An essay on the economic effects of a falling dollar.

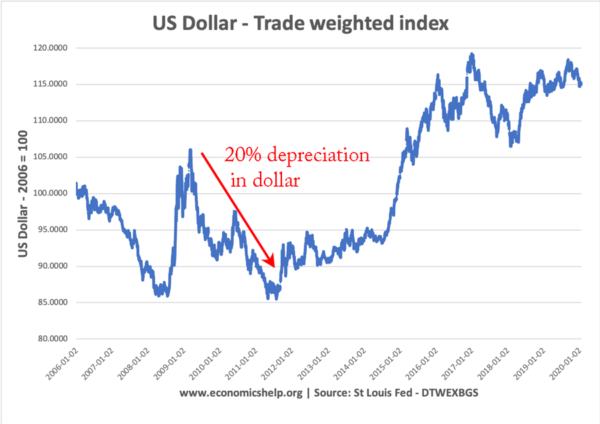

Between 2006 and early 2008, there was a 15% fall in the trade-weighted value of the dollar.

Then from 2008 to 2011, there was another fall of around 15%.

In summary, a fall in the value of the dollar will have these effects.

- Makes US exports cheaper to foreigners importing US Goods.

- It is cheaper for non-US citizens to go on holiday to the US.

- US consumers face higher price of imported goods.

1. A boost in the US manufacturing sector

A lower dollar increases the price competitiveness of US exports. Cheaper exports will lead to an increase in demand. If demand is price elastic then there will be an increase in the value of exports.

- However, a devaluation is often just a temporary increase in competitiveness. Devaluation may, in turn, cause inflationary pressures which reduce the temporary gain in competitiveness

2. Inflation

A fall in the value of the US dollar could contribute to inflationary pressures. This is for a number of reasons.

- Import prices will rise causing a degree of imported inflation

- The rise in aggregate demand from cheaper exports

- The fall in the value of the dollar may reduce the incentives for firms to cut costs because they get an ‘easy’ improvement in competitiveness. Therefore, a fall in the dollar may harm long-term competitiveness.

2. Fall in imports/switch to domestic goods.

As a result of the fall in the dollar, US consumers will face increased prices of European /imported goods, so the growth in demand for imports will slow. It may encourage US consumers to switch to domestically produced goods.

- However, to some extent, global companies can prevent price increases by reducing profit margins and cutting costs and becoming more efficient. In the short-term at least, the price of imports may not rise that much for US consumers. However, there is a limit to this; in the long-term, firms cannot keep absorbing the price increases.

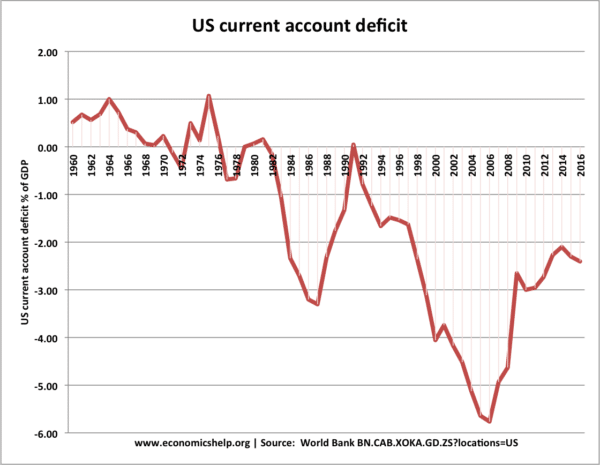

3. Improvement in US current account

Assuming the Marshall Lerner condition is satisfied i.e. PEDx +PEDm > 1 – then a devaluation will improve the current account and reduce the current account deficit.

4. A temporary improvement in US Economic growth and employment

With rising export demand this will help increase output and therefore there will be a reduction in unemployment. Also, with imports more expensive, this will increase the demand for domestically produced goods. Therefore, a fall in the value of the dollar can boost the rate of growth – especially if there is spare capacity in the economy.

- However, if the devaluation causes a rise in inflation, then it may lead to higher interest rates which hold back economic growth. Also, a devalution does not cause a sustained rise in productivity. The boost to growth is likely to prove short-term.

5. Lower growth and lower inflation in US trading partners

If the US dollar falls in value, the Euro and Yen will appreciate. This will have the effect of causing

Inflation will be lower in the EU; this is because

- Imported goods will be cheaper (Many raw commodities are priced in dollars)

- AD will be lower or increase at a slower rate.

3. Manufacturers have increased incentives to cut costs. Therefore a devaluation will help reduce EU inflation. This could cause a recession but evidence suggest EU growth is more resilient and the ECB have said a cut in interest rates is not necessary at the moment.

6. Pressure to devalue currencies linked to the dollar.

Some Latin American and Asian countries such as Thailand have a semi-fixed exchange rate against the dollar. Thus if there is a fall in the dollar, they will also see a fall in the value of their currency – helping their exports, though it could contribute to inflation.

7. Impact on China

China’s economy is reliant on exports and the competitiveness of it goods. A fall in the value of the dollar against the Yuan, will make Chinese exports less competitive and it could lead to a fall in demand for Chinese exports. This could threaten the high rates of growth in China and the government may worry it could lead to unemployment. If the fall in the dollar does harm Chinese exports, the Chinese government may respond by purchasing US dollar assets and attempting to weaken the Chinese Yuan.

Evaluation

It also depends on why the dollar is falling.

- If the dollar is falling due to higher inflation – then the US may not be benefitting from improved competitiveness. In this case, the fall in the value of the dollar is a reflection of economic weakness.

- If the dollar is falling due to a cut in US interest rates – then this may be a double cause of rising aggregate demand. Lower interest rates boost consumer spending and lower exchange rates boost export demand.

- The impact of a devaluation depends upon the elasticity of demand for exports and imports. If demand is relatively inelastic then an increase in the price of imports may not reduce the value very much. If this is the case, the impact of a devaluing dollar will be limited.

- There are many other factors which influence economic growth. A devaluation can, in theory, boost AD in the US and reduce growth in other countries. But, if the US economy was hit by a fall in house prices or weak consumer spending, then a fall in the value of the dollar may be insufficient to prevent an economic slowdown. The US economy

- Sometimes a devaluation has a lagged effect. In the short-term, demand is inelastic for exports and imports and so there is little change in the quantity of trade. However, over time, as firm renegotiate future contracts they become more affected by the long-term fall in the dollar. Therefore, the fall in the dollar will have a bigger effect.

Related