Definition

Real wages show the value of wages adjusted for inflation. Real wages are a guide to how living standards have changed.

For example, if nominal (actual) wages increased 5%, but inflation was 5%. This would mean the purchasing power of your wages had stayed the same. The net effect would be the same as a wage freeze (0% real increase)

However, if wages increase by 2%, and we have an inflation rate of 3%, your real wages is -1%. Prices have risen faster than wages, meaning you are worse off.

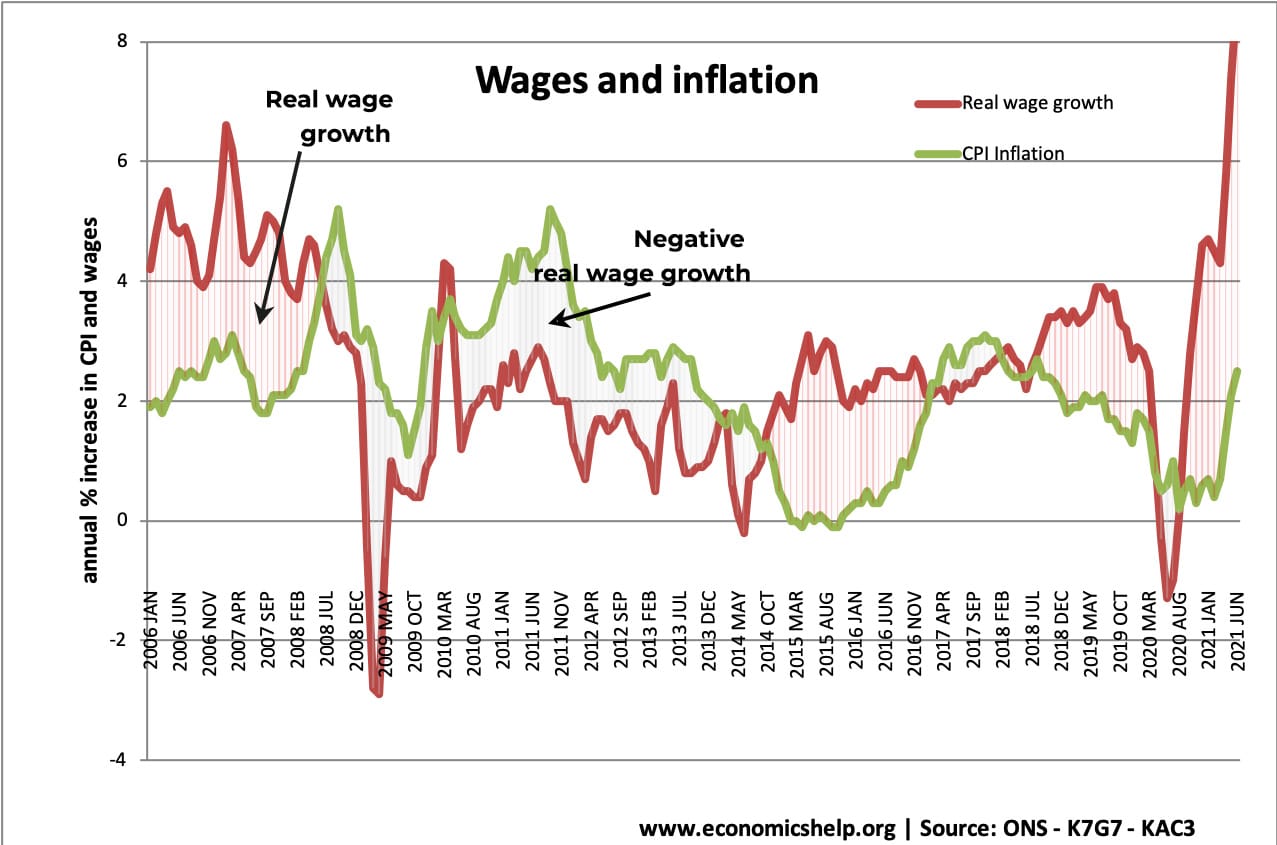

- Between 2006-2007, the UK experienced positive real wage growth (wages growing faster than inflation) – This leads to an improvement in living standards.

- Between 2010 and 2014, the UK experience negative real wage growth (inflation higher than wage growth) – This leads to a decline in living standards.

For latest wage growth see: wage growth in UK

Inflation and nominal wages UK

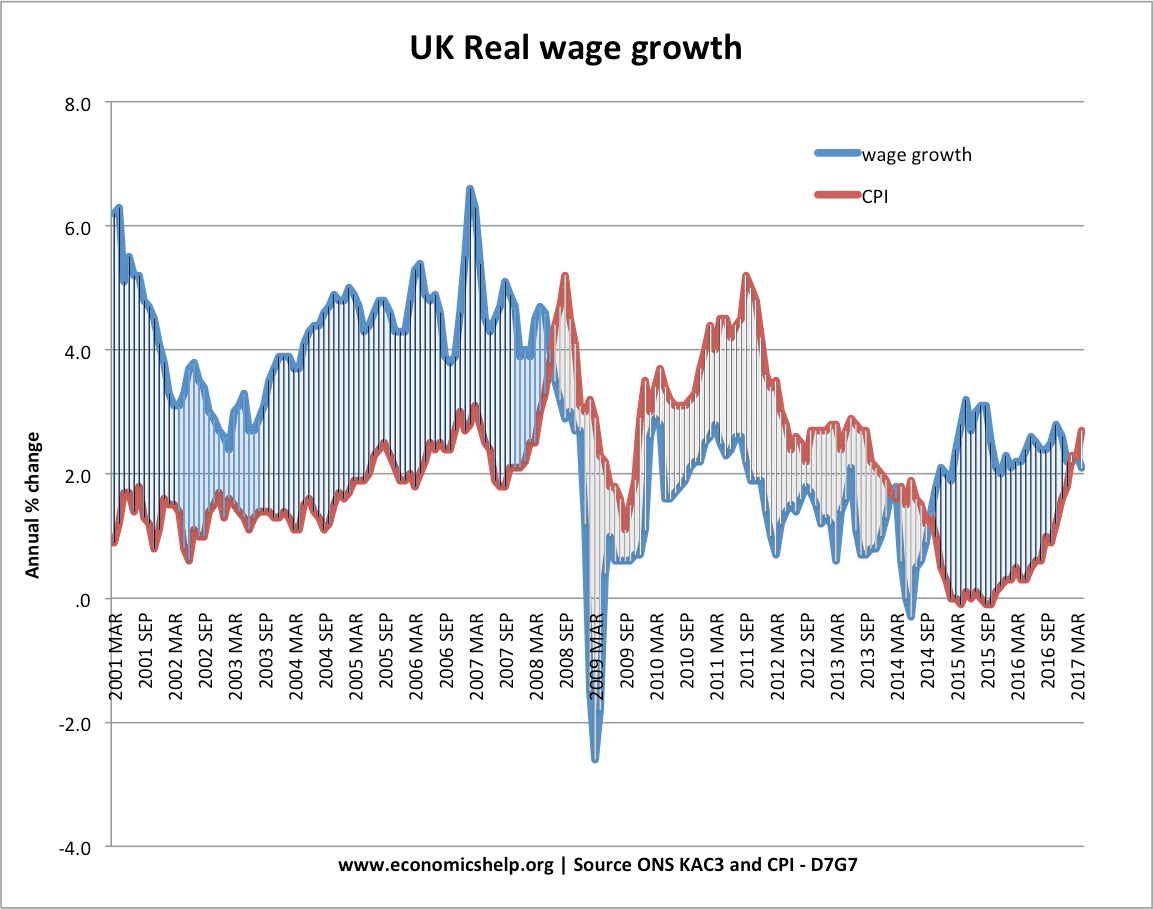

- This graph shows that from 2001 to 2008, wages are growing faster than CPI inflation. Meaning real wages are rising.

- From 2009-2014, inflation is generally higher than wages, causing negative real wage growth.

Real wages = nominal wages – inflation

These show that we are experiencing a rare period of negative real wage growth.

- In July 2010, nominal wages are growing by 2.2%, but we were experiencing CPI inflation of 3.7%

- Therefore real wages are effectively falling by 1.5%

Consumers are able to buy a smaller selection of goods and services, therefore, there is likely to a squeeze in spending on expensive ‘luxury items’.

Furthermore, UK unemployment has been rising and the number who are economically active has fallen in recent years.

Living standards and real wages

Real wages are not the only factor affecting living standards.

- If we had a rise in tax rates, then this would reduce disposable income (after tax income)

- If we saw a rise in living costs (e.g. housing costs, transport costs, heating) then this would reduce our discretionary income. (amount left over to spend after meeting essential living costs)

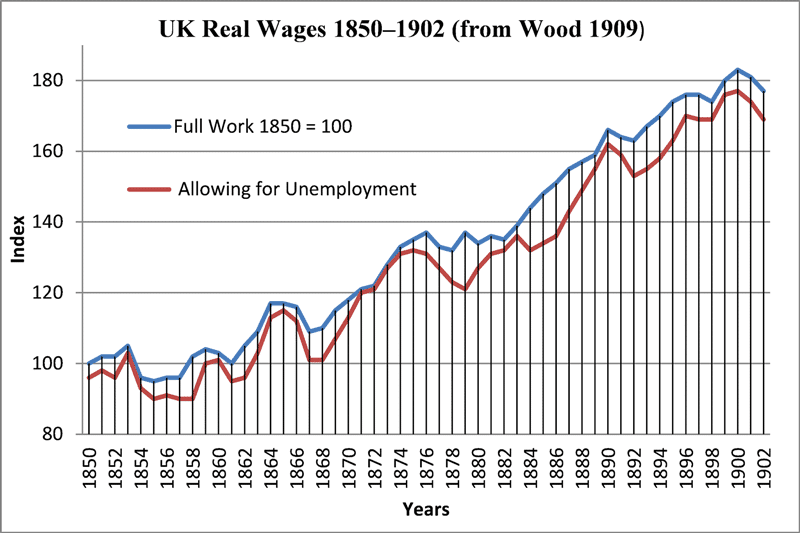

Historical real wages in the UK

Wood, George H. 1909. “Real Wages and the Standard of Comfort since 1850,” Journal of the Royal Statistical Society 72: 91–103. (Source)

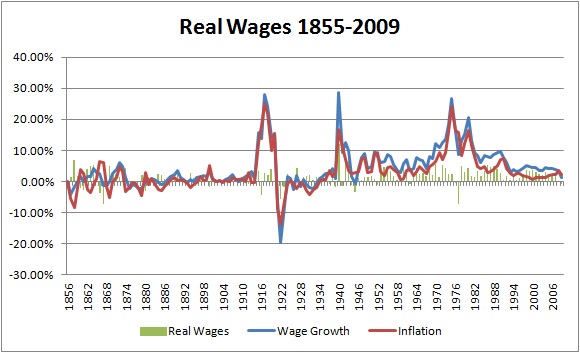

Historical real wage growth

Source: Touchstone blog (2013) – Source of Data: Bank of England Three Centuries of Data

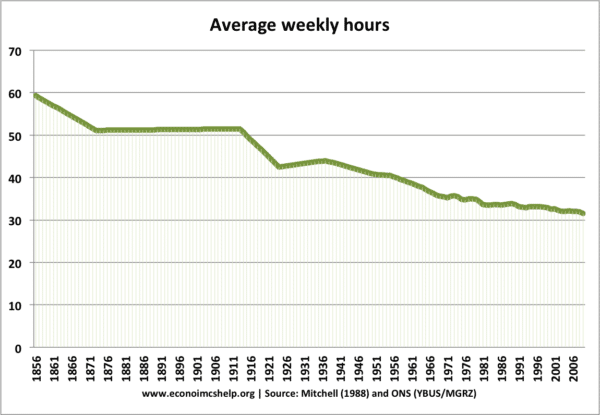

Average hourly week

It’s not just real wages – but also how many hours required. Average hours have fallen in past 150 years.

Source: ONS

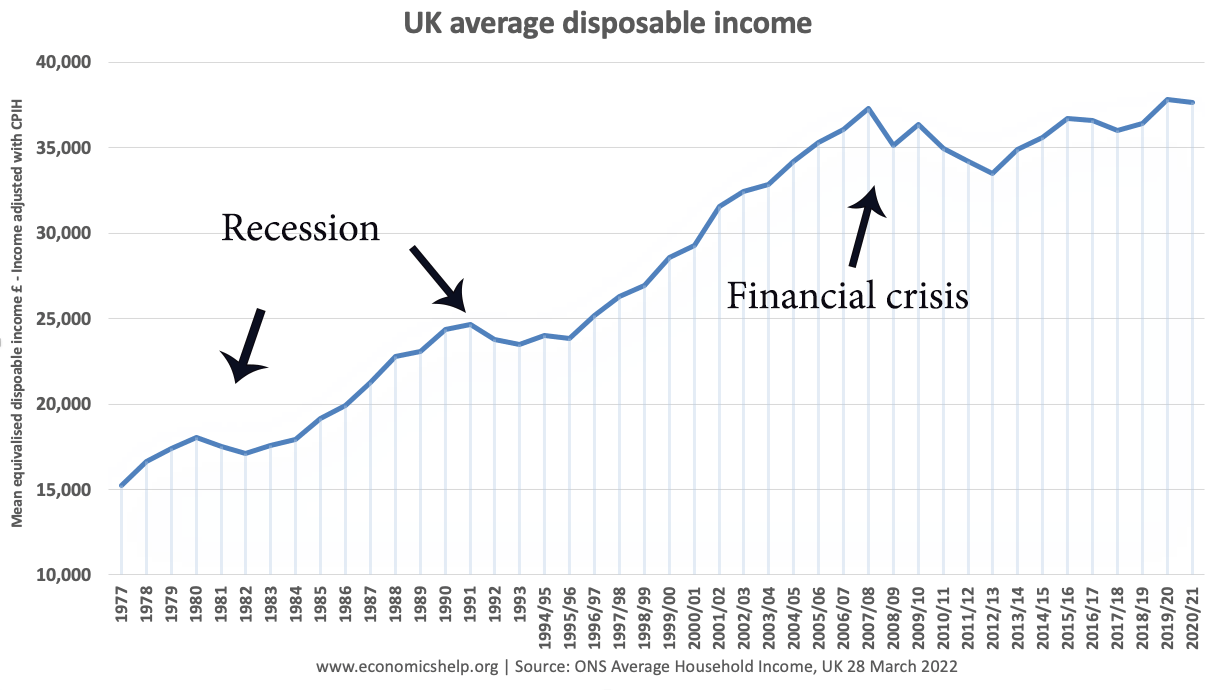

Limited real income growth since 2009.

In 2007/08 real median disposable income was £37,310. By 2020/21 that was only a very small increase of £37,622 or less than 1% growth over 13 years.

Related pages

5 thoughts on “Real wages definition”

Comments are closed.