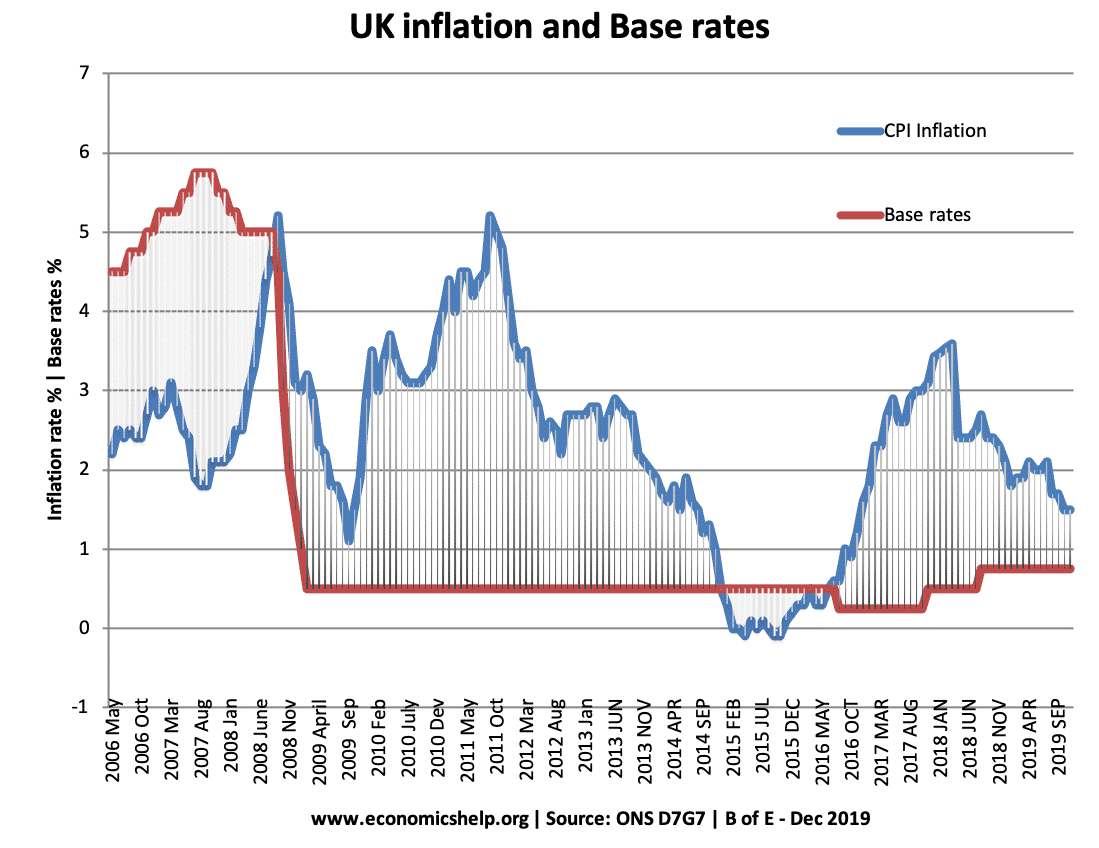

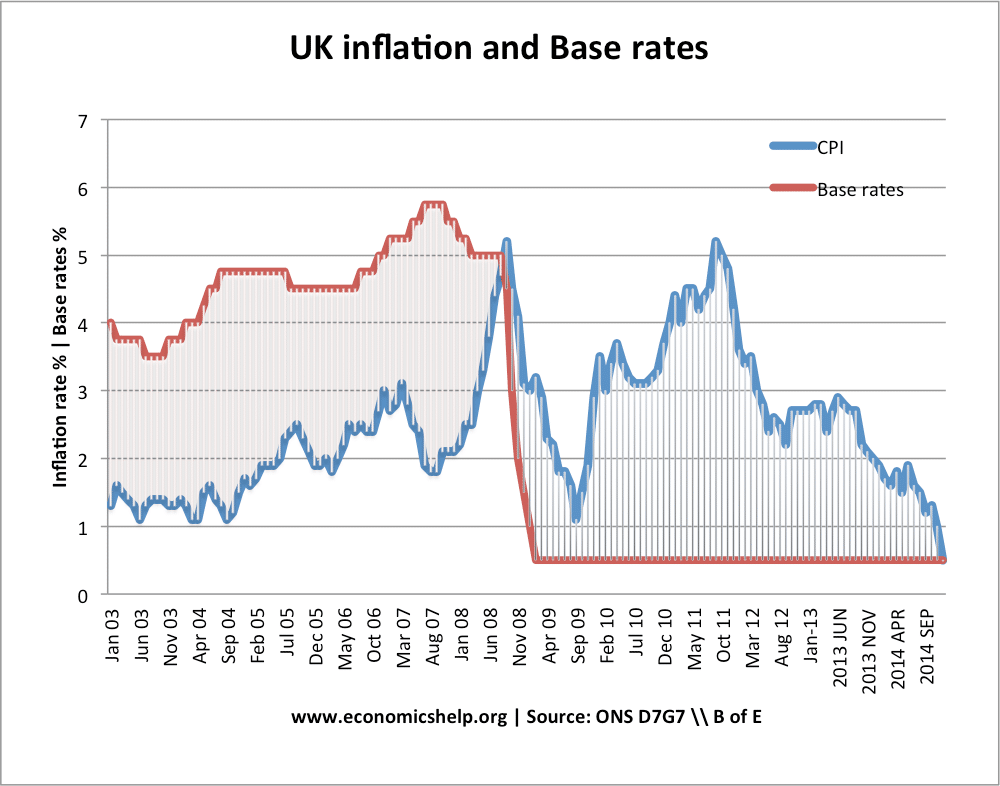

Tight Monetary Policy

Tight monetary policy implies the Central Bank (or authority in charge of Monetary Policy) is seeking to reduce the demand for money and limit the pace of economic expansion. Usually, this involves increasing interest rates. The aim of tight monetary policy is usually to reduce inflation. With higher interest rates there will be a slowdown …