A trade deficit implies the value of imports of goods is greater than exports. (M>X)

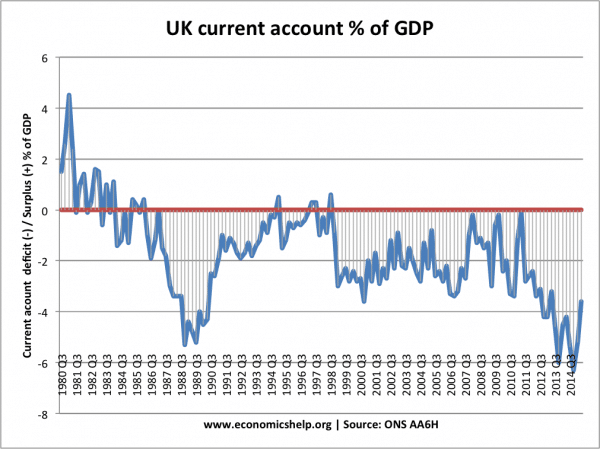

The trade deficit is an important component of the current account on the balance of payments. Sometimes people use a trade deficit and a current account interchangeably, but in the UK this is not correct. The current account also includes trade on services. (Invisibles)

A trade deficit is often seen as a bad thing. It suggests we are ‘living beyond our means’ However, many economists argue a trade deficit isn’t necessarily a bad thing.

Summary – should we worry about a trade deficit?

Yes

- A trade deficit suggests the economy is relatively uncompetitive and we cannot export as many goods as we import.

- A trade deficit suggests the economy is unbalanced – encouraging consumption at the expense of saving, investment and exports

- A trade deficit can lead to future devaluation in the exchange rate to restore balance.

- The global credit crunch of 2008/09 showed that capital flows, necessary to finance a current account deficit can suddenly dry up and this can cause a rapid depreciation in the exchange rate.

- A trade deficit is a much bigger problem for countries in the Euro, who can’t devalue to restore competitiveness. Their loss of competitiveness is leading to lower growth and higher unemployment.

No

- Trade deficit may be a consequence of rapid growth, which causes higher consumer spending on imports.

- Trade deficit financed by long term capital flows helps the economy with financing inward investment (e.g. we run a trade deficit with China, but China finances the deficit by investing in nuclear power stations in the UK.)

- If the trade deficit is too large, it will cause a depreciation in the exchange rate to restore competitiveness and improve the trade deficit.

- There are more pressing economic priorities than a trade deficit, such as economic growth, unemployment and inflation.

Trade deficit and surplus on financial account

A deficit on the trade deficit / current account means it has to be matched by a surplus on the financial and/or capital account. The financial account comprises of two main features:

- Short Term Capital flows e.g. hot money flows and purchase of securities

- Long Term Capital flows e.g. investment in building new factories

Therefore a trade deficit can lead to inward capital flows.

Related