Readers Question: If British industry was to become uncompetitive it would have the following adverse effects on the economy: one of them is a higher level of inflation. How to explain that?

If British industry becomes uncompetitive it means that basically, the UK’s cost of production is rising faster than our international competitors. For example, we may become uncompetitive because wage costs are rising and this is leading to higher inflation.

So in a way, the two are linked, we are becoming uncompetitive because of rising costs of production. Also if we become uncompetitive, there will be less demand for British goods and hence Sterling, and so this would cause a devaluation in the value of the Pound. Devaluation tends to cause inflation because:

- Rising cost of import prices (imported inflation)

- Rising aggregate demand (demand pull inflation)

- Less incentives to cut costs

How inflation affect competitiveness?

If UK goods are increasing by 3% a year and French goods are increasing by 2% a year, then ceteris paribus, the UK is going to see a decline in international competitiveness. Consumers are more likely to switch to French goods because they will become relatively cheaper.

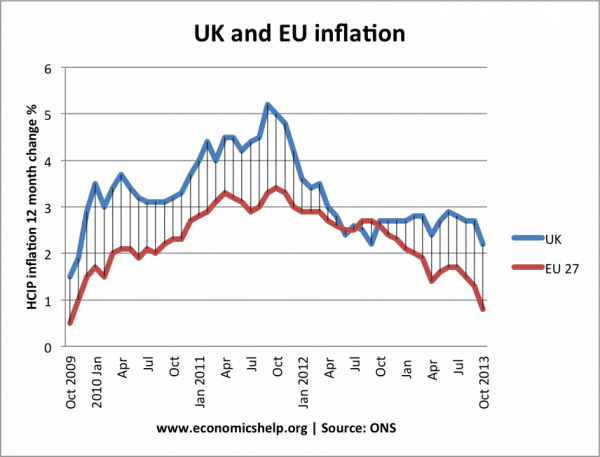

In this period, UK inflation was higher than EU inflation – causing a decline in UK competitiveness

Long-term exchange rate

In the long-term, higher UK inflation will lead to depreciation in the exchange rate, which to some extent will restore competitiveness. But, the depreciation will make imports (including the import of raw materials) more expensive and reduce living standards.

Fixed Exchange Rates and the importance of inflation

- For countries with permanently fixed exchange rates, such as countries in the Euro, the inflation rate is very important for determining competitiveness.

- For example, If inflation in Italy is higher than other Euro countries, they can’t devalue, so their exports will become less competitive.

- If the UK became uncompetitive, then the Pound would devalue to restore competitiveness.

That really make sence ! I cannot thank you more ! ^^

Thank you very much, this makes sence!