The money supply measures the total amount of money in the economy at a particular time. It includes actual notes and coins and also any deposits which can be quickly converted into cash. There are different measures of the money supply depending on how you count it. Narrow definitions include all the money supply which is highly liquid (cash). Broader definitions include all the money supply which can be easily converted into money, such as bank deposits, saving bonds, mutual funds and even short-term government gilts.

Importance of the money supply

The money supply is important for determining the rate of inflation and economic growth. Rapid growth in the money supply can cause inflation, but a rapid fall in the money supply can lead to a recession.

Definition of the money supply

Narrow Money (Monetary Base)

- Narrow money (often called the monetary base) is the amount of notes and coins in circulation and the deposits of commercial banks at the Central Bank. One measure of narrow money is M0.

- The monetary base is quite a narrow definition of the money supply as it includes savings in bank accounts.

- The monetary base is also known as ‘high powered money’ because it can be magnified by the fractional reserve banking system.

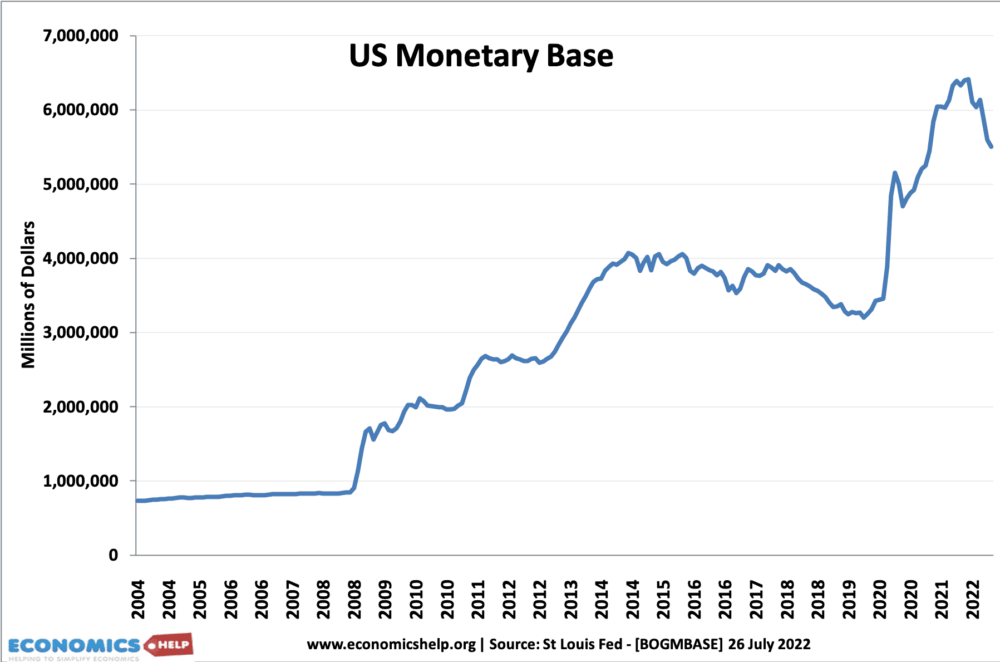

This shows the US narrow money supply. It also shows the effect of quantitative easing in 2008, 2013 and 2020. This involved the US Federal Reserve increasing the amount of monetary base by electronically increasing its own reserves.

- In June 2022, the US monetary base (M0) was $5.5 trillion. (St Louis Fed)

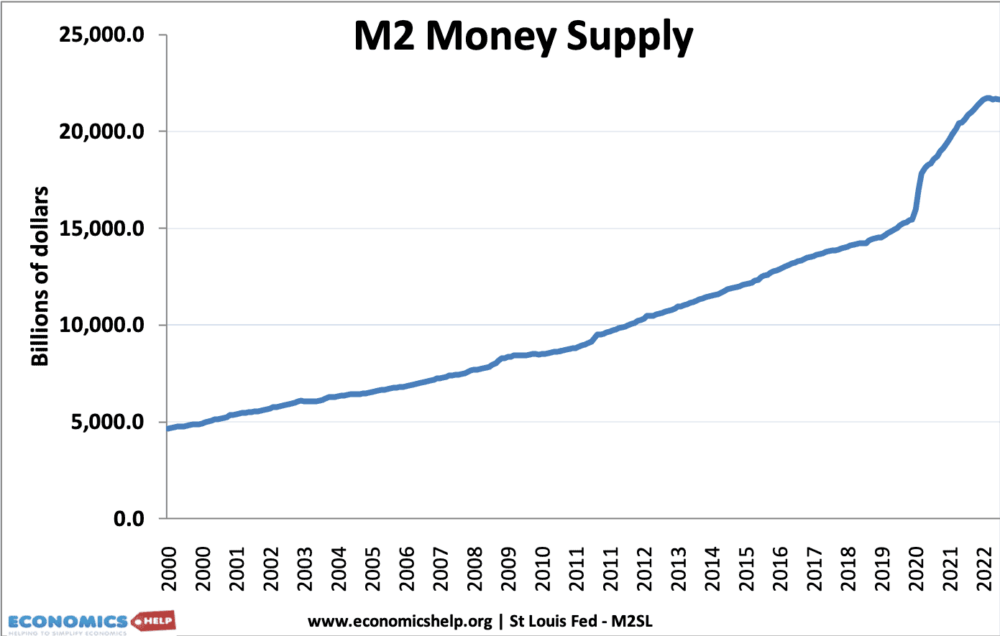

- (M2 was $21 trillion.)

Broad Money

M2 includes

M2 at St Louis Fed

- Cash and operational deposits at the Central Bank

- Savings deposits in banks

- Small time deposits

- Balances in retail money market funds

M4

M4 is a wider definition of the money supply. This broader definition includes

- Notes and coins in circulation

- Private sector deposits in banks and building societies.

- Checkable deposits, such as travellers checks.

- Mutual funds and money market securities – despoits which can be converted to cash within a fairly short time.

- Short-term government gilts, which are deemed to be ‘near money’

- Broad money is much larger because it includes all bank accounts and all the money held in electronic form (rather than just cash)

Functions of money

Money must have at least two of these functions

- Medium of exchange

- Store of value

- Deferred payment

- Unit of account

Due to changes in the financial system the money supply has been difficult to measure accurately, this makes it difficult to implement Monetarism, which states there is a relationship between the money supply and inflation.

Money supply and inflation

Monetarists believe there is a strong link between the money supply and inflation. If the money supply increases faster than real output, then prices will increase causing inflation. This is known as the quantity theory of money (MV=PT)

However, other economists believe this link between the money supply and inflation is more complicated.

See: Link between Money Supply and inflation

How to increase the money supply

- Print more money

- Quantitative easing – the electronic creation of money by Central Banks.

- Increased bank lending – banks lending higher % of their deposits.

- Central Bank purchases bonds from private individuals which can be spent.

Further reading