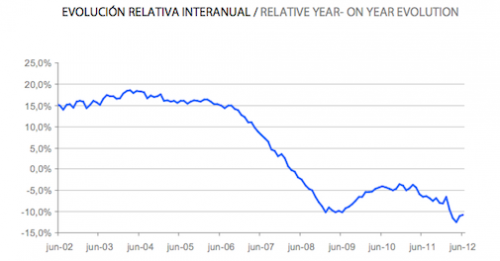

During the 1990s and early 2000s, Spain enjoyed rapid economic growth and became the 5th largest EU economy. In particular, the rapid economic growth encouraged a boom in property. In 2006, Spain started building 800,000 new homes – more than Germany, Italy, France and UK combined. (Euro Challenge.org)

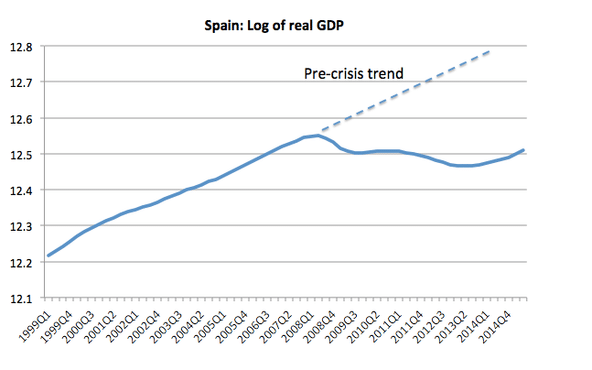

However, in 2008, Spain was badly affected by the global credit crisis. The Spanish property market collapsed leading to a deep recession, that persisted for several years.

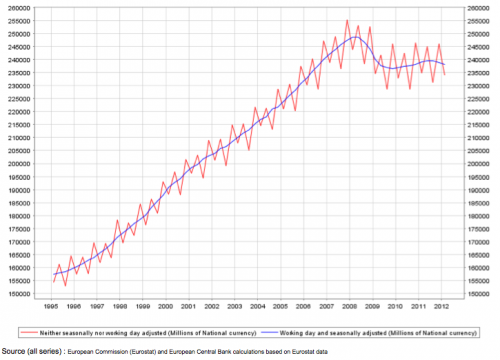

Spanish Nominal GDP

Since 2008, Spain has seen a sharp fall in GDP due to a combination of:

- Overvalued exports

- EU recession

- Austerity policies (government spending cuts)

- Collapse in Property Market and banking crisis

Spanish House Prices

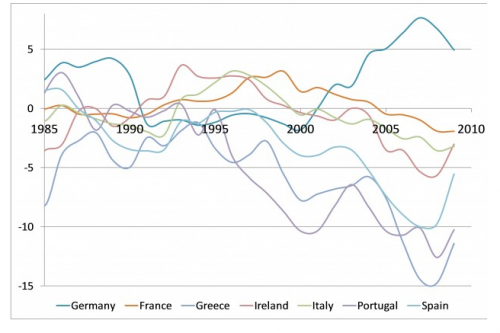

Current Account deficits in Eurozone

Spain was a founder member of the Euro. However, over the past few years, Spain has seen a relative decline in competitiveness compared to the Eurozone average. This has made Spanish exports more expensive. Being in the Eurozone means they can’t devalue, and therefore there is no quick fix to their uncompetitive exports.

After peaking at 10% of GDP, Spain’s current account deficit has fallen to 5% of GDP, but this partly reflects a sharp drop in consumer spending on imports. To restore competitiveness through internal devaluation will require a prolonged period of high unemployment.

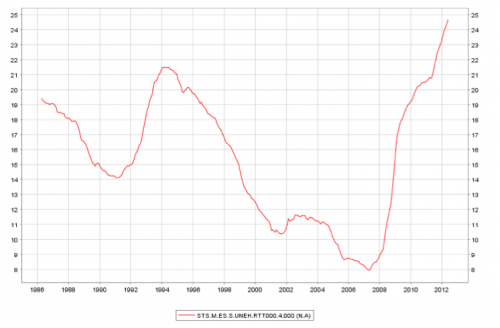

Unemployment in Spain

Even during the economic boom, unemployment remains stubbornly high in Spain, especially youth unemployment. Commentators have pointed to an inflexible labour market creating long-term structural unemployment.

Since the recession of 2008, unemployment has increased to record levels. In April 2012, 5.6 million were unemployed. (BBC)