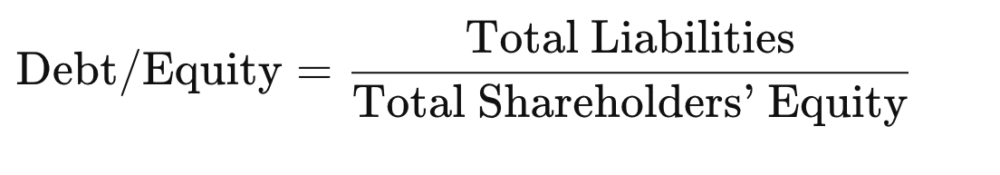

Debt/Equity Ratio = Total Shareholders’ Equity/Total Liabilities

What is a liability?

A liability is something the company owes

- Loans

- Mortgages

- Bonds

- Accounts you need to pay

Bond issues is a liability because ultimately bank has to pay

20. A company has an issued share capital of £1 million and an outstanding corporate bond issue of £200,000. To fund its expansion, the company issues additional corporate bonds for £300 000. All other things being equal, after the issue of the additional corporate bonds the ratio of the company’s total debt to its equity will be

A: 0.2:1

B: 0.3:1

C: 0.5:1

D: 2.0:1

- Initially share capital of £1 million. Bond issue of £200,000.

Therefore debt to equity is 200,000/1,000,000 = 0.2 - An additional bond issue of £300,000 means liabilities are now £500,000. But, share capital is same

Therefore debt to equity ratio is 500,000/1,000,000 = 0.5

Immobility of labour may lead to a misallocation of resources and market failure because

- A change in the pattern of demand results in structural unemployment.

A fall in demand for coal, leads to less demand for coal miners. Coal miners have occupational immobility, therefore, can’t get new jobs in IT. If there was no immobility, the workers who lost job, could easily get new job