Given levels of UK national debt and forecasts for rises in government debt, what are the prospects for a UK debt default?

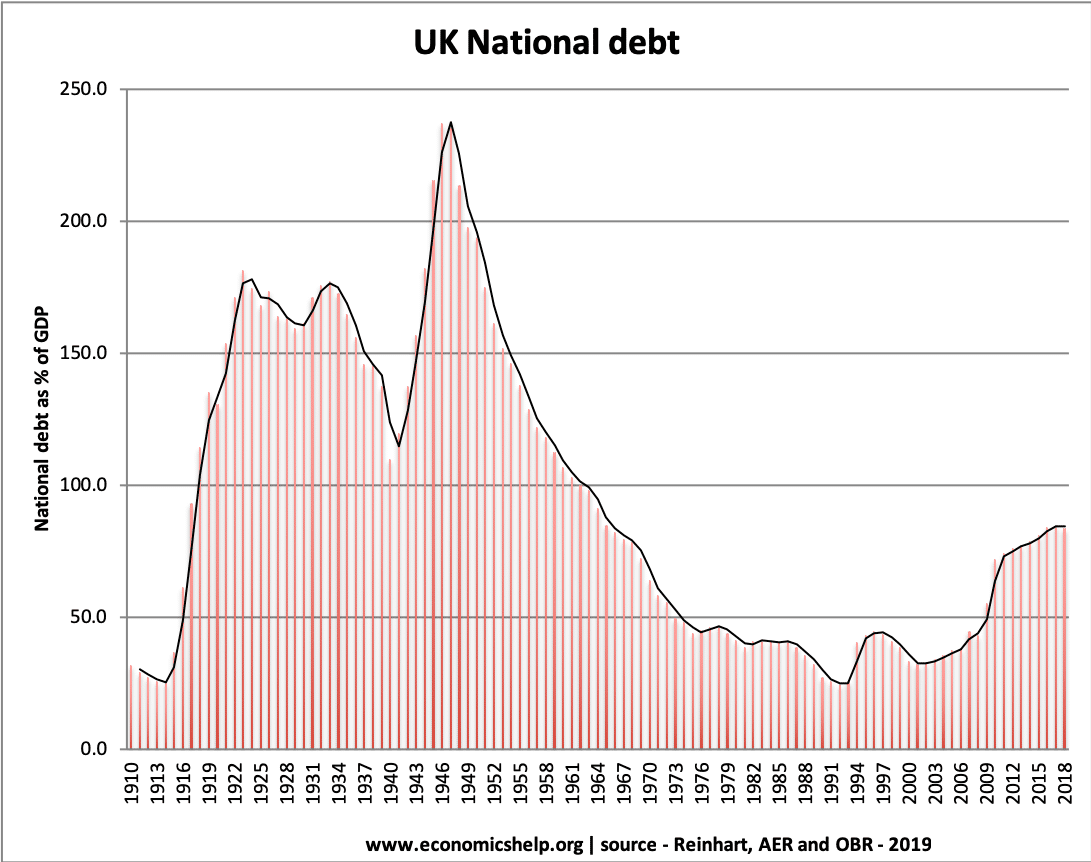

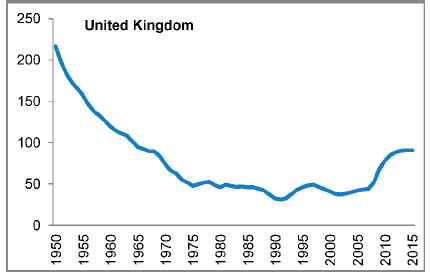

The UK has had higher levels of national debt after the First and Second World War

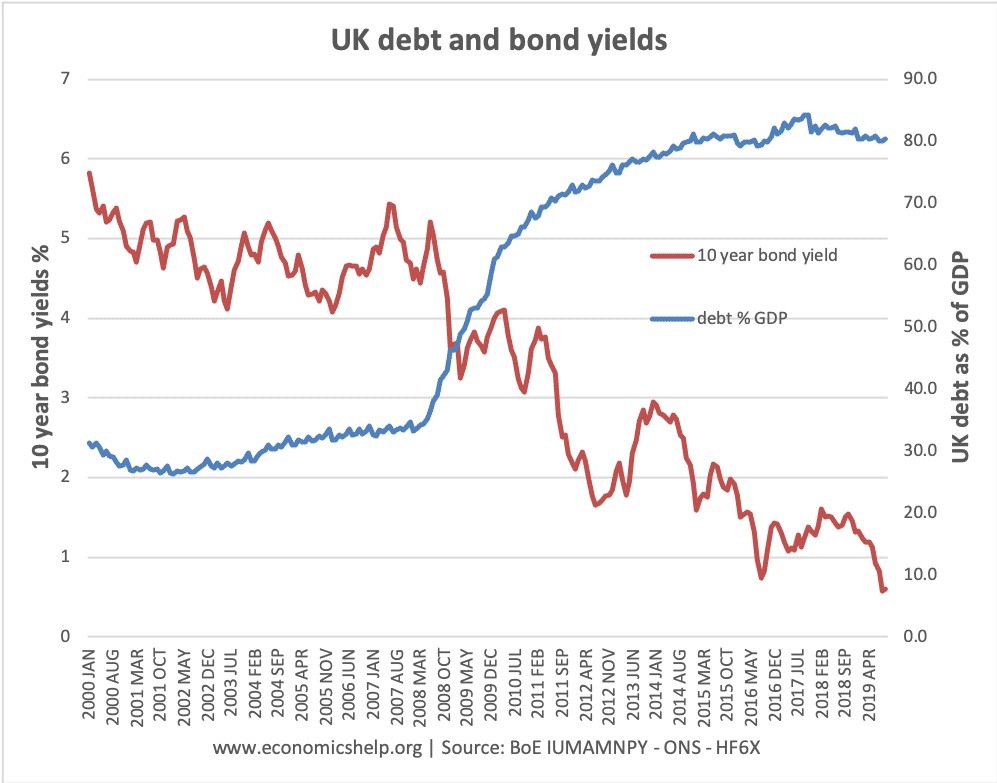

Bond Yields

Bond yields on UK government gilts are reasonable and don’t predict any default. In fact as debt rose 2010-19, bond yields fell.

Problems of Eurozone

The problems of Greece and made markets more nervous about levels of government borrowing. It means markets are being more critical and careful about lending to governments. With one of the largest levels of current annual borrowing (over 11% of GDP) the UK is increasingly open to market scrutiny.

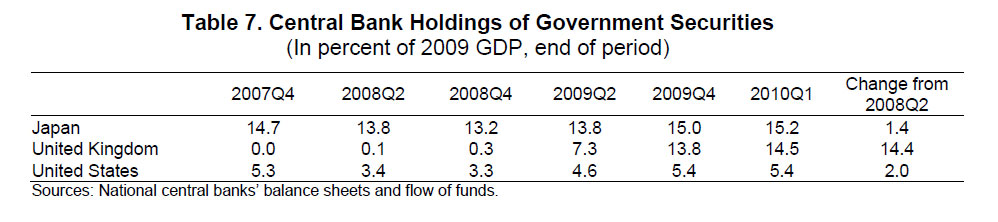

However, by being out of the Eurozone, the UK has more flexibility. It has the ability to allow currency to depreciate. This provides a boost to growth. (though does make it less attractive for foreign purchasers of UK bonds. See the rate of UK foreign bond holdings). The UK also retains an independent monetary policy. The policy of Quantitative Easing staved off threat of deflation. It also led the Bank of England to holding government bonds equal to 14% of GDP.

source: IMF via telegraph

Long Term Prospects

The long term prospects for UK debt depends to a large extent on the rate of economic growth. Strong growth would ease the cyclical debt and make it easier to cut spending without causing double dip recession. However a prolonged period of stagnant growth and deflation which would definitely increased the debt burden, and suddenly the prospects for the UK would diminish.

At least in the short term, the UK is helped by the length of debt maturity. Because the UK has the longest debt maturity ratio, it means it has to raise comparatively lower amounts of debt in the short term. See: graph here

Default Through Inflation

It is possible to have a partial default through deflating the value of bonds through inflation. At the moment, inflation is above the government’s target. But, despite Quantitative easing, underlying inflation is still moderate. There are no signs of runaway inflation at the moment, given levels of spare capacity in economy.

However, a higher rate of inflation in the UK compared to Eurozone would make it more difficult to attract foreign investors to hold UK gilts.

Historical Debt Default

The UK doesn’t have a history of debt default (despite much higher levels of Debt to GDP e.g. 200% in late 1940s). See: Historical levels of national debt

That doesn’t mean we could easily borrow 200% of GDP now – far from it. We were able to borrow so much in late 1940s because

- Higher domestic saving (period of austerity, rationing cards e.t.c)

- We survived due to generous Loan from US (which arguably made us politically dependent on US, e.g. Wilson refusing to criticise Vietnam War for fear of upsetting out main creditor. There is no chance of the US giving us a loan at the present time. The US has arguably a bigger debt problem than us at moment.

- Even longer debt maturity in the 1940s – many war bonds sold on good terms for government. It was easier to inflate away debt in 1940s and 50s because most bonds were long term.

Financial Intervention

Without the financial sector intervention, gross debt is ‘only’ 54% of GDP (April 2010) compared to 62% of GDP with financial sector intervention. The recovery in the banking sector and rise in share prices, gives hope that the UK may recover this financial sector bailout.

Immigration

The population of the UK is forecast to rise to close to 70 million in next decade due to immigration. This may cause housing shortages e.t.c, it may not be very popular. It may even be stopped by government legislation. However, Britain’s growing population does actually help government finances. It helps avoid an ageing population with increasing demands on government pensions and less income tax receipts.

Forecast for UK debt

According to IMF, the forecast level of UK debt is to stabilise over the next few years. This is much lower than other countries such as Greece, the US and Japan

Will the UK default on debt?

At the moment, it is hard to see the UK defaulting on debt – unless there is another recession and a period of debt deflation. Hopefully, this prospect is unlikely (though not impossible). For a country in the Euro fiscal straight jacket (e.g. Spain and Greece) this is not so certain. One hopes that the ECB will promote a looser monetary policy to ease the fiscal tightening.

Related

Debt default is the only solution for future generations.

Our children and grandchildren will have the millstone of national debt around their necks for most of their lives. It will impoverish and destroy them.Who caused the ‘debt crisis, the banks, who will pay the price,the people?

The privatisation of profit and the nationalisation of ‘debt’,nothing changes.

Terence, you’re absolutely right of course. Our children and grandchildren will have to work half their lives to pay off ‘national’ debt.

However, the fundamental cause of the debt is borrowing by the unproductive ruling class – i.e. government. The banks were allowed to join in the feeding frenzy because borrowing from them (and other governments) is how politicians have been able to bribe people with $3’s of ‘benefits’ and ‘services’ for every dollar they paid in. Governments, on the whole, need to keep banks sweet and so predictably they ‘nationalise’ bankers debts. The presence of government is like a magic casino for banks where they get to keep their enormous winnings and recoup their losses. What fun they have in cahoots with government at the expense of the productive classes!

What person would turn down an offer of getting back more than they put in? Well no one, naturally, generation after generation.

But where is government getting the money to give you far more than you put in? After all, government only has taxpayers money. Borrowing against future generations of course, selling them into serfdom.

But our parents and their parents have been saying: who cares where this politician guy is getting the money from? He’s giving me ‘free’ stuff! And all I have to do is vote, work, be taxed and keep quiet.

Borrow, borrow, borrow, bribe, bribe, bribe – the mantra of the politician! And how they and those with similar sociapathic tendencies have gotten rich from it. Oh how they have.

How will it all end for these states with fiat currencies and state-controlled capitalism? How it’s always ended in the last 5,000 of human civilisation; with the state eventually destroying the economic freedoms that fuelled its growth. This is happening right before our eyes in America, just as it did in ancient Egypt and the Roman empire, although the American empire doesn’t look like lasting anywhere near as long.

As we know, America was built on the philosophy of government existing only to protect the individuals rights of citizens, bound and restricted by The Constitution…or at least that was the idea anyway. As it turns out this was hopelessly naive.

In just a few centuries the U.S. government has grown exponentially to become the biggest State humanity has ever known and now it’s costing lives and condemning millions into poverty as it widly thrashes about in its death throes; which is to say, as politicians and those who exploit government powers scramble to steal every last dollar they can get before the whole thing collapses.

We’re living in the times of monopoly-money democracies where the unproductive ruling class steals from the productive classes. It’s soft-tyranny, cleverly disguised serfdom. It’s tax slavery. We are the tax livestock that produce the taxable incomes, which politicians grow fat on. Sure, you can choose your own job, even choose where you live, but you still have to surrender half your wealth to some government or other. Is this freedom? Of course not, only the seriously deluded would describe it as such.