Tax incidence refers to how the burden of a tax is distributed between firms and consumers (or between employer and employee). The tax incidence depends upon the relative elasticity of demand and supply.

- The consumer burden of a tax increase reflects the amount by which the market price rises.

- The producer burden is the decline in revenue firms face after paying the tax.

Example of tax incidence

In the diagram on the left, demand is price inelastic. A tax of £6 causes the price to rise from £10 to £14.

- The consumer burden is 80 x £4 = £320

- The producer burden is £10-£8 = £2 x 80 = £160

Elastic demand

The diagram on the right, demand is price elastic. There is only a small rise in price and a bigger percentage fall in demand.

- The consumer burden is 50 x £1 = £50

- The producer burden is 50 x (13-8) = £250

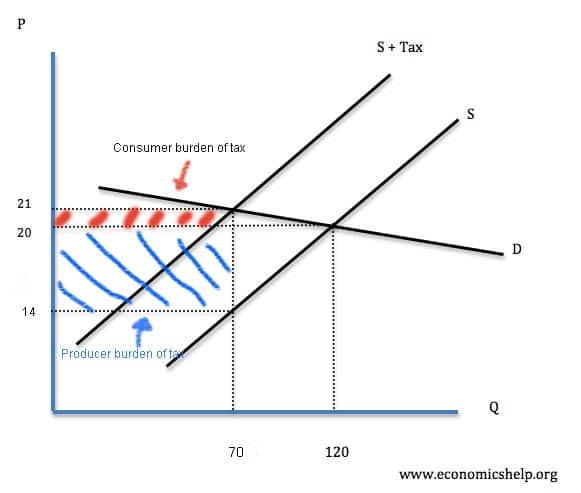

Example of elastic demand

In this case, the tax is £7. The tax reduces demand from 120 to 70.

The price rises from £20 to £21.

Consumer burden of tax

- The consumer burden is the extra amount the consumers pay. This is an extra £1. The total consumer burden is the total amount of tax paid for by consumers.

- Therefore, the consumer burden of the tax is £1 x 70 = £70

Producer burden of the tax

- The producer burden of the tax is the lost revenue to the firm. Before the tax, they used to get £20. After the tax is paid to the government, they are left with £14. They are £6 worse off.

- The total producer burden is £6 * 70 = £420

- In this case the total tax revenue = £7 * 70 = £490.

- However, the tax incidence is mostly borne by the producer. The consumer only pays a small percentage.

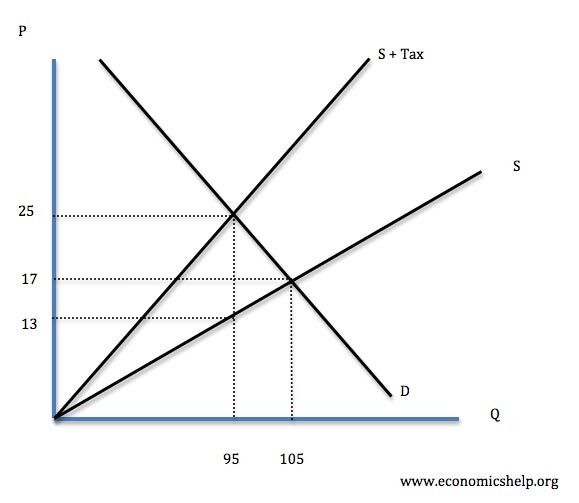

Inelastic demand

In this case, the tax is £12. The tax increases the market price from £17 to £25.

- The consumer burden is £8 *95 = £760

- The producer burden is £4* 95 = £380

In this case, a higher percentage of the tax burden is borne by the consumer.

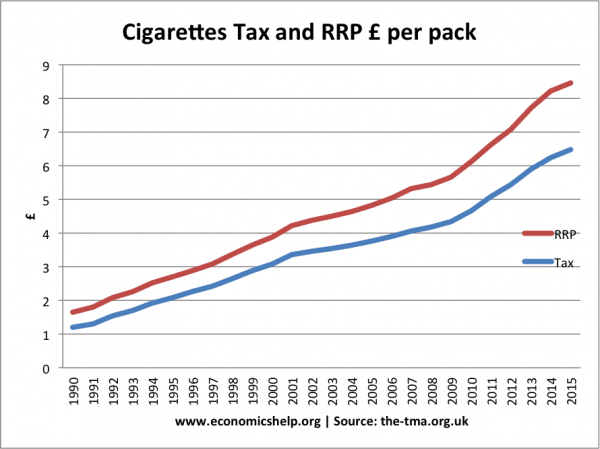

Cigarette tax

Demand for cigarettes is very price inelastic. An increase in excise duties leads to nearly all the tax being passed onto the consumer.

For example, the UK has increased tax on tobacco, and this is reflected in a higher price of cigarettes.

See: Cigarette tax and smoking rates

National insurance contributions

In the case of a tax on labour, the incidence of the tax could be borne by the employer and employee. If the employee has to pay N.I. contributions on employing labour, they may, at least partly, cut wages to be able to pay for the tax. It depends on how inelastic demand for the workers is. If workers are easily replaceable by capital, the firm will be able to cut wages to pay the tax. But, if workers are essential, the firm will be more likely to pay the cost of the tax and not cut wages.

Related pages

ELASTIC DEMAND _A producer pays the tax burden

INELASTIC DEMAND_ A consumer pays the tax burded

I want the importance of tax incidence

Please solve the taxation, saving, investment.

Sorry, but your logic behind this is completely wrong.

The assumption that clients pay taxes is wrong.

For starters, it’s simply not factual:

ALL taxes are paid by the producers / sellers of goods and services.

When you are a consumer, you do not wire the money for sales taxes or a VAT to the government.

The consumer simply pays a specific amount the seller asks for and it is up to the seller to allocate his income to the different uses, including taxes, and that includes income taxes, corporate taxes, employment taxes, social security taxes etc.

Of course ALL taxes increase the cost of every transaction, but at no point does a consumer “pay” those taxes. It’s always the producer who pays. The consumer merely experiences an overall price increase, although it would be impossible for him to pinpoint the exact tax that causes this.

In fact, a seller may offer various rebates and he may even claim that he offers the buyer a rebate equivalent to the tax, if he thinks that this will increase his volume sufficiently to compensate for the loss. He still has to pay the same sales tax, but obviously on a lesser amount. So at that point, does the client “pay the tax” or not? For client, nothing has changed except that he got a rebate, which is like any other rebate.

It is a classical fraud by governments to call some taxes “consumption” taxes.

ALL taxes are income taxes!

Producers cannot “pass on the tax to consumers”. If a seller could increase his prices by x% without any incidence on turnover and revenue, then why didn’t he do so earlier? Every seller is supposed to charge his clients the amount that optimizes his revenue.

Assuming that a seller has found his optimal price level, then a tax that alters this point is going to mess with his revenue, no matter how “flexible” or “inflexible” his market may be.

Every tax will impoverish both, the buyer and the seller. There’s no difference between income taxes and sales taxes / VAT taxes in their effect on the economy.

Doesn’t the fact that clients may avoid a sales tax or VAT by buying from place with a different tax regime prove that those are consumption taxes?

Not in the least!

The exact same again applies to ALL taxes, including corporate taxes, income taxes, wealth taxes etc.

If a seller owns a shop in Dubai where he does not pay any income tax, then he can make his products cheaper than if he was located in, say, France, irrespective of any sales or VAT tax.

Which proves beyond any possible doubt that ALL taxes are income taxes, never consumption taxes.

Well written.

“Of course ALL taxes increase the cost of every transaction, but at no point does a consumer “pay” those taxes. It’s always the producer who pays.”

You are confusing two things. The first is who is legally responsible for passing the tax to the government. The second is a counterfactual – who is paying more than they WOULD HAVE PAID without the tax, and by how much?

Once you understand that, the article and the concept of tax burden will make a lot more sense.

Payment of tax is not directly made by the buyer/consumer to the Govt. However, consumer is the one who ultimately bears the burden of tax (i.e. the price includes all the applicable taxes).

Further, classification of the taxes in to income tax or consumption tax etc is irrelevant as the burden is ultimately borne by the end user. Because in case of goods or services tax is indirectly paid and in case of income (i.e. money or earnings) tax is direct.

nothing in an abstract pseudo-scientific discipline is ever “proven”, particularly not in such a way as to preclude “any possible doubt”

statutory incidence of tax tells nothing about the incidence of tax. Discuss