- International competitiveness measures the relative cost and value of a countries exports.

- For example, if UK goods and services become more expensive than its competitors, then the UK would see a decline in its international competitiveness.

International competitiveness is determined by

- Short-run factors – inflation and exchange rate

- Long-run factors – Education, health-care, institutions, levels of corruption and macroeconomic environment that determine the productivity and quality of goods that firms produce.

Factors affecting international competitiveness

1. Relative inflation rates

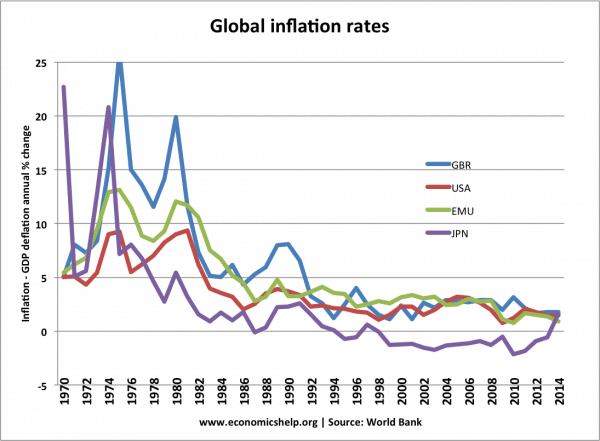

This graph shows that Japan has consistently had a lower inflation rate than its main international competitors, such as US and Eurozone. Ceteris paribus, this small increase in prices will improve the competitiveness of Japanese exports.

In the late 1970s, the UK (GBR) had the highest rates of inflation. This was a factor in the declining competitiveness of British exports and the decline in manufacturing industry.

- Evaluation – low inflation may be offset by an appreciation in the currency. Although Japan has had the lowest inflation rate in this period, it also saw an appreciation in the value of the Yen. Therefore, the gains from lower inflation were offset by the stronger currency.

2. Exchange rates

Movements in the exchange rate will affect competitiveness. If a country experiences an appreciation then its exports will be more expensive to foreigners. Devaluation will give a temporary boost to competitiveness.

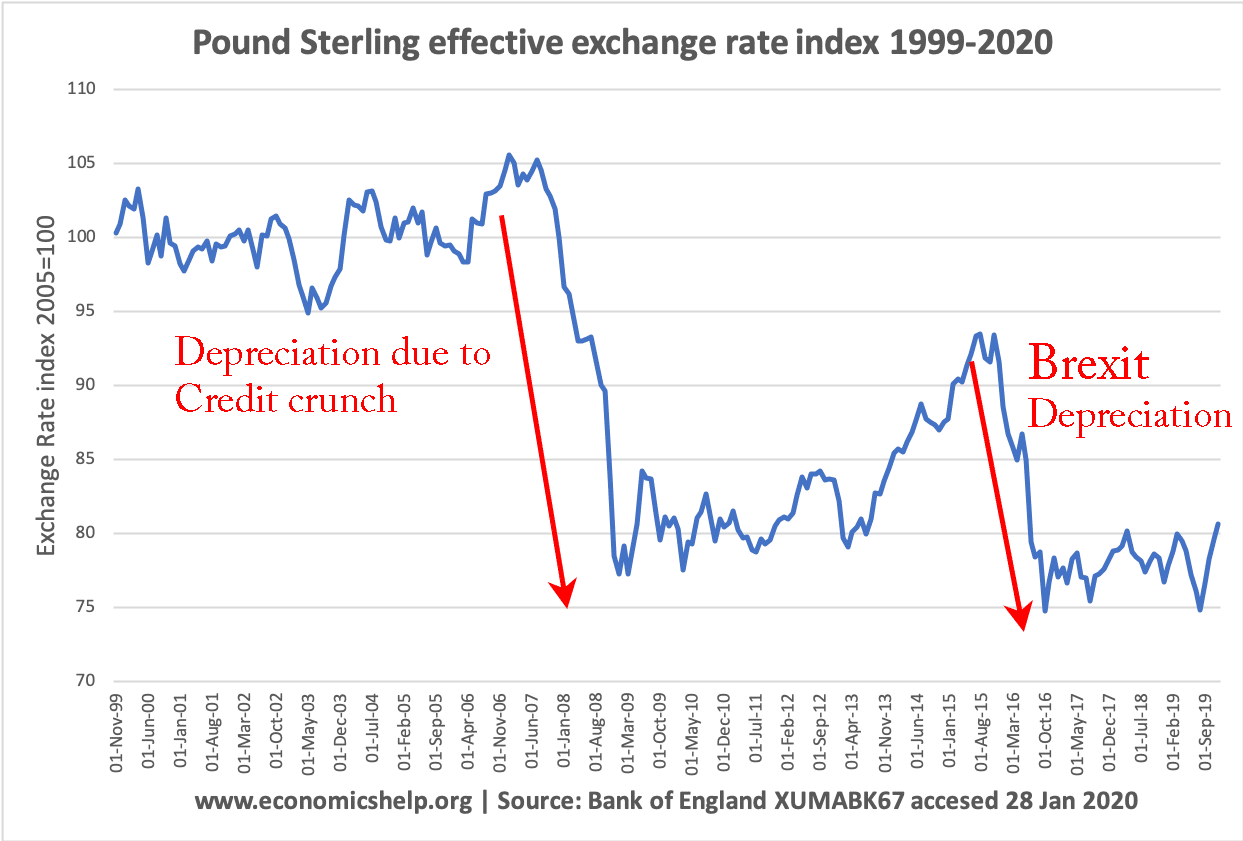

This shows that between 2008 and 2009, there was a sharp fall in the value of the Pound. This near 30% devaluation gave a short-term boost to UK competitiveness.

However, although a depreciation may improve the competitiveness of exports, it will also increase the cost of importing raw materials, so firms who rely on imports will also see higher costs. Also, a country may experience a depreciation because it is uncompetitive and its goods are in less demand. The UK saw little benefit from the 2008/09 depreciation because demand was weak.

3. Real exchange rate

The real exchange rate measures the value of a currency – taking into account relative changes in prices.

An increase in the real exchange rate – means that – even including the effects of inflation, the exchange rate is stronger and therefore, the country will see a decline in competitiveness.

For example, suppose there were political fears about the strength of the Euro, investors may buy Swiss Francs (because it is seen as a safe haven currency) this causes the Swiss Franc to appreciate because of speculation. This would increase the real exchange rate and make Swiss exports less competitive.

5. Labour productivity

Labour productivity will, in turn, depend upon

- Skills and education of the workforce. How trained and how flexible are the labour force? For example, a study suggest the UK economy will suffer from lack of skills in dealing with the rapid automation of the economy. (Britains falls in productivity table)

- Infrastructure in the economy, e.g. good transport helps make it cheaper to transport good.

- Industrial relations. Time lost to strikes. Also, whether workers are sufficiently motivated and feel a loyalty to their company.

Long-run factors determining competitiveness

Education

Education determines worker skills and labour productivity

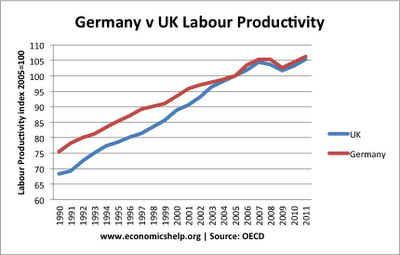

Labour productivity is output per worker and an indication of underlying competitiveness. This shows that between 1990 and 2005, UK productivity grew faster than Germany – helping the UK to become more competitive.

Institutional factors – Do countries have sound monetary policy and efficient tax collection networks?

Level of crime and corruption. A lack of law and order will make business more difficult and costly.

Financial system – Levels of access to finance. Can firms borrow from the banking sector to boost investment when they need to. Lack of access to finance will hold back investment in new productive capacity.

Tariffs and non-tariff barriers.

Regulations – Are there too many burdensome regulations on expanding business and employing workers.

Benefits of improving international competitiveness

- Exports relatively cheaper leading to higher demand for exports. Export-led growth has been a significant factor in Chinese economic growth.

- Higher exports will help increase aggregate demand and economic growth

- Improved competitiveness will help improve a country’s current account deficit.

- Create jobs in the export sector

- Help to reduce inflation in the economy.

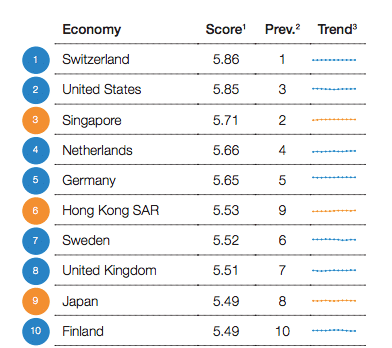

Index of Global Competitiveness

Top 10 countries

Source: World Economic Forum 2017/18

Related