Injecting Money into the Mortgage Markets 2008

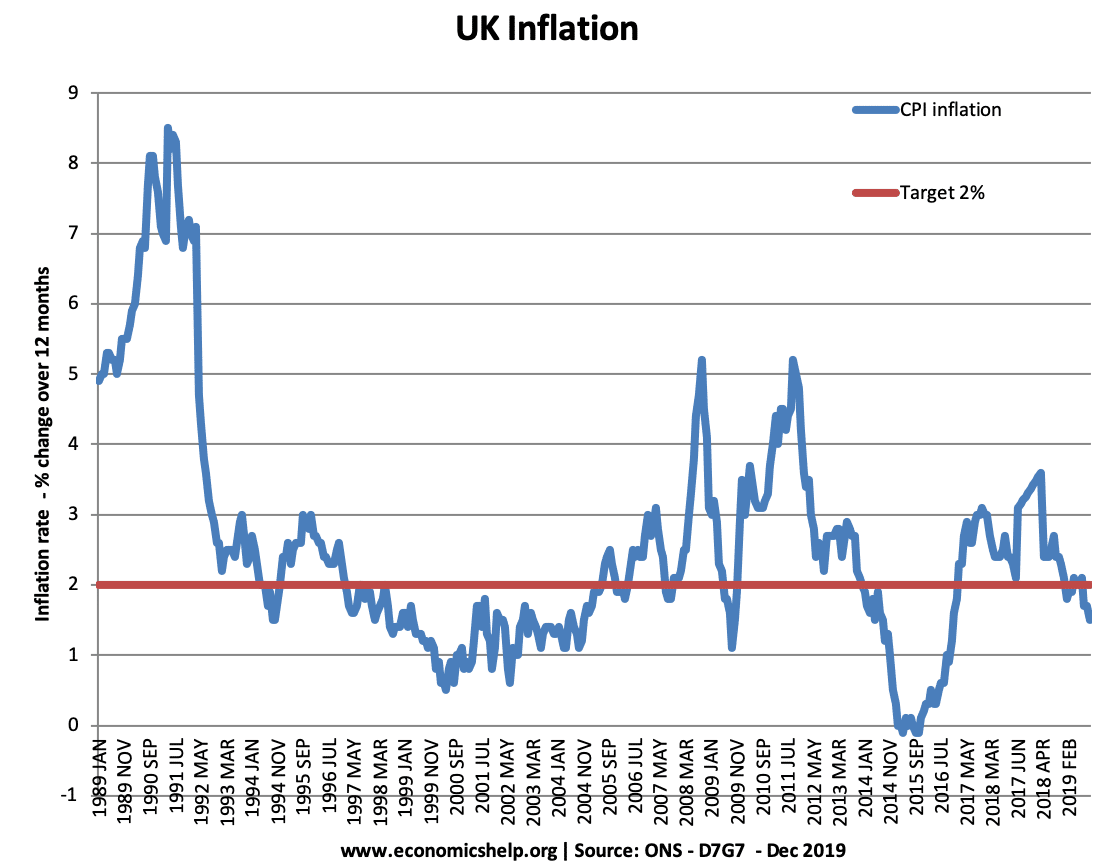

Readers Question: The Bank of England has released £15bn into the economy. That increase in the money supply will surely cause inflation? So interest rates having fallen will be raised, worsening the housing market and making the credit crunch even worse, not better….surely? The Bank of England is planning to inject money, primarily into the …