Readers Question: Since the debt is mainly in the form of government bonds or gilts then it can only be paid back when the term of the bond terminates. What happens if there is not enough money to pay this back?

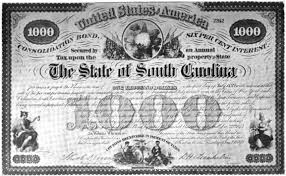

Government bonds are a method for the government to borrow money. They sell bonds (e.g. for £1,000) and promise to pay back the bond holder in say 30 years. In the meantime, they will pay an interest rate of e.g. 5% a year as compensation.

Default on debt. If the government has no money to pay bond holders, then it will be defaulting on its debt. Bond holders lose their investment.

The government will be reluctant to do this because once it has started to default on its debt – no-one will want to buy or hold government bonds – so you will see the price of government bonds fall, and the market interest rate rise. The government will have to pay much higher interest rates to compensate for the risk of default and it will be difficult to attract buyers of bonds in the future.

Haircut / partial default. If the government is in great financial difficulty it may offer a deal to bond holders that it will pay back a certain percentage, e.g. 50%. In response for writing off 50% of the bond, bondholders may feel it is better to get 50% than nothing. Alternatively, the government may extend the maturity of the bond, e.g. change a 30 year bond into a 45 year bond, to give itself more time to pay it back.