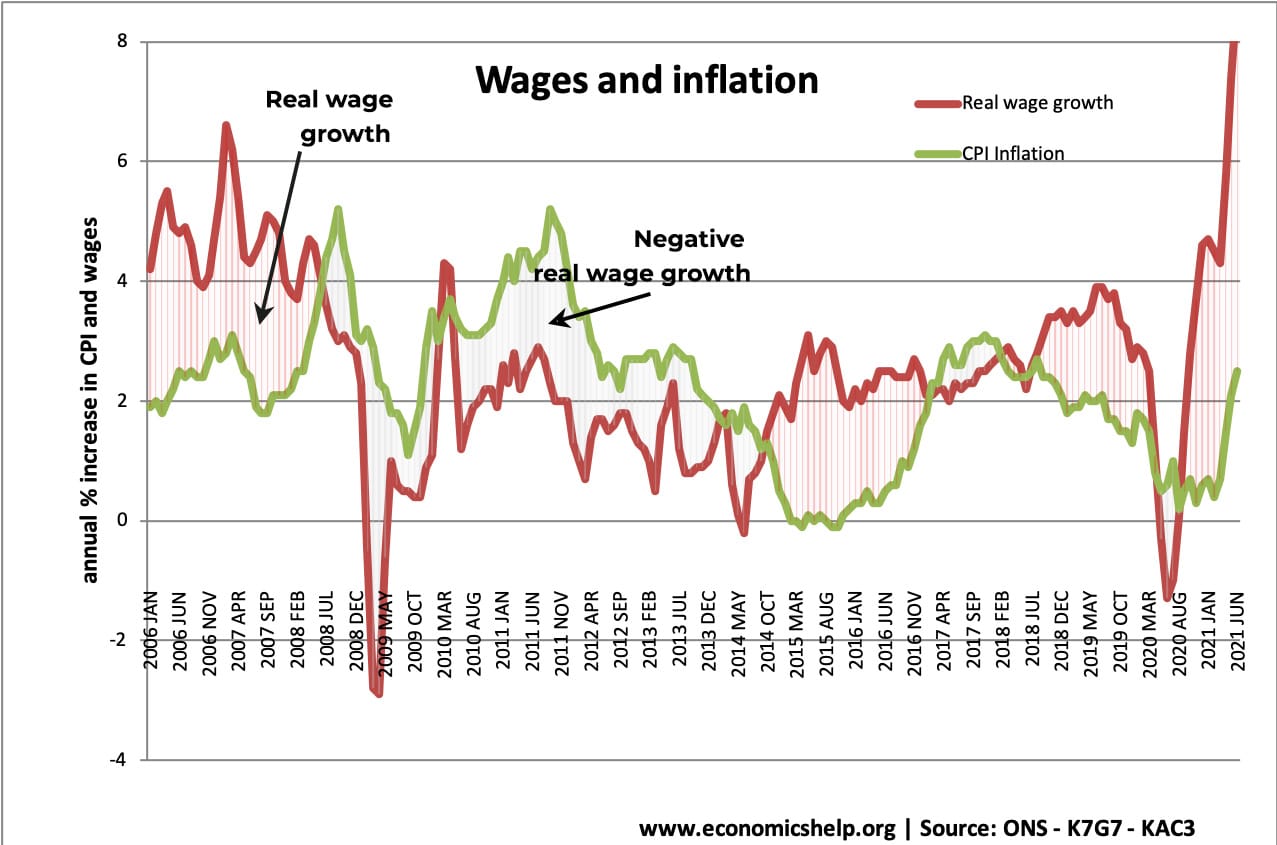

Wage growth is a key factor in determining living standards, aggregate demand and inflation. If wages increase faster than inflation, then households will be able to afford more goods and services. Real wage growth = nominal wage growth – inflation.

In the post-war period, apart from short-lived recessions, real wage growth has been positive, growing at a trend rate of roughly 2%

2008-14

This period was one of the longest periods of falling real wages. It was due to:

- Great recession

- Depreciation in Pound Sterling, raising the price of imported goods

- Rise in cost of living through rising energy/food prices.

- Period of low-wage growth/low productivity

Research from the ONS stated that in 2012 real wages have fallen back to 2003 levels. (real wages fall)

Between 2014 and 2016, inflation fell and wage growth picked up. This led to positive real wage growth. The first sustained growth in real wages since pre-2007.

However, this is being overturned by the depreciation of the Pound post-Brexit referendum and continued low growth in nominal wages.

2020 onwards

The covid shock to the economy has led to volatile wage growth. With wages falling at the start of the crisis. Though the UK recovery has seen a shortage of some workers and a rapid rise in wages in the recovery. However, this recovery in real wages has been hampered by record inflation in 2022, with CPI reaching 9% – above nominal wage growth.

Recent wage growth in UK

Source: wages KAC3 – ONS (average weekly earnings) – | CPI inflation (D7G7) ONS | UKEA

Until May 2008, wage growth was above inflation, causing positive real wage growth. But, since 2008, the UK has seen periods of negative real wage growth.

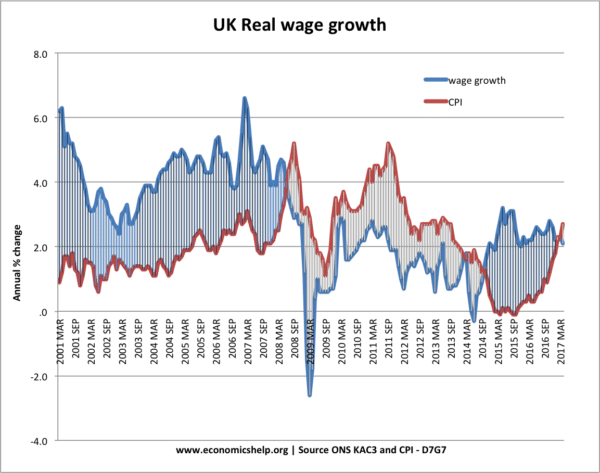

Wage growth since 2000

During the great moderation, we saw a steady period of rising real wages. This has been reversed since the prolonged recession of 2008 onwards.

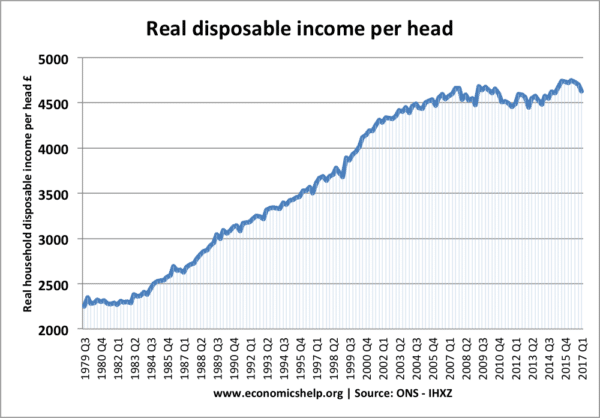

Real disposable income per head

Real disposable income per head is income households have to spend after taxes and benefits. It is closely related to real wage growth but takes into account changes in taxes.

Source: ONS

Limited real income growth since 2009.

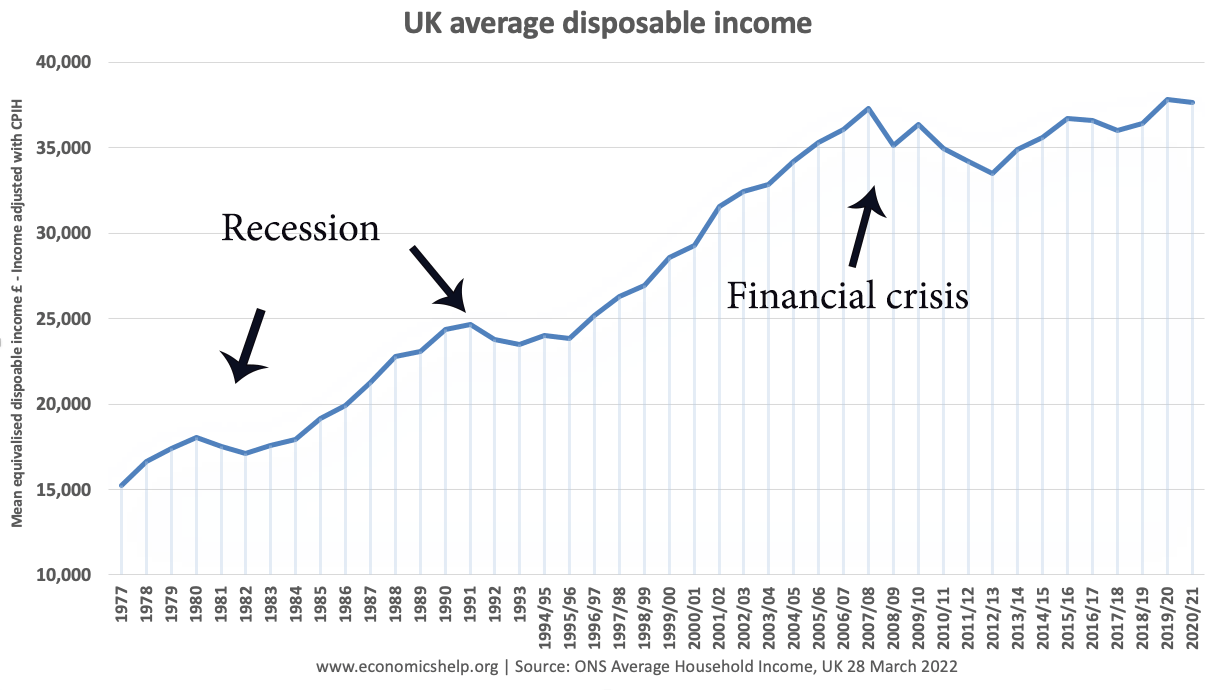

In 2007/08 real median disposable income was £37,310. By 2020/21 that was only a very small increase of £37,622 or less than 1% growth over 13 years.

Economic implications of recent wage trends

1. Muted inflationary potential. Some economists have worried that there is a risk of inflation from ultra-low-interest rates. During the great depression, we saw cost-push inflation, but this has evaporated because they were just temporary factors, such as rising oil prices, higher taxes e.t.c.

This shows the importance of wage growth for determining underlying inflationary trends. While wage growth remains low, there is muted potential for any long-term inflation.

2. Accommodative monetary policy. A consequence of the above is that if inflationary pressures are low, and real incomes falling, this puts more pressure on the Bank of England to pursue a loosening of monetary policy rather than tightening. If real wages were rising rapidly, then it would make sense to reverse quantitative easing and put up interest rates. But, falling real wages suggest the opposite.

3. Muted Unemployment. The fall in real wages may be having a positive effect in reducing the unemployment rate. In previous (milder) recessions, the UK has seen a bigger increase in unemployment. But, in this recession, unemployment has not increased as much as we might expect. One reason to explain the UK unemployment mystery is falling real wages making labour less expensive. It helps reduce real wage unemployment.

4. Low labour productivity growth. The UK has seen disappointing labour productivity growth in recent years. Falling real wages are one reason which explains this poor labour productivity growth. With lower wages, firms more willing to hang onto workers and accept lower productivity levels. See: Labour Productivity.

5. International competitiveness. Lower wages will help UK exports to be competitive. However, this competitive advantage is reduced because of poor labour productivity growth and also the fact that many countries are experiencing low wage growth as well.

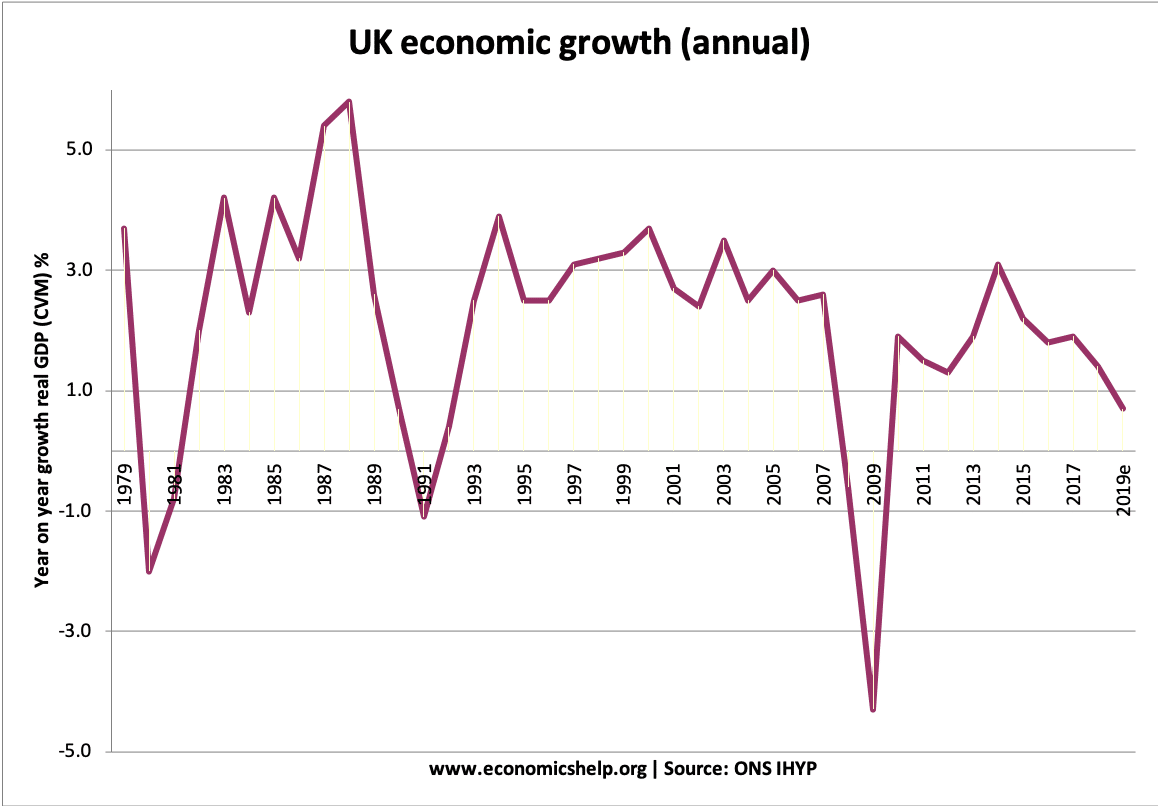

6. Economic growth. Until recently the fall in real wages matched the decline in real GDP and negative economic growth.

However, since the start of 2013, the economic recovery has not been matched by rising real wages, which raises concerns about the balanced nature of the UK recovery.

7. Increased relative poverty. Falling real wages have increased relative poverty. There is more concern over fuel poverty and food poverty, with rising living costs leaving people struggling to afford the basics.

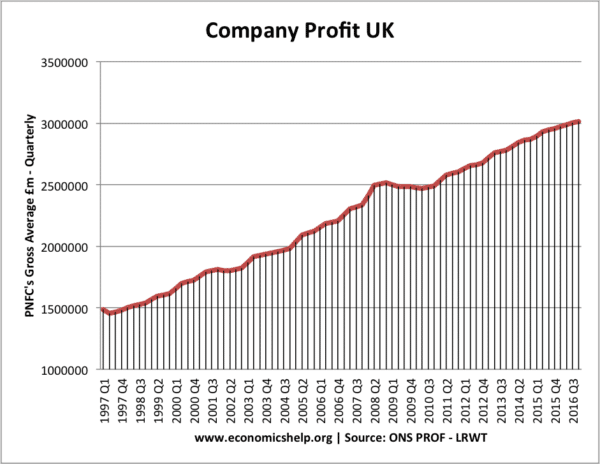

8. Increased profitability of companies. With rising GDP and falling real wages – where is GDP going. It is not the whole story, but company profitability has been rising – helped by low wage growth.

9. Discretionary income. Another factor to consider is the discretionary income of households which takes into account living costs, such as housing, rent and transport. Rising rents and mortgage payments, reduce the effective discretionary income of households.

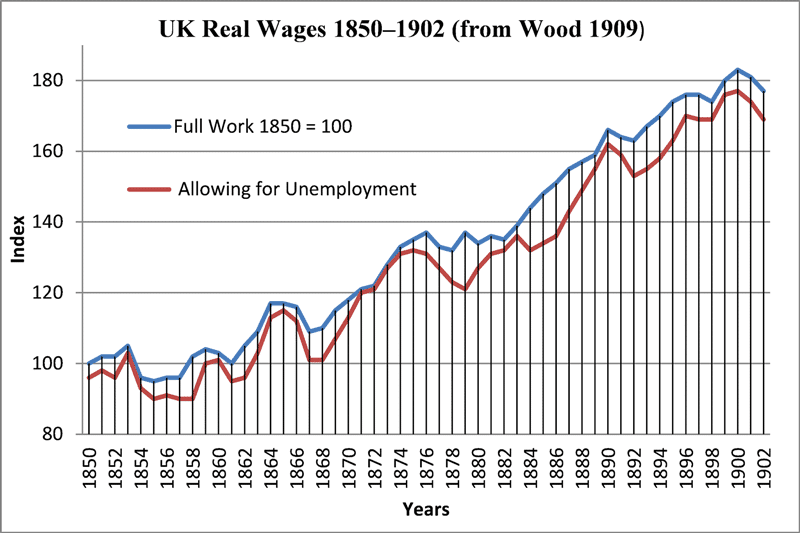

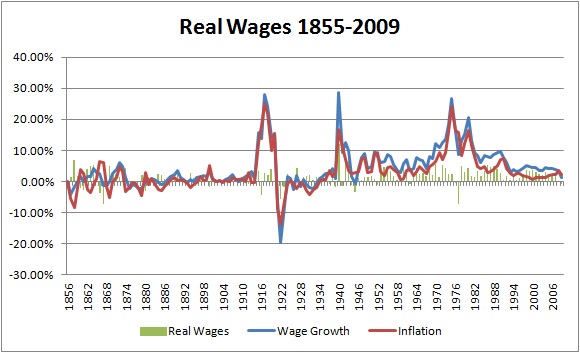

Historical real wage growth

Wood, George H. 1909. “Real Wages and the Standard of Comfort since 1850,” Journal of the Royal Statistical Society 72: 91–103. (Source)

Historical real wage growth

Source: Touchstone blog (2013) – Source of Data: Bank of England Three Centuries of Data

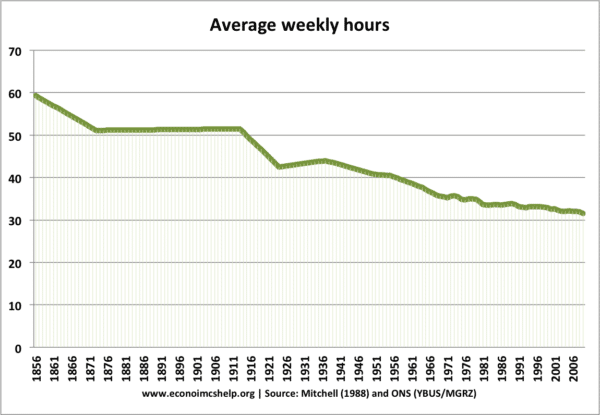

Average hourly week

Related pages

5 thoughts on “UK wage growth”

Comments are closed.