A currency carry trade occurs when people borrow in one currency and invest in another country.

For example, suppose Japanese interest rates are 0% and US interest rates are 5%.

In this case, an investor can buy Yen and borrow from a Japanese bank at 0% interest. He can then exchange Yen for Dollars and put the money in a European bank, gaining 5% interest on his savings. Therefore, in theory, he can make a profit of 5% on the difference between Japanese and European interest rates.

Many investors took part in this because with leverage, the potential profit is quite high. (leverage is a way to magnify any

Problems with Yen carry trade

The only problem with the Yen Carry Trade is potential fluctuations in the exchange rates. If the US dollar depreciated then an investor would see his profit wiped out. In a period of exchange rate uncertainty, it becomes less attractive to engage in any currency carry trade.

What happens when Europe cut interest rates?

With the Euro economy going into recession, Euro interest rates are falling and could get closer to Japanese interest rates (Japan rates currently 0.3%)

As the gap between European interest rates and Japanese rates narrows, the incentive to borrow in Yen and invest in European banks declines. Therefore, as European interest rates fall, investors are reducing their holdings of Euros and are paying back their borrowings in Yen. This is one reason why the Euro has fallen. Lower interest rates are making people sell Euro investments.

Yen carry trade unwinding

To understand the impact of an unwinding Yen carry trade and its impact on the global economy, it is important to understand why the Yen carry trade occurs in the first place.

- For several years Japan has had 0% interest rates. Recently they were increased to 0.5% but, they are much lower than other economies. For example, ECB has had interest rates of 3.5-5%

- Japan has very high levels of savings – a pool of $15,000bn. This pool of savings is worth more than the total GDP of the US economy. Japan’s excessive saving contrasts with the excessive spending and borrowing of the US.

- Because interest rates in Japan are very low. Japanese investors have been investing overseas. Why save in a Japanese bank and get 0% interest when you could save in Australia and get 6% or Europe and get 4%? Japan has accumulated $6 trillion of foreign assets. As they buy foreign assets it increases the value of foreign currencies such as the dollar

- Also many foreign investors, especially American have borrowed in Yen to invest in global stock markets. This is known as the Yen Carry Trade.

- The Yen Carry trade is profitable if currencies are stable and / or the dollar is rising against the Yen. If you borrow in Yen and then the dollar falls, you could lose despite the interest rate difference.

Lower Interest rates in US, Europe and other countries – The end of the carry trade

Recently the global economy has been entering a recession. This means interest rates are falling and are predicted to fall in Europe, America and other countries affected by the slowdown. This means that the difference in interest rates between Japan and the rest of the world is narrowing. There is no longer the same incentive to borrow Yen and invest oversees.

Because US and European interest rates are low, Japanese Investors have started to sell their dollar and Euro investments and return their money to Japan. This means the Yen has been appreciating.

Because the Yen is rising, the Yen carry trade becomes unprofitable, investors could lose substantial money if the Yen rises against the dollar and Euro. Therefore, with the Yen rising, people are selling their foreign investments and ending their carry trade. This increases demand for Yen even more, causing a further rise in the Yen.

The effects of unwinding Yen carry trade

1. The Japanese have an incentive to sell their foreign investments. This means selling shares. Therefore, stock markets around the world could fall as the Japanese unwind their $6,000bn foreign holdings. (Japan is by far the world’s largest creditor nation.

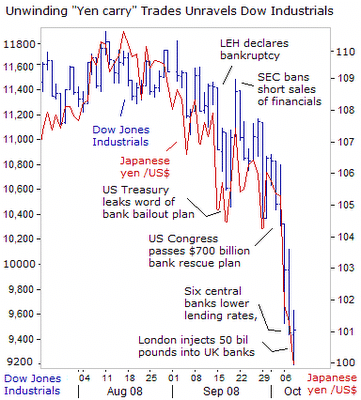

Graph showing appreciating Yen and falling Dow Jones Index

2. As the Yen rises, people will rush for the exits selling their foreign currency to repay their Yen loans. The rise in the Yen causes a speculative bubble causing a large rise in the Yen and fall in other countries.

3. Harms Japanese exports. A higher value of the Yen makes Japanese exports more expensive reducing demand and causing lower economic growth and possibly deflation.

4. To deal with the rising Yen and slowing economy, Japan reluctantly cut its base rate from 0.5% to 0.3%. However, there is only very limited scope for future interest rate cuts.

5. Depreciation in other major currencies.

Related pages