Readers Question: Should the government provide more welfare support programs such as child tax benefit and unemployment insurance in order to decrease economic inequality?

This is a classic dilemma that governments face. To simplify the argument.

- Higher welfare benefits help to reduce inequality and reduce relative poverty. Higher benefits will give those on low income a better living standard and help contribute to a more cohesive society.

However, opponents argue that:

- Increasing welfare benefits creates a disincentive to work. If welfare benefits are too generous, people may have a strong incentive to avoid work or work fewer hours. Furthermore, higher welfare payments increase the burden on the government requiring higher taxes and/or higher borrowing. Both taxes and borrowing place economic costs on society.

Both arguments have merits and setting the optimal level of benefits is not easy. It will partly depend on which you feel is more important – reducing inequality in society or limiting the role of government and creating incentives to maximise individual incentives to work.

Between each polarised view, most economists would probably agree on certain principles which will be helpful in setting the level of welfare benefits.

- Guaranteeing a minimum income to avoid absolute poverty is desirable.

- It is important children are not too adversely affected by the choices of their parents.

- Welfare benefits should be designed so there is always some incentive to work rather than stay on benefits. Ideally, benefits would be temporary to help families through difficult times – not a permanent handout.

- Welfare benefits should be deemed to be fair, easily accessible and available to all legitimate claimants.

Arguments for increasing welfare benefits

- Reducing absolute/relative poverty. For families without work, welfare benefits help maintain a minimum standard of living. Without a minimum income, it will cause low living standards. For example, children in low-income families may suffer inadequate diet and poorer health. Benefits can ensure everyone is able to afford important aspects of what we consider to be basic living standards.

- The diminishing marginal utility of money. Progressive taxation which takes money from high earners and redistributes to low-income earners can increase economic welfare because of the diminishing marginal utility of extra money. A millionaire will not be affected significantly by losing £1,000 in extra tax. However, if someone on very low income gains an extra £100, this can make a big difference to their quality of life. (e.g. people on low income can now afford a better diet)

- Lower inequality reduces social problems. If people perceive there is vast inequality in society, it may increase resentment and increase the prevalence of crime, vandalism and general dissatisfaction. If welfare benefits provide basic living standards, it could contribute to greater social cohesion as those living in disadvantaged areas can see improvements in their living standards.

- Children may gain better opportunities. If children are brought up in poverty it may affect their health and education. Increasing welfare benefits may help them gain a better education (e.g. less need to go out and work, but instead concentrate on studies). In the long-term this can create external benefits for society; if everyone has the opportunity to gain an education, it can increase long-term labour productivity.

- Higher consumption. If there is income redistribution from high earners to low earners then overall consumption in the economy may rise. High earners have a high marginal propensity to save. Low-income earners have a much higher marginal propensity to consume. In a recession, increasing welfare benefits could play a role in increasing the level of aggregate demand.

Arguments for reducing welfare benefits

- Benefits can create a dependency culture. If people get used to receiving benefits, this may reduce the incentive to work. Critics of welfare systems point to how some families remain on benefits for a considerable time period – negating the original idea of the welfare state to only provide temporary help in times of crisis.

- Benefits can diminish self-esteem. A culture of benefit dependency can diminish peoples self-esteem because they don’t have the incentive to work and undertake a fulfilling job.

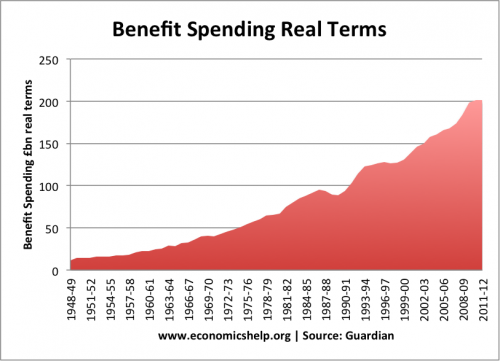

- Cost. The UK has seen a sharp rise in the cost of the welfare state since it was introduced post-1945.

This rising cost of welfare payments requires higher taxes, such as income tax and VAT. Higher income tax can cause additional disincentives to work.

Evaluation

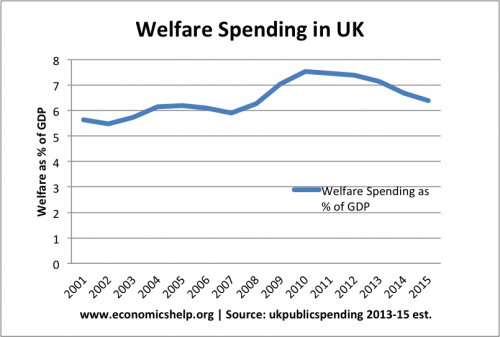

- When evaluating the cost of the welfare state, it is most helpful to compare spending as a % of GDP. If GDP rises, then arguably the real spending on welfare should increase. If benefits stayed stagnant when real incomes rose, we will see a rise in relative poverty.

- For example, when looking at welfare spending as a % of GDP, the picture looks different.

- The disincentive effect of benefits is perhaps exaggerated. Given the relatively low level of unemployment benefits in the UK, I don’t feel there is a significant disincentive to get a job. It is often when several benefits, such as housing benefit, and child benefit are included, that certain families may start to have very high marginal tax rates from working longer hours.

- In terms of child care benefit, I really doubt there is an incentive to have more children in order to receive more child care benefits. Some commentators have claimed single mothers had an incentive to have a child to jump the housing queue – though I don’t have time to investigate how reliable this claim was.

- The government claim that their new ‘universal credit‘ is designed to prevent any disincentive to work through grading benefits carefully and only gradually reducing benefits when people start work.

Conclusion

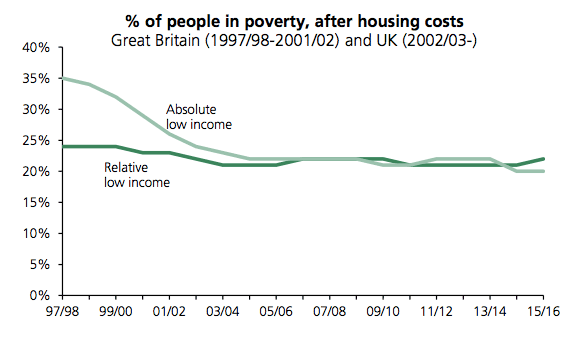

Benefits have helped reduce absolute income, but with UK benefits linked to inflation – there has been little change in incidence of relatively low income.

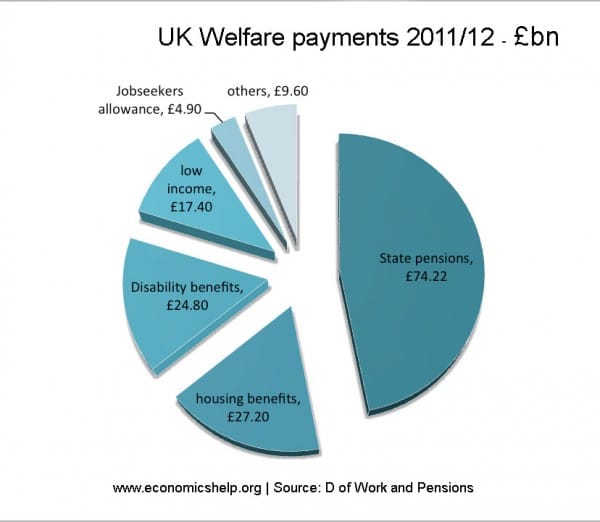

State pensions (£74.2bn) by far the biggest share of welfare payments. Job Seekers allowance only accounts for £4.9 bn.

To some extent all arguments here have validity. Benefits can play a role in preventing unnecessary poverty, especially during a recession, when people lose jobs through no fault of their own. But, at certain levels, benefits can create disincentives to work and create a substantial cost to government spending.

It is hard to strike the balance between reducing poverty and maintaining sufficient incentives and limit the cost to the taxpayer. If you’ve ever been a situation of unemployment and poverty, you would probably tend to a more generous attitude. If you work hard at a low paid job, you may feel aggrieved other people get similar amounts from benefits without working.

Related

A little annoyed at the thought of increasing benefit payments, i have a number of friends on benefits and I do envy the ammount of spare time they have. Being able to go out and do things that I can’t because of work the next day yet they are getting the same ammount a week as me give or take $100. If the payment goes up I am seriously tempted to quit and live off the payments stress free like many others do.

The argument that the payment ammount isn’t high enough to survive off with inflation etc is unbelievable when I’m watching friends buy concert tickets, going to splendor in the grass and one recently went on a holiday to new zealand JUST on welfare 😐

Very clear and helpful review of topics

I would argue that we need to increase wages. They are so low that people in work are on the same money as those on benefits? When benefits do not cover the cost of living, i find this concerning, that employers can even think of this. I cannot believe that people are buying concert tickets and be on benefits legitimately because the people I know who are on benefits and in real need are struggling.

Amelia just mad cause she took an L for Leeds fest