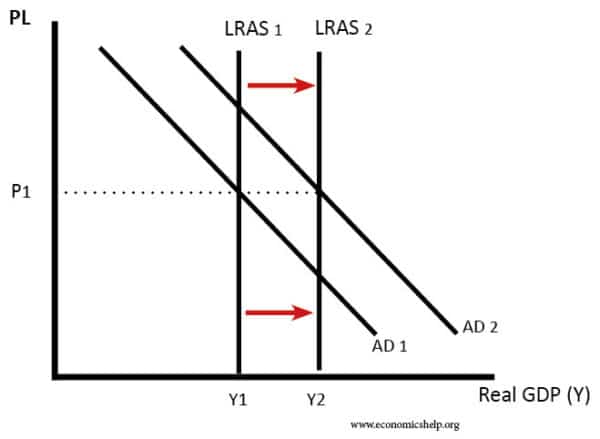

Supply-side policies are government attempts to increase productivity and increase efficiency in the economy. If successful, they will shift aggregate supply (AS) to the right and enable higher economic growth in the long-run.

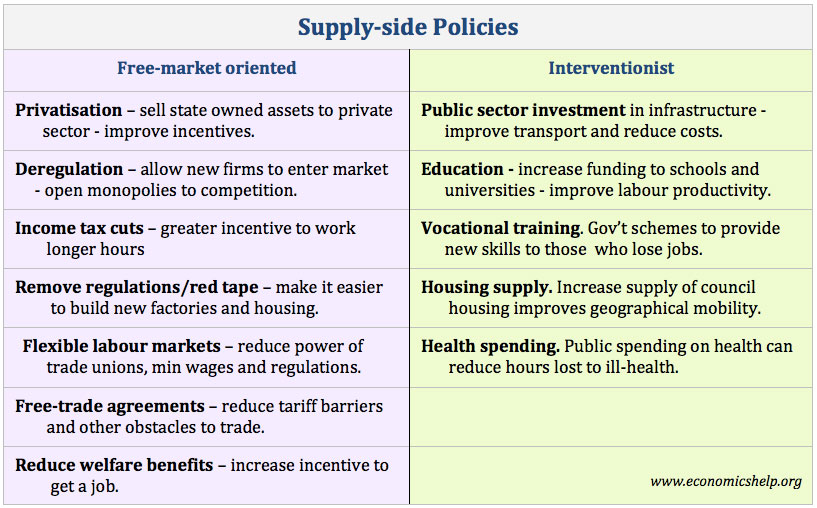

There are two main types of supply-side policies.

- Free-market supply-side policies involve policies to increase competitiveness and free-market efficiency. For example, privatisation, deregulation, lower income tax rates, and reduced power of trade unions.

- Interventionist supply-side policies involve government intervention to overcome market failure. For example, higher government spending on transport, education and communication.

Benefits of Supply-Side Policies

In theory, supply-side policies should increase productivity and shift long-run aggregate supply (LRAS) to the right.

1. Lower Inflation

Shifting AS to the right will cause a lower price level. By making the economy more efficient, supply-side policies will help reduce cost-push inflation. For example, if privatisation leads to more efficiency it can lead to lower prices.

2. Lower Unemployment

Supply-side policies can contribute to reducing structural, frictional and real wage unemployment and therefore help reduce the natural rate of unemployment. See: Supply-side policies for reducing unemployment

3. Improved economic growth

Supply-side policies will increase the sustainable rate of economic growth by increasing LRAS; this enables a higher rate of economic growth without causing inflation.

4. Improved trade and Balance of Payments.

By making firms more productive and competitive, they will be able to export more. This is important in light of the increased competition from an increasingly globalised marketplace. See also: Economic Importance of Supply-Side Policies

Examples of supply-side policies

1. Privatisation

This involves selling state-owned assets to the private sector. It is argued that the private sector is more efficient in running businesses because they have a profit motive to reduce costs and develop better services. See more on Privatisation.

2. Deregulation

This involves reducing barriers to entry to allow new firms to enter the market. This will make the market more competitive. For example, BT used to be a monopoly in telecommunications, but now several firms compete for our business. Competition tends to lead to lower prices and better quality of goods/service.

- The difficulty is that not all industries are amenable to competition. For example, power generation and water supply is a natural monopoly. Privatising and deregulating these industries tends to create a private monopoly who can charge higher prices.

3. Reducing income tax rates

It is argued that lower income tax rates increase the incentives for people to work harder, leading to an increase in labour supply and more output. Similarly, a cut in corporation tax gives firms more retained profit they can use for investment.

- However this is not necessarily true, lower taxes do not always increase work incentives (e.g. if income effect outweighs substitution effect). Firms may not invest the increased profit but give to shareholders or save. See: Cutting corporation tax.

5. Deregulate Labour Markets

Labour markets can be deregulated through policies such as

- Make it easier to hire and fire workers. Abolish redundancy pay or right of appeal

- Reduce maximum working weeks and minimum holiday pay.

- Enable zero-hour contracts which allow firms to employ workers when demand is greater.

If it is cheaper to hire and fire workers, the argument is that it encourages firms to take on workers in the first place, creating more employment opportunities.

- However, more flexible labour markets can cause increased uncertainty and lower productivity. See also: Flexible labour markets

5. Reducing the power of trades unions

This can involve legislation which reduces the ability of trade unions to go on strike. This should:

- Increase efficiency of firms e.g. less time lost to strikes.

- Reduce real wage unemployment. (if labour markets are competitive)

6. Reducing unemployment benefits

Lower benefits may encourage the unemployed to take jobs. Lower means-tested benefits for those in work may increase the incentive to work longer hours.

7. Deregulate financial markets

For example, building societies were allowed to become for profit-making banks. Deregulation should allow more competition and, in theory, lead to lower borrowing costs for consumers and firms.

7. Increase free-trade

Lower tariff barriers will increase trade and provide an incentive for export firms to invest. Increasingly important are non-tariff barriers. For example, the EU Single Market has harmonisation over regulations, which enables more frictionless trade. Negotiating frictionless trade-deals can lead to lower cost for business and improve productivity.

9. Removing unnecessary red tape

Planning restrictions can make it difficult for firms to expand and invest in new capacity. Reducing red tape and levels of bureaucracy reduce firms’ costs and encourage an environment conducive to encouraging investment.

10. Encourage immigration

Free-movement of labour can enable firms to fill labour shortages – whether they are skilled jobs, in construction and engineering or low-skilled jobs such as fruit picking. Liberal immigration policies make labour markets more flexible and in economic booms – help firms keep up with growing demand. This can prevent wage inflation and enable firms to increase productive capacity.

Interventionist supply-side policies

1. Increased education and training

Better education can improve labour productivity and increase AS. Often there is under-provision of education in a free market, leading to market failure. Therefore the government may need to subsidise suitable education and training schemes to fill vacancies in the labour market.

- However govt intervention will cost money and require higher taxes, It will take time to have an effect and the government may subsidise the wrong types of training.

2. Improving transport and infrastructure

With transport, there is usually a degree of market failure – congestion and pollution. Government spending on improved transport links can help reduce congestion and overcome this market failure. Improved transport provision helps reduce the cost of transport and will encourage firms to invest. Transport bottlenecks on the road, rail and air – are often cited as a major stumbling block for the UK economy.

- However, in a crowded country like the UK, it can be difficult to increase transport capacity, especially in London.

3. Build more affordable homes

Building affordable council homes in expensive areas can make it easier for workers to move and find jobs in expensive areas reducing geographical immobility. Firms can suffer from labour shortages in areas that have become very expensive to live in.

4. Improved healthcare

Business can face substantial costs from time lost to ill-health. Health care spending which improves a nation’s health can improve labour productivity. Improved health can also come from discouraging unhealthy habits. For example, tax on cigarettes, alcohol and sugar can reduce health care costs associated with drunkenness, obesity and polluted environments.

Limitations of supply-side policies

- Productivity growth depends largely on private enterprise and trends in technological innovation. There is a limit to which the government can accelerate the growth of technological change and improvements in working practices.

- Supply-side policies can be counter-productive. For example, flexible labour markets may reduce costs for business – but if they cause job-insecurity, workers may become demotivated and labour productivity stagnates. Since 2009, the UK has seen a fall in structural unemployment due to more flexible labour markets – but productivity growth is almost stagnant.

- In a recession, supply-side policies cannot tackle the fundamental problem which is lack of aggregate demand.

- Time. All supply-side policies take a long time to have an effect. Some policies, such as education spending may not influence the economy for 20-30 years.

Related