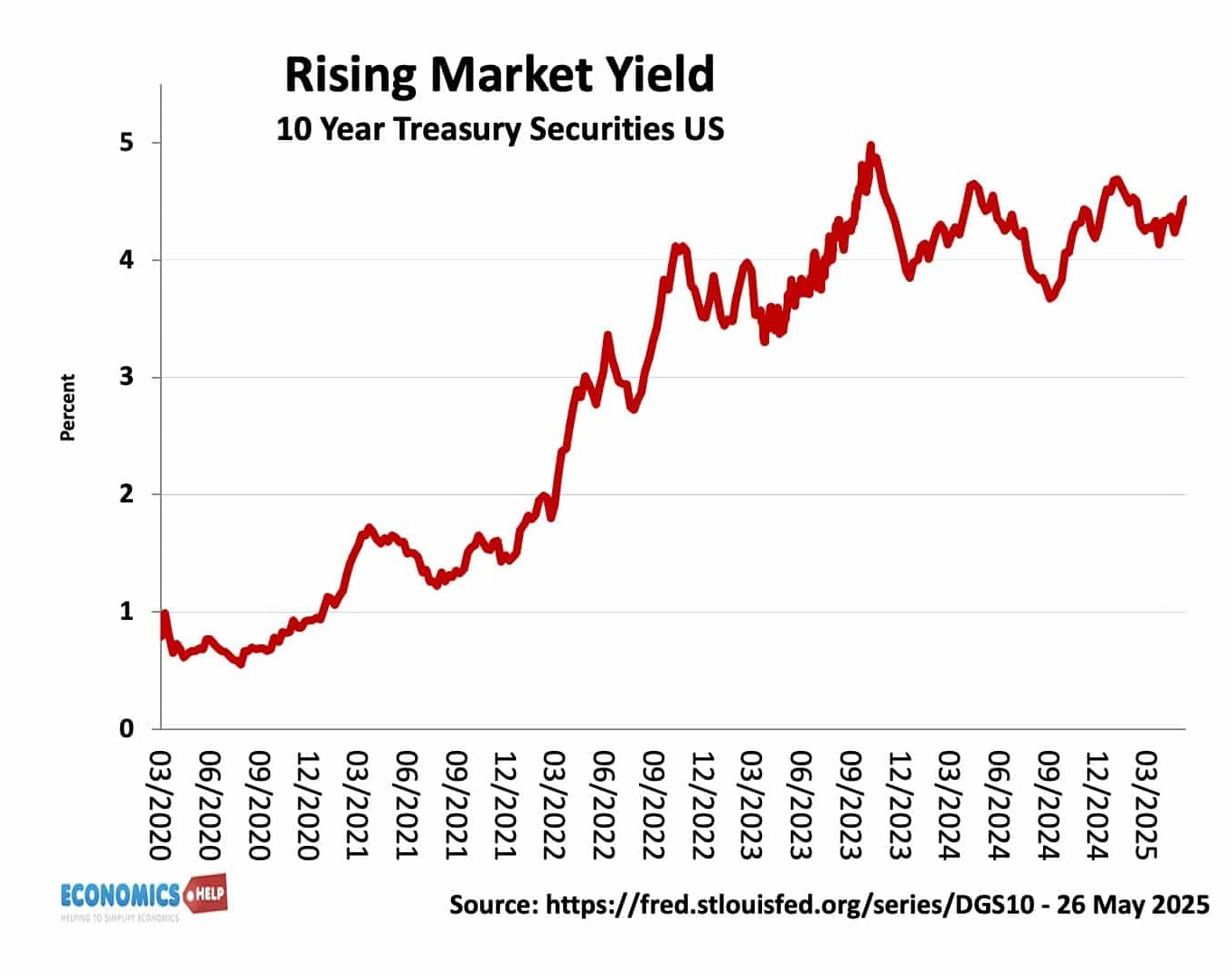

Why Fed Tapering caused a rise in bond yields

Readers Question Why did bond yields in the USA rise at news of the Fed Tapering back in August? The Federal Reserve has been engaged in a policy of quantitative easing. This involves: Creating money electronically Using this created money to buy assets, such as government bonds. The aim of quantitative easing is to stimulate economic …