Moral Hazard is the concept that individuals have incentives to alter their behaviour when their risk or bad-decision making is borne by others.

Examples of moral hazard include:

- Comprehensive insurance policies decrease the incentive to take care of your possessions

- Governments promising to bail out loss-making banks can encourage banks to take greater risks.

Conditions necessary for moral hazard

- There is information asymmetry. Where one party holds more information than another. For example, a firm selling sub-prime loans may know that the people taking out the loan are liable to default. But, the bank purchasing the mortgage bundle has less information and assumes that the mortgage will be good.

- A contract affects the behaviour of two different agents. In some cases, two parties face different incentives. If you are insured, then you may have less incentive to take care against risks. For example, if a country knows it will receive a bailout from the IMF, then it may feel less incentive to reduce debt. Moral hazard is particularly a problem in the insurance market because when insured, people may be more liable to lose things.

Definition of Moral Hazard

“any situation in which one person makes the decision about how much risk to take, while someone else bears the cost if things go badly.” [1]

– Paul Krugman

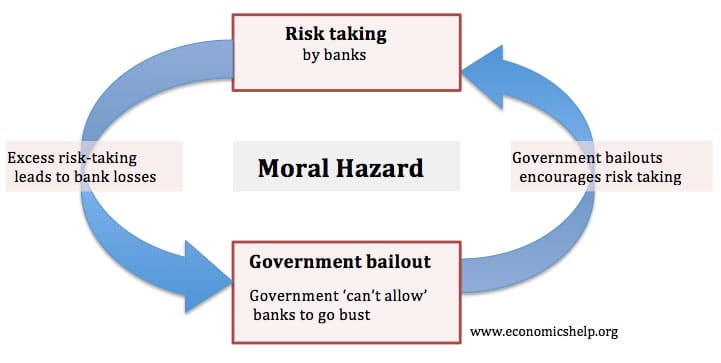

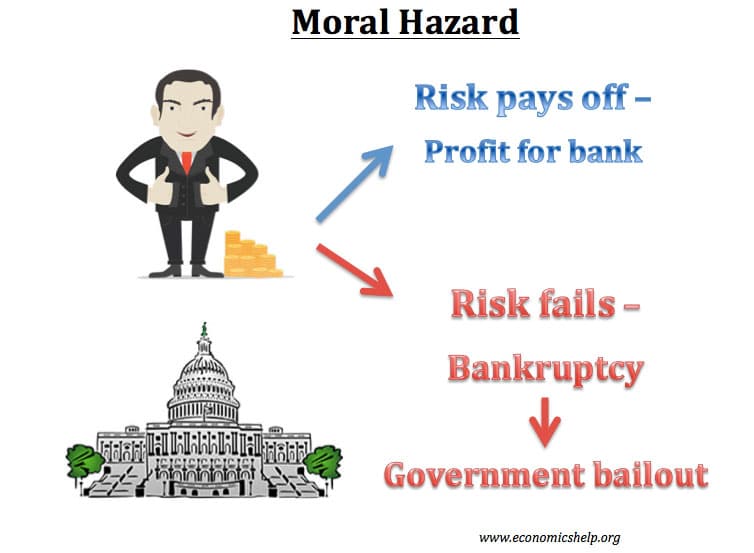

However, this implicit guarantee to bailout banks means that banks have a greater incentive to take risks.

If risks lead to higher profit – they benefit

If risks fail and lead to bankruptcy – the banks will benefit from a government bailout.

A simplistic model of the dangers of moral hazard.

The financial crisis of 2008/09 led to many banks/large financial institutions to run short of liquidity. In the UK and US, governments intervened offering large-scale bailouts.

The problem with bailing out banks is that it creates another precedent for the future. It may encourage banks to take risks in the future.

- However, despite this problem of moral hazard, the economic costs of allowing banks to fail would be even greater.

- The solution is to try to separate banks into investment and saving branches. In other words, governments will guarantee ordinary savings, but if banks make a risky sub-prime investment, there is no need for governments to bail out this branch of bank activity.

Other examples of Moral Hazard

1. Insurance and consumer behaviour

If your bike is not insured, you will take great care to avoid it getting stolen. You will lock it carefully. However, if it becomes insured for its full value then if it gets stolen you do not really lose out. Therefore, you have less incentive to protect against theft. This becomes a situation of asymmetric information. The insurance company may assume you will look after your bike, but you may know that you won’t.

In these cases, an insurance firm faces a dilemma.

- When your bike is uninsured, it has, say, a 10% chance of getting stolen. Therefore, if the bike is worth £1,000. The cost of insurance would be based around £100.

- However, once insured, the bike may now have a 30% chance of getting stolen. Therefore, if the insurance firm charges £100 based on the 10% risk, it will lose out.

- This could lead to a missing market. The insurance firm doesn’t want to insure bicycles because people change their behaviour.

2. Moral hazard and Sub-Prime Mortgages

In the case of the sub-prime mortgage market 2000-2007; lenders faced a situation of moral hazard. They were able to sell on mortgage bundles to other financial institutions. Because there was strong demand from other people, and because other banks were taking on all the risk, the mortgage companies had less incentive to check the mortgages could be repaid. Therefore, there was a big growth in sub-prime mortgage lending with inadequate checks made.

3. Fiscal and Monetary Union

It is argued that membership of the Euro can cause a type of moral hazard. A country in the Euro may assume that if it gets into difficulties, other countries will bail it out. Therefore, they may allow their debt to grow. For example, when Greece joined the Euro, it benefited from low-interest rates because it was in the Euro. This encouraged them to keep increasing public sector debt – until markets realised too late that they actually had high, unsustainable debts.

4. Management

If managers or civil servants have a guaranteed job for life, this may alter their work incentives. If they are protected from making bad decisions, they have a greater willingness to make self-serving decisions or help out friends. This is more of a problem if it is difficult to evaluate who is accountable for the decision. It is related to the principle-agent problem and can lead to outcomes such as profit satisficing.

5. Health insurance

J. Arrow (1963) in “Uncertainty and the Welfare Economics of Medical Care,” argued that medical insurance companies may be reluctant to offer full insurance because doctors have an incentive to over-prescribe treatment – even if risky and not certain to work. Doctors will take on risky treatment because the cost is borne by others (the insurance companies)

6. Moral Hazard from IMF intervention.

Free market economists have argued that IMF intervention for countries experiencing crisis, encourages risky behaviour by countries. (Criticisms of IMF)

Overcoming Moral Hazard

1. Build in incentives. To avoid moral hazard in insurance, the insurance firm will design a contract to give you an incentive to make you insure your bike. This is why they will not insure for the full amount. Usually you have to pay the first £50 of an insurance claim. Insurance firms also make the process of getting money difficult. This means that you become more reluctant to make claims and so will try to avoid having your bike stolen in the first place.

2. Penalise bad behaviour. The government could bail out banks, but penalise those responsible for making the reckless decisions. In the case of Greece, bailout funds are being given very reluctantly and with conditions to reform and pursue austerity.

3. Split up banks so they are not too big to fail. The problem occurs when banks with consumer savings also take on risky investments. It is the risky investments which need a bailout.

4. Performance related pay. To avoid moral hazard in the labour market, there can be some form of performance evaluation and no guarantee of a job for life.

Readers Question on Moral Hazard – can it be when information is complete when information is asymmetric when information is biased against the consumer or is it when information is exaggerated?

Two parties may have good information, but the presence of a contract changes peoples behaviour, e.g. in the case of insurance. In that sense, the information isn’t really complete because the insurer isn’t aware the contract will change peoples behaviour. Exaggerated or asymmetric information can all lead to moral hazard.

It is worth being aware of adverse selection. Adverse selection occurs when there may be a bad choice of products due to asymmetric information.

Related pages

Reference

[1] Krugman, Paul (2009). The Return of Depression Economics and the Crisis of 2008. W.W. Norton Company Limited. ISBN 978-0-393-07101-6.

when would a moral hazard occur, can it be when information is complete, when information is asymmetric, when information is biased against the consumer or is it when information is exaggerated. can you help be with this question please?

Protecting elderly or unemployed family member can lead to MORAL HAZARD. Example: Paying ONE electric bill can ENABLE non-essential spending, leaving rent and other bills unpaid as Sister/daughter will bail out to PROTECT hardship/ homelessness.

Overcoming: 1. Penalty: Show MH the impact of “bail outs” on Protector’s finances (fiscal uncertainty means christmas visit with young family has to be cancelled to ensure future unpredict emergency bailouts) 2. Incentive: Draw up monthly budget together – DD all essentials rent & utilities as soon as pension comes in so allowed to spend (or SAVE) disposable income. 3. Performance Related: if stick to budget protector agree to take on a small bill eg TV licence