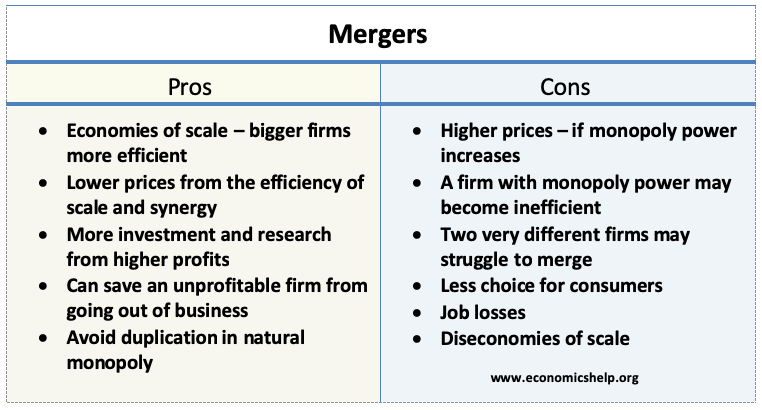

The pros and cons in summary:

Advantages of mergers

- Economies of scale – bigger firms more efficient

- More profit enables more research and development.

- Struggling firms can benefit from new management.

Disadvantages of mergers

- Increased market share can lead to monopoly power and higher prices for consumers

- A larger firm may experience diseconomies of scale – e.g. harder to communicate and coordinate.

When looking at mergers it is important to look at the subject on a case by case basis as each merger has different possible benefits and costs – depending on the industry and firms in question.

Pros of mergers

1. Network Economies. In some industries, firms need to provide a national network. This means there are very significant economies of scale. A national network may imply the most efficient number of firms in the industry is one. For example, when T-Mobile merged with Orange in the UK, they justified the merger on the grounds that:

“The ambition is to combine both the Orange and T-Mobile networks, cut out duplication, and create a single super-network. For customers, it will mean bigger network and better coverage, while reducing the number of stations and sites – which is good for cost reduction as well as being good for the environment.”

2. Research and development. In some industries, it is important to invest in research and development to discover new products/technology. A merger enables the firm to be more profitable and have greater funds for research and development. This is important in industries such as drug research, where a firm needs to be able to afford many failures.