Fiscal Policy is the use of Government spending and taxation levels to influence the level of economic activity. In theory, fiscal policy can be used to prevent inflation and avoid recession. Fiscal Policy explained

But, in practice, there are many limitations of using fiscal policy.

Evaluation / Criticism of Fiscal Policy

- Disincentives of Tax Cuts. Increasing taxes to reduce AD may cause disincentives to work, if this occurs, there will be a fall in productivity and AS could fall.

- However higher taxes do not necessarily reduce incentives to work if the income effect dominates the substitution effect.

- Side effects on public spending. Reduced government spending (G) to decrease inflationary pressure could adversely affect public services such as public transport and education causing market failure and social inefficiency.

- Poor information. Fiscal policy will suffer if the government has poor information. E.g. If the government believes there is going to be a recession, they will increase AD, however, if this forecast was wrong and the economy grew too fast, the government action would cause inflation.

- Time lags. If the government plans to increase spending – this can take a long time to filter into the economy, and it may be too late. Spending plans are only set once a year. There is also a delay in implementing any changes to spending patterns.

- Budget Deficit. Expansionary fiscal policy (cutting taxes and increasing G) will cause an increase in the budget deficit which has many adverse effects. A higher budget deficit will require higher taxes in the future and may cause crowding out.

- Other components of AD. If the government uses fiscal policy, its effectiveness will also depend upon the other components of AD, for example, if consumer confidence is very low, reducing taxes may not lead to an increase in consumer spending.

- Depends on the Multiplier effect. Any change in injections may be increased by the multiplier effect, therefore the size of the multiplier will be significant. If consumers save any extra income, the multiplier effect will be low and fiscal policy less effective.

- Crowding Out. Expansionary fiscal policy of increased government spending (G) to increase AD may cause “Crowding out” Crowding out occurs when increased government spending results in a decrease in the size of the private sector.

– For example, if the government increase spending it will have to increase taxes or sell bonds and borrow money, both methods reduce private consumption and investment. If this occurs, AD will not increase or increase only very slowly.

– Also classical economists argue that the government is more inefficient in spending money than the private sector, therefore, there will be a decline in economic welfare

– Increased government borrowing can also put upward pressure on interest rates. To borrow more money the interest rate on bonds may have to rise, causing slower growth in the rest of the economy.

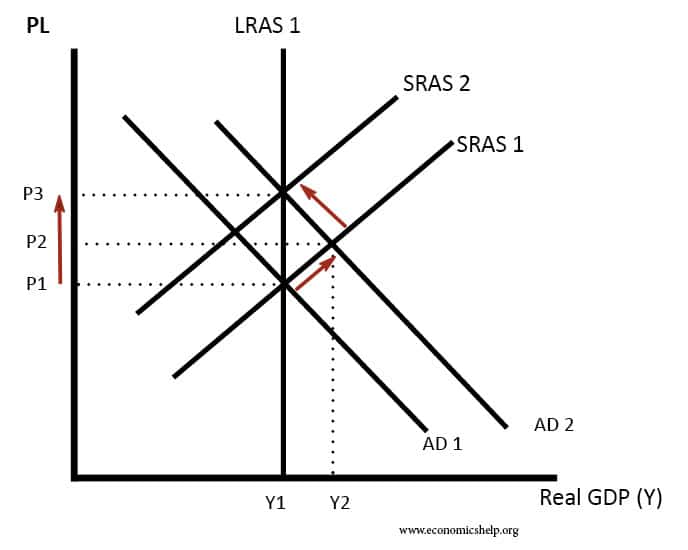

- Monetarist critique. Monetarists argue that in the LRAS is inelastic therefore an increase in AD will only cause inflation to increase.

Impact of expansionary fiscal policy under Monetarist model

Monetarists are generally sceptical of fiscal policy as a tool to boost economic growth. They argue that the economy

10. Real business cycle critique

The real business cycle argues that macroeconomic fluctuations are due to changes in technological progress and supply-side shocks. Therefore, using demand-side policy to influence economic growth fails to address the issue and just makes the situation worse.