Readers Question: Should the government provide more welfare support programs such as child tax benefit and unemployment insurance in order to decrease economic inequality?

This is a classic dilemma that governments face. To simplify the argument.

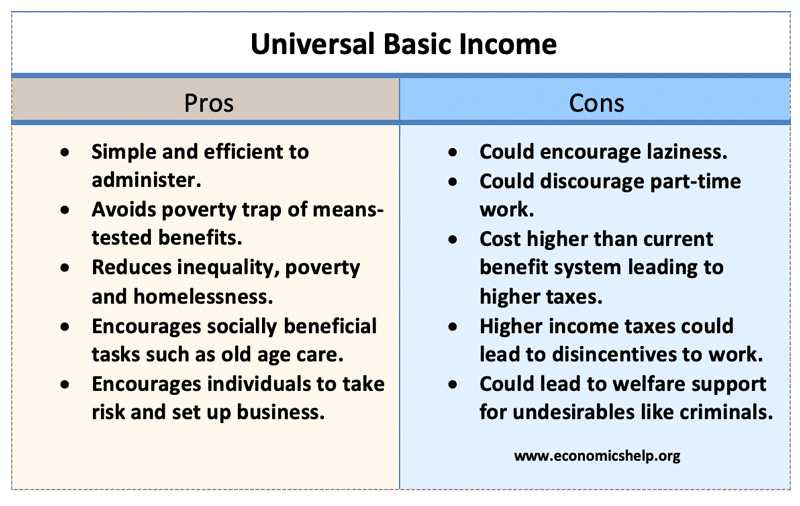

- Higher welfare benefits help to reduce inequality and reduce relative poverty. Higher benefits will give those on low income a better living standard and help contribute to a more cohesive society.

However, opponents argue that:

- Increasing welfare benefits creates a disincentive to work. If welfare benefits are too generous, people may have a strong incentive to avoid work or work fewer hours. Furthermore, higher welfare payments increase the burden on the government requiring higher taxes and/or higher borrowing. Both taxes and borrowing place economic costs on society.

Both arguments have merits and setting the optimal level of benefits is not easy. It will partly depend on which you feel is more important – reducing inequality in society or limiting the role of government and creating incentives to maximise individual incentives to work.

Between each polarised view, most economists would probably agree on certain principles which will be helpful in setting the level of welfare benefits.

- Guaranteeing a minimum income to avoid absolute poverty is desirable.

- It is important children are not too adversely affected by the choices of their parents.

- Welfare benefits should be designed so there is always some incentive to work rather than stay on benefits. Ideally, benefits would be temporary to help families through difficult times – not a permanent handout.

- Welfare benefits should be deemed to be fair, easily accessible and available to all legitimate claimants.