Readers Question: what are the possible consequences/effects of protectionism with regard to the UK and the rest of the world?

Protectionism occurs when countries place restrictions on imports into the economy. This can involve higher tariffs (a type of tax on imports) or quotas and embargoes. Other forms of protectionism can be less obvious, such as domestic subsidies to give industries unfair advantages. The main effect of protectionism is a decline in trade, higher prices for some goods, and a form of subsidy for protected industries. Some jobs in these industries may be saved, but jobs in other industries are likely to be lost.

Different types of protectionism

- Tariffs – This is a tax on imports.

- Quotas – This is a physical limit on the quantity of imports

- Embargoes – This is a total ban on a good, this may be done to stop dangerous substances

- Subsidies – If a govt subsidises domestic production this gives them an unfair advantage over competitors. This is quite common

- Administrative barriers Making it more difficult to trade, e.g. imposing minimum environmental standards. These are sometimes known as non-tariff barriers.

Potential benefits of Protectionism

Countries may impose tariffs on goods because:

- Infant industry argument – protect new industries against free trade. Protectionism can enable some industries to survive. E.g. President Trump placed tariffs on steel imports to try and protect jobs in the US steel industry.

- Diversify the economy – tariffs and protectionism can help develop new industries to give more diversification to the economy

- Raise revenue for the government.

- Protect certain key industries from international competition to try and safeguard jobs.

See: Argument against free trade

Potential costs of protectionism

It is argued that if trade falls then protectionism will have many negative effects.

- Protectionism leads to retaliation and therefore higher import prices and higher consumer prices.

- Consumers will have to pay higher prices for imports of goods (e.g. electronic goods from China, food from Africa)

- Higher prices lead to lower overall demand causing job losses in other industries

- Exporters will see a fall in demand, causing less output and possibly unemployment

- Protectionism can encourage inefficient firms to stay in business and there is less scope for specialisation and economies of scale.

- Protectionism can keep smaller national firms which can’t benefit from the same economies of scale. There is less competitive pressure for firms and economies to cut costs.

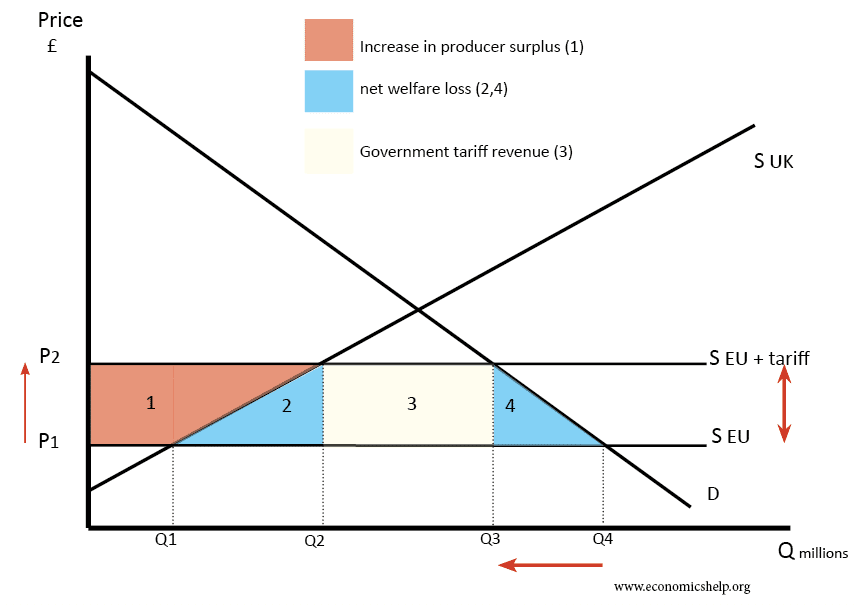

Diagram of tariff protectionism

Losers from tariffs

- Domestic consumers who pay higher prices (P1 to P2). There is a lost consumer surplus of areas (1+2+3+4)

- Foreign exporting firms. Exports fall from (Q4-Q1) to (Q3-Q2)

- Domestic exporting firms hit by retaliatory tariffs (not shown in above diagram)

- There is a net welfare loss to the domestic economy of (2+4)

- Other firms in the economy who see lower demand. Because prices rise for this good, consumers have less disposable income to spend on other goods. Therefore, other firms see a decline in demand.

Winners from Tariffs

- Government gains tariff revenue of area (3)

- Domestic producers who are able to sell a higher quantity to the domestic market. Domestic supply increases from Q1 to Q2. There is an increase in producer surplus of area (1)

Impact on countries like the UK

Some argue, that the benefits of free trade ignore many good reasons to impose tariffs. In particular, it is argued free trade discriminates against developing economies. It is argued developing countries need an element of protection to enable new industries to grow and their economies to diversify. See arguments against free trade

In the case of the UK, many of these arguments don’t really apply. However, for developing countries carefully implemented protectionism may help develop their economies. There are also good environmental reasons for promoting an element of protectionism.

However, it depends on the type of protectionism. If it is just tariffs increased out of spite, then there may be very little benefit to anyone. Tariffs have to be carefully targeted and ideally only last for a couple of years.

Conclusion

Since the UK relies on trade for much of its economy, a rise in protectionism will harm the UK economy (perhaps more than other economies). Higher tariffs will definitely lead to lower exports, lower imports and a lower rate of economic growth.

However, it is worth noting that 60% of UK trade is now with the EU. Therefore, if it is just protectionism about non-EU countries, the effect will be smaller and the impact not so severe.

Related

1 thought on “The Effects of Protectionism”

Comments are closed.