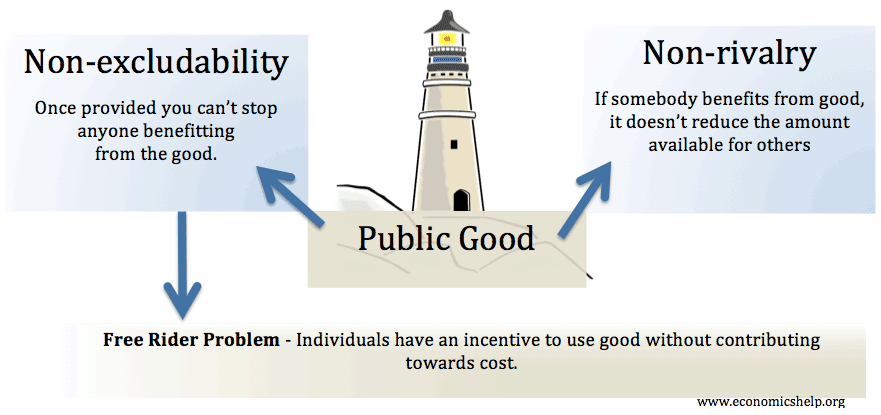

A public good has two characteristics:

- Non-rivalry: This means that when a good is consumed, it doesn’t reduce the amount available for others.

– E.g. benefiting from a street light doesn’t reduce the light available for others but eating an apple would. - Non-excludability: This occurs when it is not possible to provide a good without it being possible for others to enjoy. For example, if you erect a dam to stop flooding – you protect everyone in the area (whether they contributed to flooding defences or not.

A public good is often (though not always) under-provided in a free market because its characteristics of non-rivalry and non-excludability mean there is an incentive not to pay. In a free market, firms may not provide the good as they have difficulty charging people for their use.

Free rider problem

The problem with public goods is that they have a free-rider problem. This means that it is not possible to prevent anyone from enjoying a good, once it has been provided. Therefore there is no incentive for people to pay for the good because they can consume it without paying for it.

- However, this will lead to there being no good being provided.

- Therefore there will be social inefficiency.

- Therefore there will be a need for the govt to provide it directly out of general taxation.

Examples of Public Goods

- National defence. If you protect the country from invasion, it benefits everyone in the country.

- Street lighting. If you provide light at night, you can’t stop anyone consuming the good. Walking under a street light doesn’t reduce the amount of light for others.

- Police service. If you provide law and order, everyone in the community will benefit from improved security and reduced crime.

- Flood defences – Protecting the coastline against flooding provides benefits for the whole community.

- The internet. Once websites are provided, everyone can see the website for free, without reducing the amount available to others. (assuming an individual can access for free, which is not always the case)

Quasi-Public Goods

These are goods which have an element of non-excludability and non-rivalry. Roads are a good example. Once provided most people can use them, for example, those who have a driving licence. However, when you use a road, the amount others can benefit is reduced to some extent, because there will be increased congestion.

Market provision of public goods

Although classical economic theory suggests public goods will not be provided by a free market, there are cases when groups of individuals can come together to voluntarily provide public goods.

Behavioural economics suggests that individuals can have motivations other than just money. People may volunteer to contribute to local flood defences out of a sense of civic pride, peer pressure or genuine altruism. Therefore, in the real world, enough people may contribute to paying for a public good, even if – from a narrow self-interest point of view – it may be rational to avoid paying.

Examples of market provision of public goods include:

- Local communities providing private policing

- Local communities raising money to pay for a local school, new garden or new statue.

Difference between public spending and public goods

One possible area of confusion. We talk about public spending. This is spending done by the government. E.g. UK public spending

However, not all government (public) spending is on ‘public goods’, e.g. the government will also spend on other goods and services, .e.g. – merit goods, like education and healthcare.

Related

- Public goods – police and fire services

- Private, public and free goods

1 thought on “Definition of Public Good”

Comments are closed.