USA’s trade deficit with China was $201.6 billion in 2005, an all-time high for a trade deficit with any country. Explain some possible causes of a balance of trade deficit and consider if the USA should be concerned over its trade deficit with China.

Reasons for Balance of Trade Deficit Between US and China

1.Undervalued Yuan

According to the Big Mac index compiled by the Economist, the Chinese Yuan is 49% undervalued against the Dollar. This is partly because the Chinese Government seek to keep the Yuan undervalued by restricting currency flows. The Chinese have also been buying significant quantities of US assets (e.g. Treasury bills). This keeps the Chinese currency undervalued.

The undervalued Yuan gives a competitive advantage to Chinese exporters relative to US exporters.

2. Changing Comparative Advantage

China is becoming more competitive because it has:

- Low labour costs, elastic supply of labour

- Growing skills base

In manufactured goods, China has a clear comparative advantage; it’s greater competitiveness has contributed to US deficit.

3. Higher Savings Ratio in China

The past decade has seen a very low level of savings in the US, but much higher in China. A low saving ratios mean that levels of consumption are higher in US. China’s high saving ratios mean that consumer spending on imports is relatively lower. Instead China use their savings to invest and purchase capital flows from abroad. (It is these capital flows which help to finance current account deficit.)

4. General Trade Deficit.

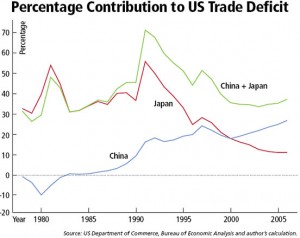

The US has a large trade deficit with a range of countries, not just China. China accounts for 30% of US trade deficit.

See also: Reasons for Current account deficit

Why US current account deficit exists

Should US be Concerned Over Trade Deficit?

Loss of output and jobs. Because China is more competitive, it means there is a relatively higher demand in China than US. US manufacturers claim that they have lost out, leading to lower employment levels.

One advantage of the trade deficit is that it is financed by capital flows from China to US. China has bought significant quantities of US Treasury bills, which has helped keep bond yields low.

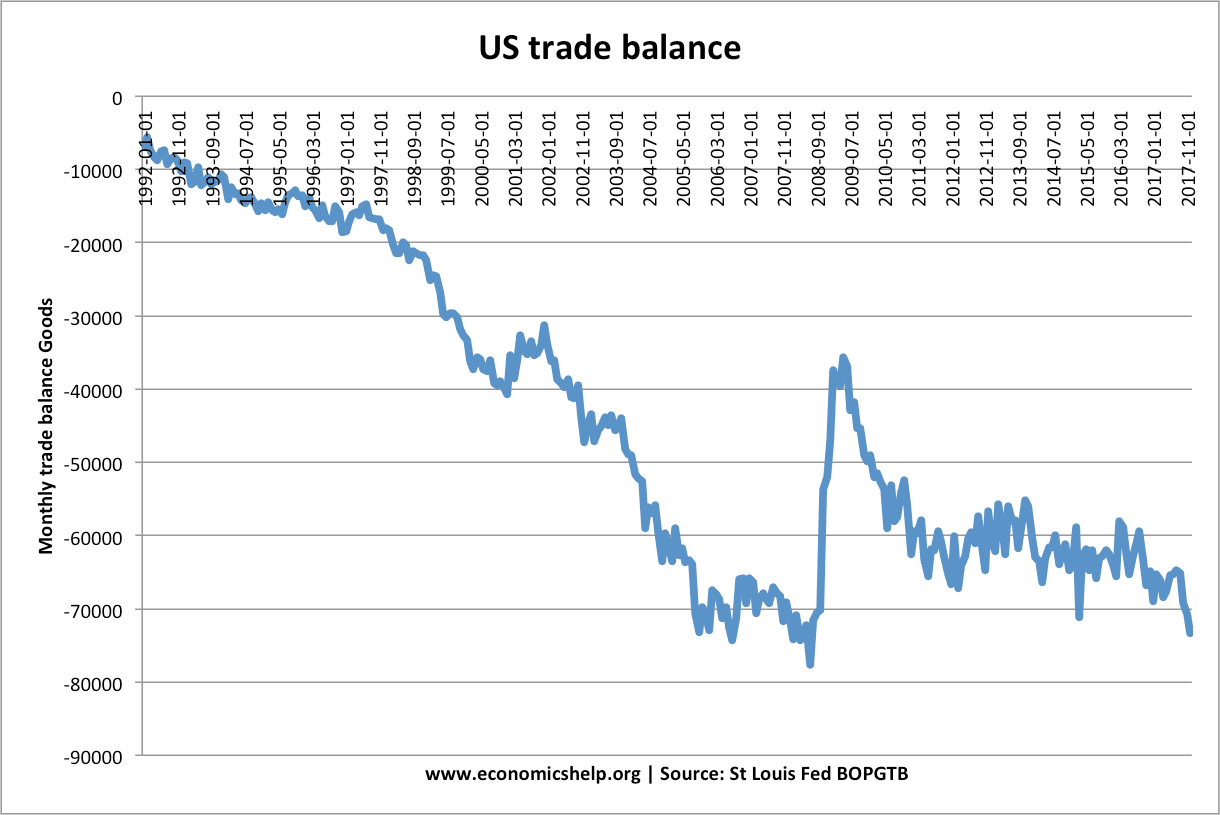

Our enormous trade deficit is rightly of growing concern to Americans. Since leading the global drive toward trade liberalization by signing the Global Agreement on Tariffs and Trade in 1947, America has been transformed from the weathiest nation on earth – its preeminent industrial power – into a skid row bum, literally begging the rest of the world for cash to keep us afloat. It’s a disgusting spectacle. Our cumulative trade deficit since 1976, financed by a sell-off of American assets, is now approaching $9 trillion. What will happen when those assets are depleted? Today’s recession may be just a preview of what’s to come.

Why? The American work force is the most productive on earth. Our product quality, though it may have fallen short at one time, is now on a par with the Japanese. Our workers have labored tirelessly to improve our competitiveness. Yet our deficit continues to grow. Our median wages and net worth have declined for decades. Our debt has soared.

Clearly, there is something amiss with “free trade.” The concept of free trade is rooted in Ricardo’s principle of comparative advantage. In 1817 Ricardo hypothesized that every nation benefits when it trades what it makes best for products made best by other nations. On the surface, it seems to make sense. But is it possible that this theory is flawed in some way? Is there something that Ricardo didn’t consider?

At this point, I should introduce myself. I am author of a book titled “Five Short Blasts: A New Economic Theory Exposes The Fatal Flaw in Globalization and Its Consequences for America.” My theory is that, as population density rises beyond some optimum level, per capita consumption begins to decline. This occurs because, as people are forced to crowd together and conserve space, it becomes ever more impractical to own many products. Falling per capita consumption, in the face of rising productivity (per capita output, which always rises), inevitably yields rising unemployment and poverty.

This theory has huge ramifications for U.S. policy toward population management (especially immigration policy) and trade. The implications for population policy may be obvious, but why trade? It’s because these effects of an excessive population density – rising unemployment and poverty – are actually imported when we attempt to engage in free trade in manufactured goods with a nation that is much more densely populated. Our economies combine. The work of manufacturing is spread evenly across the combined labor force. But, while the more densely populated nation gets free access to a healthy market, all we get in return is access to a market emaciated by over-crowding and low per capita consumption. The result is an automatic, irreversible trade deficit and loss of jobs, tantamount to economic suicide.

One need look no further than the U.S.’s trade data for proof of this effect. Using 2006 data, an in-depth analysis reveals that, of our top twenty per capita trade deficits in manufactured goods (the trade deficit divided by the population of the country in question), eighteen are with nations much more densely populated than our own. Even more revealing, if the nations of the world are divided equally around the median population density, the U.S. had a trade surplus in manufactured goods of $17 billion with the half of nations below the median population density. With the half above the median, we had a $480 billion deficit!

Our trade deficit with China is getting all of the attention these days. But, when expressed in per capita terms, our deficit with China in manufactured goods is rather unremarkable – nineteenth on the list. Our per capita deficit with other nations such as Japan, Germany, Mexico, Korea and others (all much more densely populated than the U.S.) is worse. In fact, our largest per capita trade deficit in manufactured goods is with Ireland, a nation twice as densely populated as the U.S. Our per capita deficit with Ireland is twenty-five times worse than China’s. My point is not that our deficit with China isn’t a problem, but rather that it’s exactly what we should have expected when we suddenly applied a trade policy that was a proven failure around the world to a country with one sixth of the world’s population.

Ricardo’s principle of comparative advantage is overly simplistic and flawed because it does not take into consideration this population density effect and what happens when two nations grossly disparate in population density attempt to trade freely in manufactured goods. While free trade in natural resources and free trade in manufactured goods between nations of roughly equal population density is indeed beneficial, just as Ricardo predicts, it’s a sure-fire loser when attempting to trade freely in manufactured goods with a nation with an excessive population density.

If you‘re interested in learning more about this important new economic theory, then I invite you to visit my web site at OpenWindowPublishingCo.com where you can read the preface for free, join in the blog discussion and, of course, buy the book if you like. (It’s also available at Amazon.com.)

Please forgive me for the somewhat “spammish” nature of the previous paragraph, but I don’t know how else to inject this new theory into the debate about trade without drawing attention to the book that explains the theory.

Pete Murphy

Author, Five Short Blasts

There’s nothing wrong with Ricardo’s theory. If population pressures affect the local appetite for consumption, one place may have a comparative advantage in “production” and another in “distribution,” which is a very real combination of goods and services that can be relatively more or less expensive in one place than another. As compared to China, the US has an advantage in distribution, so there is a booming “We’ll make it, you take it” trade between China and ourselves. China makes things more cheaply than they can distribute them, and the US can distribute things more cheaply than it can make them. It’s classic Ricardo, really.

The problem is that the “win-win” aspect of comparative advantage occurs only on an aggregate basis. If the society does not have a way for the national benefit to be distributed among the people of the nation, what good is it to them? And if the trade is permanently unbalanced – and the surplus country takes steps to maintain that surplus (see Smoot-Hawley) – the glut of money in the deficit country can distort the local economy until it breaks.

The specific nature of the trade and the imbalance of the trade are two distinct problems. Independently of the manufacturing/distribution trade, the US participates in a manufacturing/manufacturing trade, too. The so-called “developing world” has a comparative advantage in labor-intensive goods, and, the US has one in capital-intensive goods. So, even if the US didn’t run a trade deficit, the “distribution” partner in a make-it/take-it trade deal can only distribute the benefit of that trade in the form of lower prices, a distribution that has value only to people who have jobs that enable them to shop at all. If the trade puts people out of work, the “survivors” get the benefit of it, but too many people, from a political standpoint (leaving ethics aside), are unemployed. In short, a comparative advantage in labor itself cannot be the basis for healthy trade. It necessarily beggars the workers in the trading partner’s home.

This is so whether or not the trade results in a deficit. But the deficit does matter. It matters because the foreigners need a place to invest their dollar holdings, and the US ran out of creditworthy borrowers a few years ago. So America fabricated some – subprime CDOs with AAA ratings – and foreigners jumped at them. The rest is history. Now, foreigners, who, thanks to the trade deficit, still have all the money, will lend only to Uncle Sam, which is nice for the US fiscal deficit spending, but makes it very hard for Americans to find work.

Uncle Sam cannot be the employer of last resort. The Federal government, through the Federal Reserve, is making it cheap for potential employers to borrow money, but the banks won’t lend it, as there are no creditworthy borrowers so long as the country has primarily capital-intensive industries that won’t employ enough people to be their own customers. In the micro realm, businesses lay off workers; in the macro, they lay off customers. Duh.

What the US needs, therefore, is a tariff on labor-intensive goods sufficient to enable the country to hire its own people to make those goods so that there will be enough customers with enough money to buy them. Yes, things will cost more, but more people will be able to buy them because more people will be employed making them. It’s a trade-off, but one I think the US needs to make. (I would not use quotas. All I want to do is neutralize the advantage that arises from cheap labor per se – not render better products from abroad non-competitive.)

Of course, as Dennis Miller says, that’s just my opinion. I may be wrong.