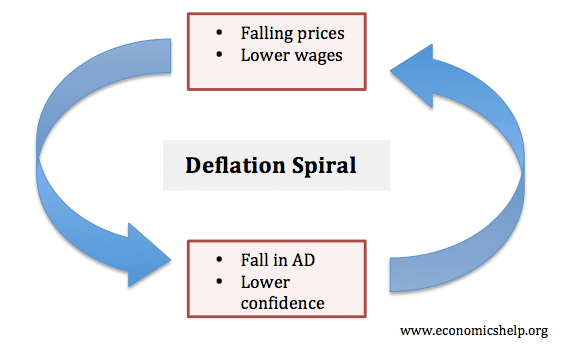

A deflationary spiral occurs when falling prices cause further deflationary pressures to cut prices.

Deflation creates expectations of further price falls, and therefore consumers reduce their spending because they expect goods to become spending in the future. This fall in spending creates further deflationary pressure in the economy.

Deflation increases the real value of debt. This makes it harder to meet repayments and companies are more at risk of going bankrupt. Because bankruptcies increase, banks become reluctant to lend. This leads to a further fall in spending and investment.

Real interest rates increase. Normally bank rates are stuck at 0%. Therefore, deflation of 2.6% means the real interest rate in Japan is quite high for the economic situation. This makes it attractive to save money and unattractive to borrow.

Deflation and falling demand also reduce confidence. Lower confidence reduces investment and consumer spending.

The European countries will be hoping the deflation just reflects the recent falls in oil prices, but, once deflation takes hold, it influences consumer expectations and economic behaviour making future deflation more likely. This is why we talk of a deflationary spiral. Deflation can be a difficult habit to break. Deflation was a prominent feature of the Great Depression.

Solutions to deflationary spiral

- Increasing money supply (quantitative easing or helicopter money which is more direct)

- Targetting higher inflation rate (Helps to raise inflationary expectations.)

- Expansionary fiscal policy. Government borrowing makes use of surplus saving. If spent on infrastructure spending it ensures money enters the circular flow of income.

The Bank of England has been buying gilts through the creation of money. One reason for increasing the money supply is to try and avoid deflation.

Japan experienced serious bout of deflation in the 2000s. Prices fell by up to 2.4% a year. (BBC link) This fall in prices is also termed a negative inflation rate.

In the aftermath of Eurozone crisis 2012-15, European countries also experienced deflation.

- Belgium – 1.2%

- Spain – 1.0%

- Germany – 0.3%

- UK RPI is -1.3% (though the governments preferred measure, CPI, is 1.6%)

Related

Note: Be Careful when talking about inflation and deflation.

- For example, recently the CPI measure of inflation fell from 1.7% to 1.6%. This means prices are rising at a slower rate.

- The RPI measure of inflation changed from – 1.4% to – 1.3%. This means that measure by RPI prices are now falling by 1.3% a year.

Watching Channel 4 news, the newsreader made a mistake saying RPI inflation fell to 1.3%. She missed out the negative sign and this changed its meaning.

2 thoughts on “Deflationary Spiral”

Comments are closed.