Readers Question: Tax changes in recent years have brought a significant increase in tax burden in the UK expressed as a percentage of GDP. Can you please assess the possible impact of such an increase?

An increase in the burden of tax from say 35% of GDP to 38% of GDP could have the following impacts.

- Some tax increases may reduce incentives to work. E.g higher income tax may reduce incentive to work overtime. However, most of the tax increases have been indirect taxes such as tax on cigarettes and aeroplanes. Income tax rates have actually fallen. Therefore, the tax increases may affect demand for the goods with higher tax.

- The higher tax burden has enabled higher levels of Government spending. In particular, the government have spent more on health care, welfare state and education. You could argue that the increased spending on education has helped to increase labour productivity and should help the long term economic performance of the UK. However, it is debatable how effective the increased spending has been. For example, higher spending on health care has often gone to pay for administration. Some spending increases are due to an ageing population – more pensions and health care. This is definitely not increasing productivity in the economy.

- Affect on aggregate demand (AD) is generally neutral. Higher taxes may reduce consumer spending. However, because higher taxes have led to higher government spending, the overall impact on aggregate demand has been neutral. The UK’s rate of economic growth in the past 10 years has been generally good.

- Crowding out. You could argue an increase in the tax burden has contributed to crowding out. This relates to the fact the government sector has become bigger at the expense of the private sector. Generally, it is argued that government spending tends to be more inefficient than private sector spending so this will reduce the productivity of the economy.

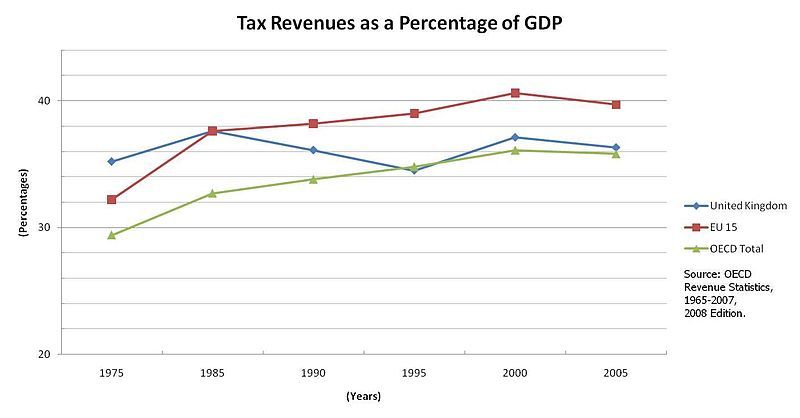

- Competitive tax rates. An important factor is a countries tax burden compared to other countries. If the UK tax burden rises whilst competitors fall, this may encourage flexible workers and companies to move abroad to get lower tax rates. However, if tax rates in the UK increase at a similar rate, then there will be little disincentive effect.

- Effect on equality? The effect on equality depends on the type of tax that is increased. If we increase progressive taxes like income tax, then equality could improve. But, if it is regressive taxes like excise duties, the post-tax distribution could worsen.

Related