Classical economic theory assumes that individuals are rational. However, in the real world, we often see irrational behaviour – decisions which don’t maximise utility but can cause a loss of economic welfare. Irrational behaviour is not just isolated to a few ‘irrational individuals’ but can become the dominant choice for most people in society (e.g. Tulip mania/dot-com bubble).

Irrational behaviour can lead to market failure, loss of economic welfare and personal issues such as drug addiction and poor health. Irrational behaviour has implications for formulating economic policy. It means economists need to take into account the potential for irrationality.

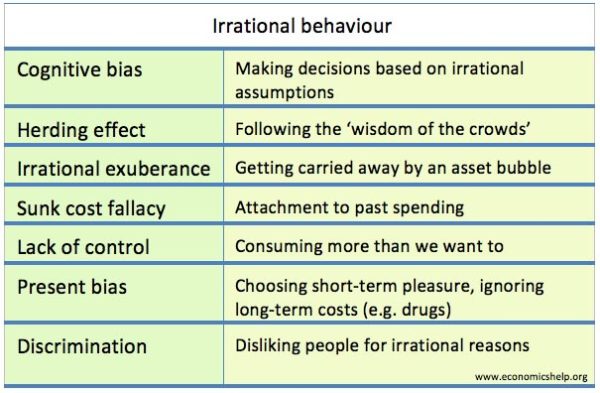

Different types of irrational behaviour

Irrational exuberance

Irrational exuberance is a term to describe over-optimism, especially about asset bubbles. For example, if shares rise and people see an increase in wealth, this may encourage them to keep buying more. If prices rise above their long-term value, we can think ‘this time is different’, and perhaps there is some reason for the increased value of shares. Irrational exuberance has occurred during ‘bubbles’ such as the “Dot Com Bubble” of the late 1990s and the financial bubble of the early 2000s. See also Irrational exuberance.

Herding – the wisdom of the crowds

Herding is a situation where individuals assume that ‘the majority must be correct.’ Therefore even if we are wary of buying shares in South Sea Company, we think if everyone else is – they must know something.

Cognitive bias

Cognitive bias occurs when we make irrational decisions, but often are unaware of our own irrationality. For example, we may focus on a study that says one glass of red wine a day is good for health and then make the assumption that any quantity of alcohol can be good for us. In making decisions we use ‘mental shortcuts’ or ‘heuristics’ – these decisions are based on impulsive/emotional responses. For example, if we have one bad experience travelling on British Airways, we may always avoid them in the future.

Status quo bias

Another type of cognitive bias is preferring a choice that we are used to. The model of perfect competition states that a market with thousands of firms will be efficient because we can choose best. But, the internet shows us that sometimes too much information can be overwhelming. Rather than spend time trying to decide, we stick with default option – what we already have. Given a choice, many people would avoid any updates to their phone/operating system and stick with what they are used to.

Demerit goods

Demerit goods are damaging to individuals, but people continue to consume – either unaware or ignoring their harmful effects. For example, heavy drinking can cause health problems, but many people drink heavily. Taking illegal drugs like heroin can ruin a life, but some people choose to get addicted – and then regret it later. More on demerit goods

Discrimination

In labour markets firms can discriminate against certain types of worker (gender/race/age) If you refuse to employ a good worker, then it means less profit for the firm, but we can be motivated by these human prejudices rather than the utility maximisation of economic theory. See more on: discrimination

Present Bias

Present bias is when we place relatively greater value on consumption in the present moment. In simple terms, it may be rational to save for a pension (e.g. Life cycle hypothesis suggests we should try to smooth consumption over a lifetime). However, in practice around 25% of individuals fail to plan adequately. More on Present Bias

Sunk Cost Fallacy

If you have bought a machine for £10,000 and it is not profitable to use, the rational action is to sell and cut your losses. But, we can become attached to our past decisions, and for reasons of pride, we try to make our decisions work – even though we just create a bigger problem. Sunk-cost fallacy – Placing too much importance on sunk costs (irretrievable costs) – costs that cannot be got back.

Lack of control

Another irrational behaviour may stem from a lack of control. A drug addict may wish to stop his habit, but the power of addiction makes it difficult to achieve. Rationally, we may want to stick to a diet and lose weight, but we get tempted by the pleasure of the present moment.

Implications of irrational behaviour

Market failure – Irrational behaviour can lead to market failure – an inefficient allocation of resources in society. If people get addicted to drugs, the social cost is much higher than the social benefit. If people get caught up in financial bubbles, it can have devastating effects when the bubble bursts.

Nudges – If individuals are prone to emotional/impulsive decisions, both firms and governments can make use of this. In a positive way, governments may try to ‘nudge’ consumers into better behaviour.

- Incentives to save for a private pension

- Making it difficult to purchase demerit goods

- Setting default option to be the choice which maximises utility.

In a less positive way, firms can use nudges to appeal to our impulsive side (e.g. chocolate at checkout counters)

Financial stability. Since the credit crunch, more emphasis has been placed on dealing with financial instability. How markets and individuals can get caught up in ‘bubbles.’ Good policy needs to find effective ‘counter-cyclical’ policies for credit and lending – as well as usual economic cycle. However, this needs regulators to avoid the ‘herding effect’ that investors are capable of.

Evaluation – When is behaviour irrational?

- If my mother wants to stick with an old outdated mobile phone is this status quo bias – or actually rational behaviour? If we keep life simple and never bother changing this may increase our utility more than keep changing our phone every two years.

- Who is to say what a demerit good is? Is it really irrational to have a few pints on Friday evening? The pleasure gained may be greater than long-term health costs – it depends on what individuals value most.

- Some may gamble for fun, but others struggle to control.

- Is it really irrational to follow the advice of market professionals? It is true they can get it wrong, but if we try to make decisions ourself – will it be any better? By following the advice of ‘market wisdom’ – we at least save ourselves the time spent investigating share prices.

- Narrow definitions of rationality. Classical economic theory assumes rational firms will seek to maximise profit/income. But, a rational agent may give more importance to leisure, being kind to workers and looking after the environment. It depends on how we define what rational behaviour is. Classical economics defines it in a ‘narrow way’ – profit maximisation. Non-profit maximising behaviour may give more satisfaction and therefore be entirely rational.

Related pages

- Irrational behaviour and the economics of football (written in 2007 when Leeds United were in the 3rd division)

- Rational economic man

- Behavioural economics

so how does irrational behavior tie into impulsiveness and emotional nudging by firms and government?